Cryptocurrency is becoming an increasing focus for North American Chief Financial Officers, according to Deloitte’s latest CFO signal research.

The survey, conducted between June 4th and June 18th, voted 200 CFOs for companies with annual revenues of at least $1 billion, revealing growing interest in crypto adoption between the corporate finance sectors.

CFOs accept ciphers despite volatility

The survey found that 23% of respondents expected the Ministry of Finance to incorporate cryptocurrency for investment or payment within two years. This interest rises significantly to about 40% of CFOs among the CFOs of large corporations with annual revenues of over $10 billion. Despite lingering concerns about market instability, these executives are aware of the potential benefits from cryptocurrency investments.

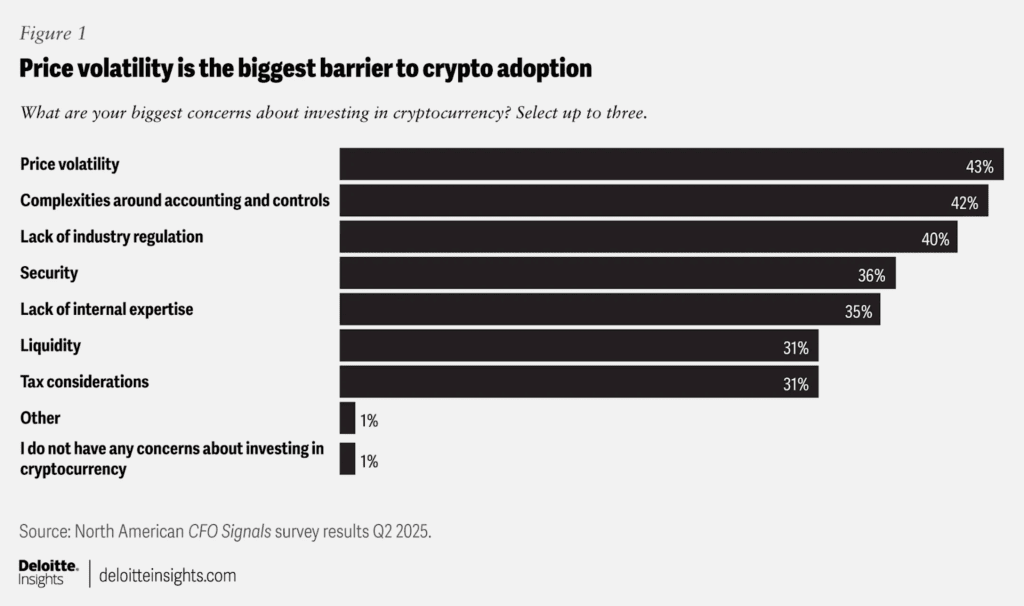

Cryptocurrency concerns remain important. Approximately 43% of CFOs identified price volatility as the highest concern. The anxiety reflects historical instability, with Bitcoin falling by 28% earlier this year for just 10 weeks before.

Complex accounting practices and insufficient industry regulations further complicate the problem. Approximately 42% of respondents cited the complexity of accounting and control as a deterrent, while 40% emphasized the lack of clarity in regulations. Recent developments, including the creation of a cryptographic task force by the Securities and Exchange Commission, underscore regulatory uncertainty.

Nevertheless, the CFO appears to be unattached. Approximately 15% expect to purchase unstable cryptocurrencies such as Bitcoin and Ethereum as strategic investments within two years. For large corporations’ CFOs, this number rises to almost 25%. High returns, portfolio diversification and potential for inflation hedging continue to attract corporate finance leaders.

Stubcoin and supply chain efficiency

Interest in Stablecoins, cryptocurrencies pinned in assets like the US dollar are growing among North American CFOs. Approximately 15% of financial executives surveyed predict that the organization will accept Stablecoin payments within two years. Among large companies, acceptance rises to 24%.

The appeal of Stablecoins primarily includes its ability to enhance customer privacy and promote cross-border transactions. Approximately 45% of CFOs view enhanced privacy as a major benefit. Approximately 39% views stubcoin as a way to streamline international payments, potentially reducing transaction costs and processing times.

Crypto-based payments can streamline complex transactions and eliminate inconsistencies between buyer and seller records. Blockchain technology that underpins cryptocurrency transactions provides secure, real-time transaction verification, increasing transparency and efficiency in supply chain management.

Beyond payments, the investigated executives identified the critical potential of crypto in supply chain management. Over half (52%) expect organizations to use unstable cryptocurrencies to track and manage supply chain logistics. Meanwhile, 48% foresee the stubbcoin, which plays a similar role.

The corporate conversations about crypto adoption reflect this momentum. A Deloitte survey revealed that 37% of CFOs discussed Crypto with the board of directors, 41% with the chief information officer, and 34% with the financial institutions. Only 2% reported no internal discussions about cryptocurrency.

Beincrypto previously reported on the growing adoption of Bitcoin and crypto by companies, highlighting a variety of approaches ranging from aggressive accumulation to careful exposure. Currently, public companies own more than 4% of their total Bitcoin supply. Recently, Joseph Charom, former head of digital assets strategy at BlackRock, has recently moved to co-CEO of Sharplink Gaming, which has established itself as a company in the Ethereum Treasury. Chalom aims to “activate” Ethereum Holdings in Sharplink.

Coinbase Exchange is one of the companies that accelerate the “Saylorization” trend, gradually growing its Bitcoin stockpile. Meanwhile, MicroStrategy Executive Chairman (now rebranded as a strategy) Michael Saylor appeared on CNBC to highlight the importance of Bitcoin’s Treasury trends.

Saylor said, “There are 160 companies that have been using Bitcoin in their open market since they were around 60 years old last year. Therefore, the Bitcoin financial movement is explosive. Also, there are explosive companies such as the metaplanet of Japan, the French capital B, and the UK, including the smarter web.”

However, small and medium-sized businesses engaged in Bitcoin and crypto acquisitions only risk taking serious financial burdens during the market slump.

While the turning point in corporate crypto adoption may still be ahead, Deloitte’s research clearly shows an upward trend. The CFO recognizes both the risks and opportunities presented by cryptocurrencies, signaling a period of change in corporate finance strategies.

Post-crypto is gaining momentum with North American CFOs. Deloitte first appeared in Beincrypto.