Hedera Hashgraph’s native token Hbar posted a 10% price surge last week, pushing Altcoin to a new 30-day high of $0.179.

As broader market sentiment improves, Altcoin appears to be in a good position to extend the rally in the coming days. But how much can it climb?

HBAR volume reaches $373 million, leading by a long position

HBAR’s daily trading volume rose almost 100%, reaching a 60-day high of $373 million at press time. This highlights the growing interest of investors and strengthens the strength of the current uptrend.

Asset prices and trading volumes rise simultaneously, it shows strong bullish momentum and increased investor confidence. The rise in volume confirms that price movements are driven by key trading activities.

Therefore, this reduces the likelihood of false breakouts and suggests that buyers are actively pushing the market.

In the case of HBAR, double-digit price surges ($373 million trading volume is 60 days higher, indicating that recent rally has gained traction. This convergence of price and volume strength supports the view that HBAR’s upward trend could continue in the short term.

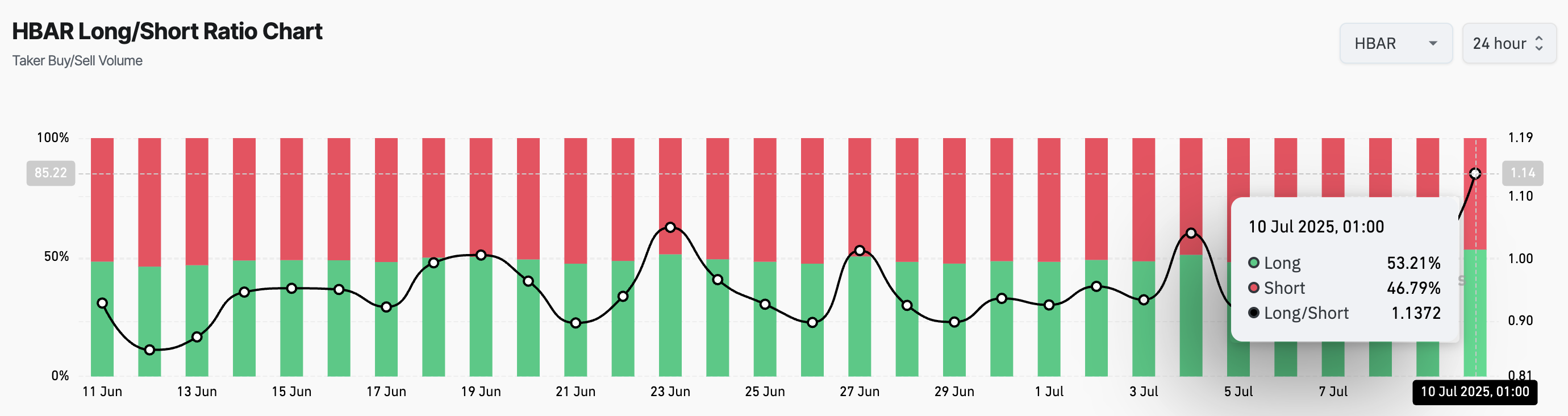

Furthermore, the price surge to 30-day highs in HBAR has sparked demand for long positions in the futures market. This is reflected in the long/short ratio at a 30-day high of 1.13 at press.

This metric measures the percentage of bullish (long) positions in the futures market for assets (short) positions (short) positions. If the ratio is below 1, traders bet on a price drop rather than an increase.

The trainers further predict downside movements, showing skepticism about the token’s short-term price outlook.

Conversely, like HBAR, if there is one or more ratios, there is a longer position than a short position. This suggests bullish sentiment, with most traders expecting the value of their assets to rise.

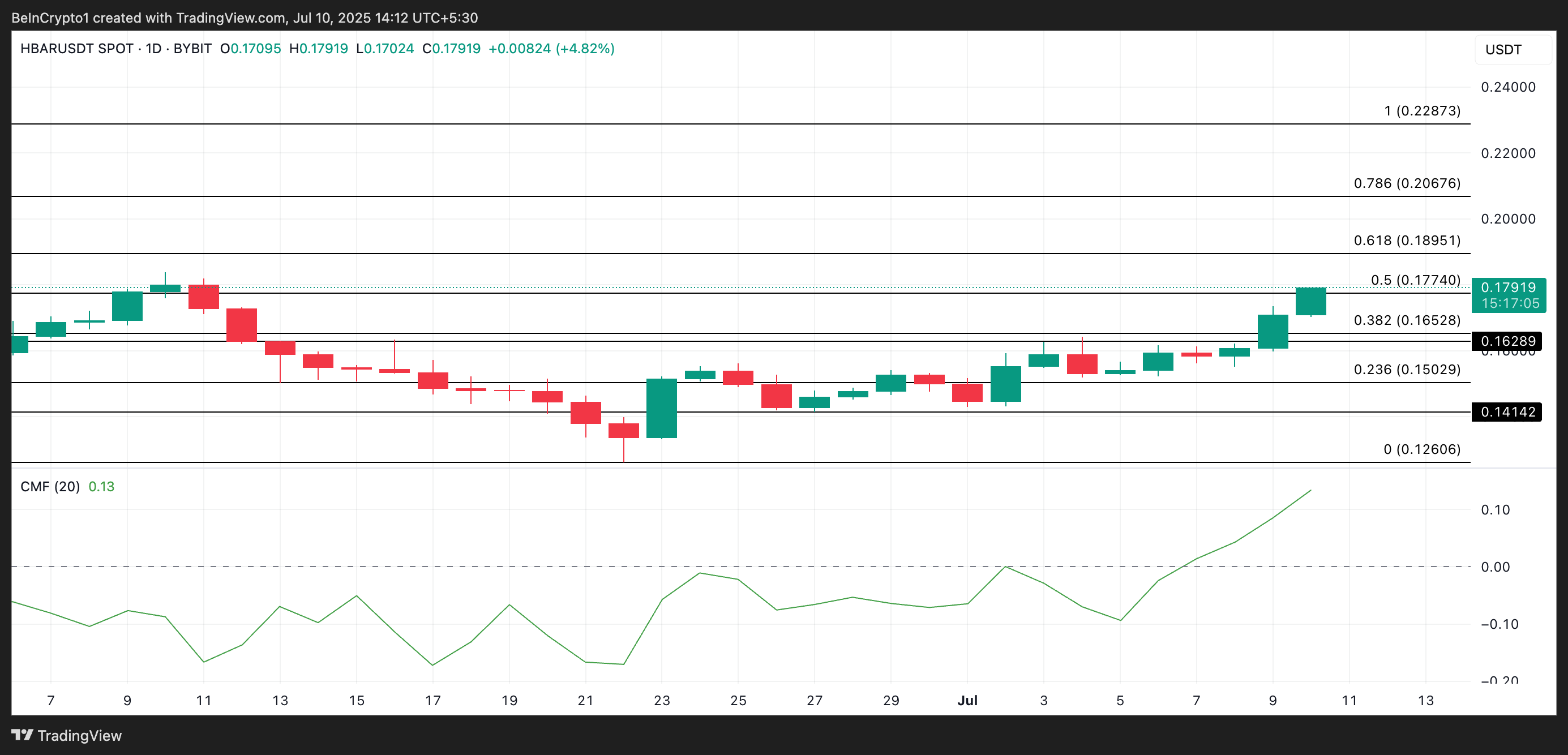

Money flow to HBAR surge – price is extremely facing $0.189 test

Hbar’s Rising Chaikin Money Flow (CMF) on the Daily Chart supports the bullish outlook mentioned above. This momentum indicator, which tracks how assets enter and exit the assets, surpasses the zero line at 0.13 and is on an upward trend at press.

Positive CMF measurements during these rally indicate that purchase pressure exceeds sales pressure and steadily flows into the HBAR. This means investors are confident in their upward trend and are accumulating in the hopes of recording more profits.

If this continues, the token price can test resistance at $0.189. A successful violation of this price barrier could send an HBAR to $0.206.

On the other hand, this bullish projection will be invalidated if sales activities resume. In that case, the token price could drop to $0.165.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.