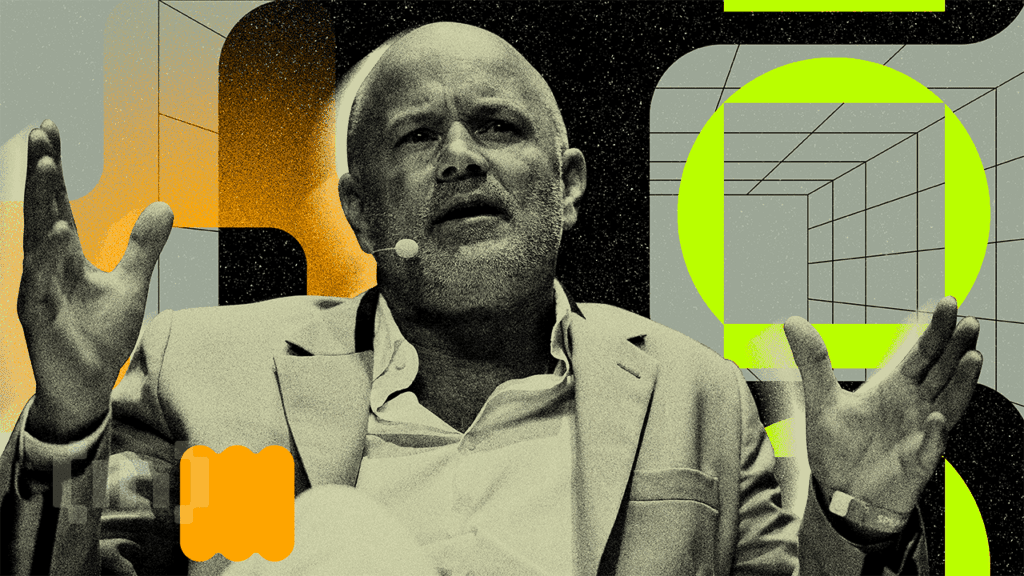

The surge in companies created to hold crypto assets has probably reached its peak. Galaxy Digital CEO Mike Novogratz warned that future success relies on strategic positioning rather than simple asset accumulation.

Issued by the Peak Treasury Behind us

On Galaxy’s second quarter revenue call, Novogratz said on Tuesday it is likely that the surge in Cryptocurrency businesses has reached its peak. “We probably had the experience of Peak Treasury issuance,” he said. “The question now is which of the existing companies will become monsters.”

Ethereum already has two major financial holders. Both Tom Lee’s Bitmine and Joe Lubin’s Sharplink are expected to continue growing. Newcomers are “hard to get oxygen,” Novograts warned.

Galaxy Digital has partnered with over 20 Crypto Treasury companies to earn administrative fees to oversee digital asset holdings. These partnerships add about $2 billion in assets to Galaxy’s platform, generating what Novogratz calls “recurring and recurring revenue.”

The rise of US Crypto Treasury companies has benefited from improved regulatory conditions. Early adopters followed MicroStrategy’s Bitcoin-rich approach, while new participants diversify into Ethereum, Solana and other tokens.

Galaxy recently ran what Novogratz calls “more than 900 million trades,” which he considers to be “one of the largest or largest bitcoin transactions in history.” The successful execution showed strong market confidence in Galaxy’s brand and service. July recorded Galaxy’s best month on all business lines.

Tokenized Inventory Plans with Strong Q2 Performance

Galaxy has submitted a plan to issue a tokenized version of GLXY Class A common stock through a prospectus supplement. The filing relates to up to 245 million shares that existing shareholders can use for resale. Galaxy’s shares are traded under “Glxy” on both the Nasdaq and the Toronto Stock Exchange.

Galaxy’s second quarter results showed that the company added 4,272 Bitcoins in the quarter, bringing total holdings to 17,102 people as of June 30th. Galaxy also completed over 80,000 Bitcoin sales on behalf of its clients and holds $15 million in XRP tokens.

Post Bitcoin Holding Firms may have peaked, says Galaxy CEO was the first to appear on Beincrypto.