Crypto Markets has regained momentum over the past 24 hours, with the “Made in USA” coin increasing its market capitalization by 7%. The rebound followed Jerome Powell’s comments by Jackson Hole. The Fed chair struck a particularly incredible stance, acknowledging the signal of increased risk in the labour market and openness to interest rate cuts in September.

While there is no solid commitment, the easing outlook has already lifted key assets, not all tokens respond equally. Against this background, there are three made US coins that can be viewed before the September interest rate cuts unleash the next wave of liquidity.

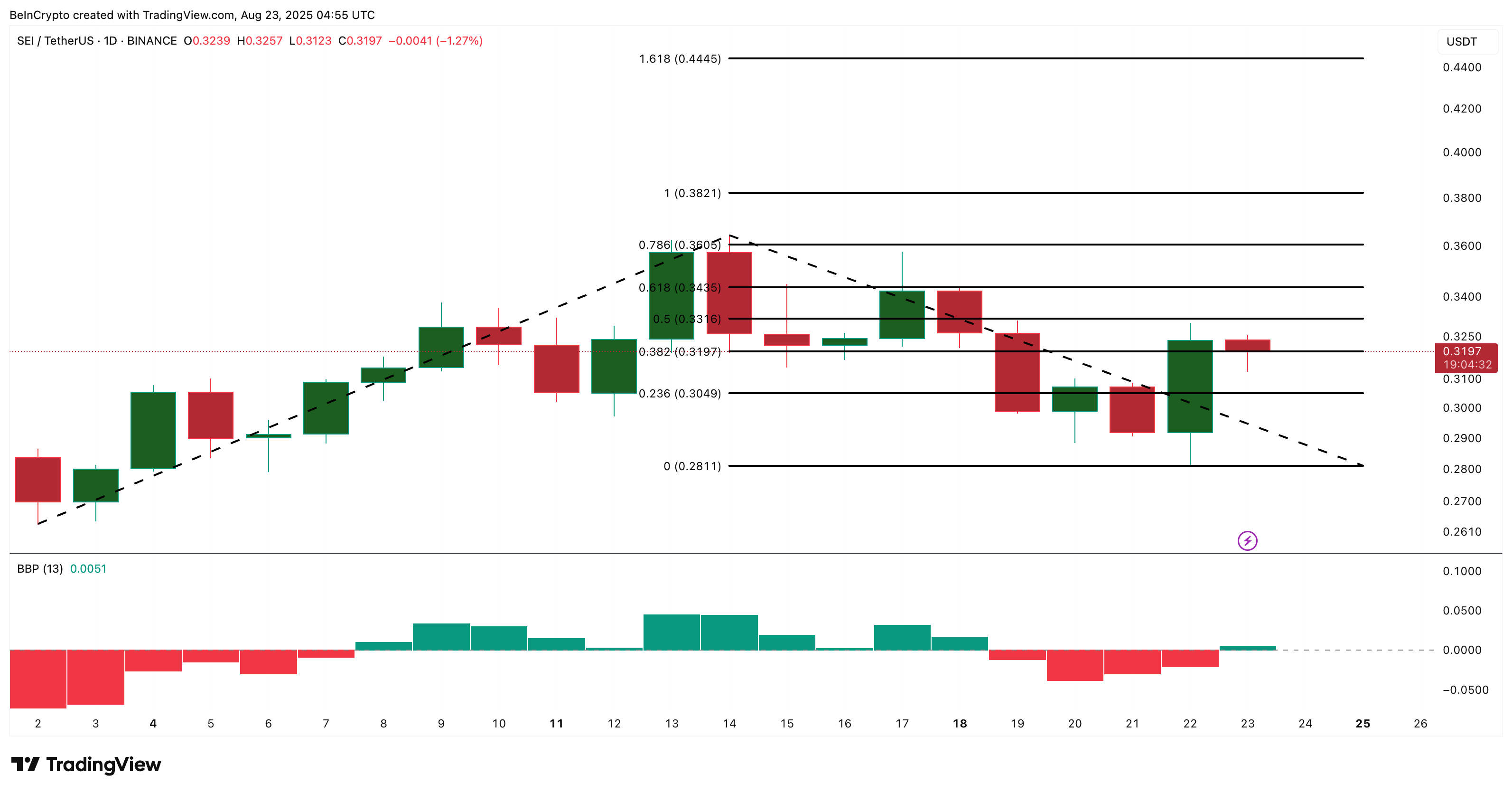

XRP (XRP)

XRP has traded nearly $3, up 6.5% over the past 24 hours, but its rally remains restrained compared to Ethereum and Solana. This performance suggests that interest rate cuts in September may not be fully priced, making it one of the coins XRP will watch before the September interest rate cuts come true.

On the daily charts, Chaikin Money Flow (CMF) is pushed higher. This reflects a stronger inflow, but the relative strength index (RSI) is located at about 49. This is a neutral measure that indicates that tokens are not being over-built.

Chaikin Money Flow (CMF) combines price and volume to measure buying and selling pressure, with higher measurements indicating stronger inflows.

The Relative Strength Index (RSI), on the other hand, tracks the speed and change of price movements to measure momentum, and is considered oversold at values above 70.

Technically, if you exceed $3.10, you’ll be able to increase your chances of moving to $3.34. And if you break through that resistance it could ignite a stronger rallies north of $3.65. However, a drop below $2.78 is risky for deeper losses.

Beyond the price, the foundation is at work. Ripple secured a legal victory in rejecting the SEC’s appeal, with a cluster of revised XRP ETF submissions reviving speculations about the influx of the scheme.

Together, these factors set the XRP stage to respond sharply if interest rate cuts are confirmed in September.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

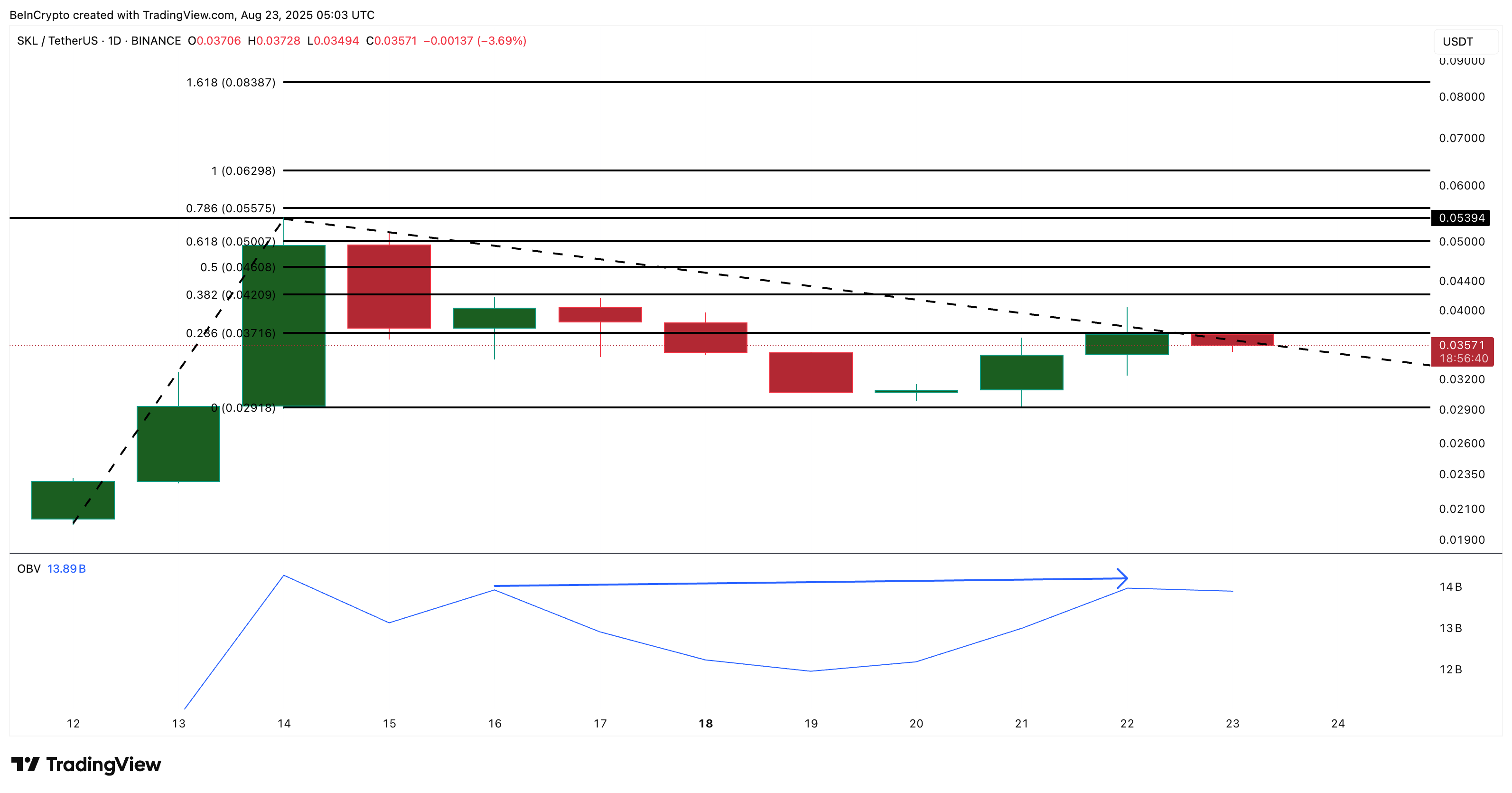

sei (sei)

The SEI Network, a layer-1 US development built for trading applications, has quietly gained traction in recent months. Ondo Finance’s decision to launch a tokenized finance ministry with SEI highlights its relevance in the real world asset narrative.

Tokens rose nearly 10% in the past days, but are now trading at $0.31. The Bulls may have finally regained control after four sessions of decline.

This shift was confirmed by the Bullbear Power Indicator turning the green over. And it also strengthens SEI inclusion between coins to watch before interest rate cuts in September.

Bullbear Power (BBP) emphasizes the balance between bullish and bearish momentum, with green bars indicating that bulls are gaining control

For three months, SEI has provided a 44% profit, backed by an unharmed uptrend. Fibonacci’s forecast shows resistance between $0.33 and $0.36 with a breakout opening the door to $0.44.

On the downside, if you fall below $0.30 and below $0.28, your setup will weaken. As the wider sentiment leaps towards dovish, the muted assembly of SEI will leave a range of acceleration if fluidity increases in September.

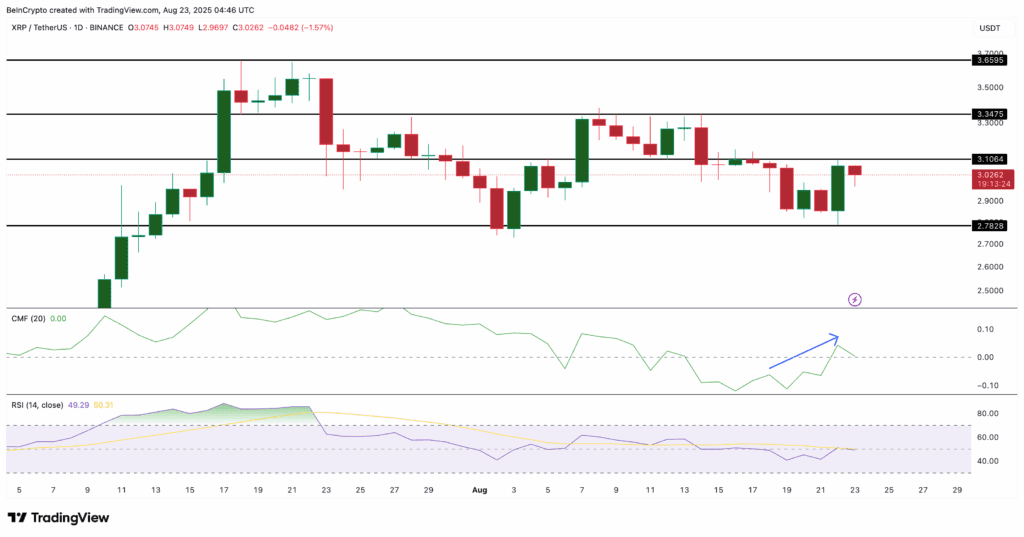

Skale (SKL)

Skale, a US-based Ethereum scaling solution, is gaining attention after 50% of the rally stemming from whale activity and speculation about Google linkups.

Prices are cooled, but have earned less than 5% in the last 24 hours and are steadily trading at nearly $0.035. The wider construction indicates that buyers are quietly re-emerging.

Even if prices were higher, they increased from 139.3 billion on August 16th to 199.8 billion on August 22nd. This is a sign that accumulation is ongoing. Netflow data also shows stable outflow, suggesting that the pressure on the seller has been eased.

On-Balance Volume (OBV) adds volumes on the up day and subtracts down day to indicate whether the pressure on buying or selling is driving trends.

Key levels are at $0.037 and $0.055, with breakouts above $0.055 rarely reaching resistance up to $0.083.

With interest rate cuts in September, there is a high chance that liquidity will be injected into risk assets, so the link between Skale’s technology improvements and the Ethereum Scaling project makes it one of the most convincing coins before the rate cuts in September.

However, a DIP below $0.029 could override bullish outlook and prime new low SKL prices.

Overall, these three “Made in USA Coins” show significant volatility in anticipation of potential September interest rate cuts.

Post 3, made with US coins to watch before the interest rate cuts in September, first appeared on Beincrypto.

(@filanlaw) August 22, 2025

(@filanlaw) August 22, 2025