PI coin prices have reached nearly 15% in the last seven days, riding on a wider market rally. I’ve never seen a Pace Trader in over a month.

August began with signs of strength, and now three key technical indicators point in the same bullish direction. When multiple signals line up, the chances of strong movements increase, but only when a follow-through comes.

The rise in ADX shows that Pi Coin’s trend is gaining strength

The Mean Directional Index (ADX) measures the intensity of trends, whether bullish or bearish. Less reading means the market is drifting away. A rising reading indicates that momentum is being built.

For PI coin prices, ADX was near 13.3 on July 31, which is considered a weak trend. As of now, it jumps to 19.6, suggesting that the current uptrend is beginning to gain real traction.

Enhancing ADX with upward price trends means buyers are getting closer and the market is committing more volume to this move. This makes the next resistance test of Pi Coin more meaningful.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Daily RSI bullish divergence signal buyers are quietly applying pressure

Relative Strength Index (RSI) measures whether an asset is over-acquired or oversold by tracking the rate and size of price changes. While bullish divergence occurs when prices are low, RSI increases highs, indicating that buying pressure is being built even when prices are lagging.

For the PI Coin on July 22nd, the price was 51, and RSI was around $0.52. By August 10th, the price had dropped to $0.46, but the RSI had risen to 54. And this is our first bullish indicator.

The rise in ADX combined with bullish RSI divergence means that the uptrend is less intense and is supported by improving surface momentum.

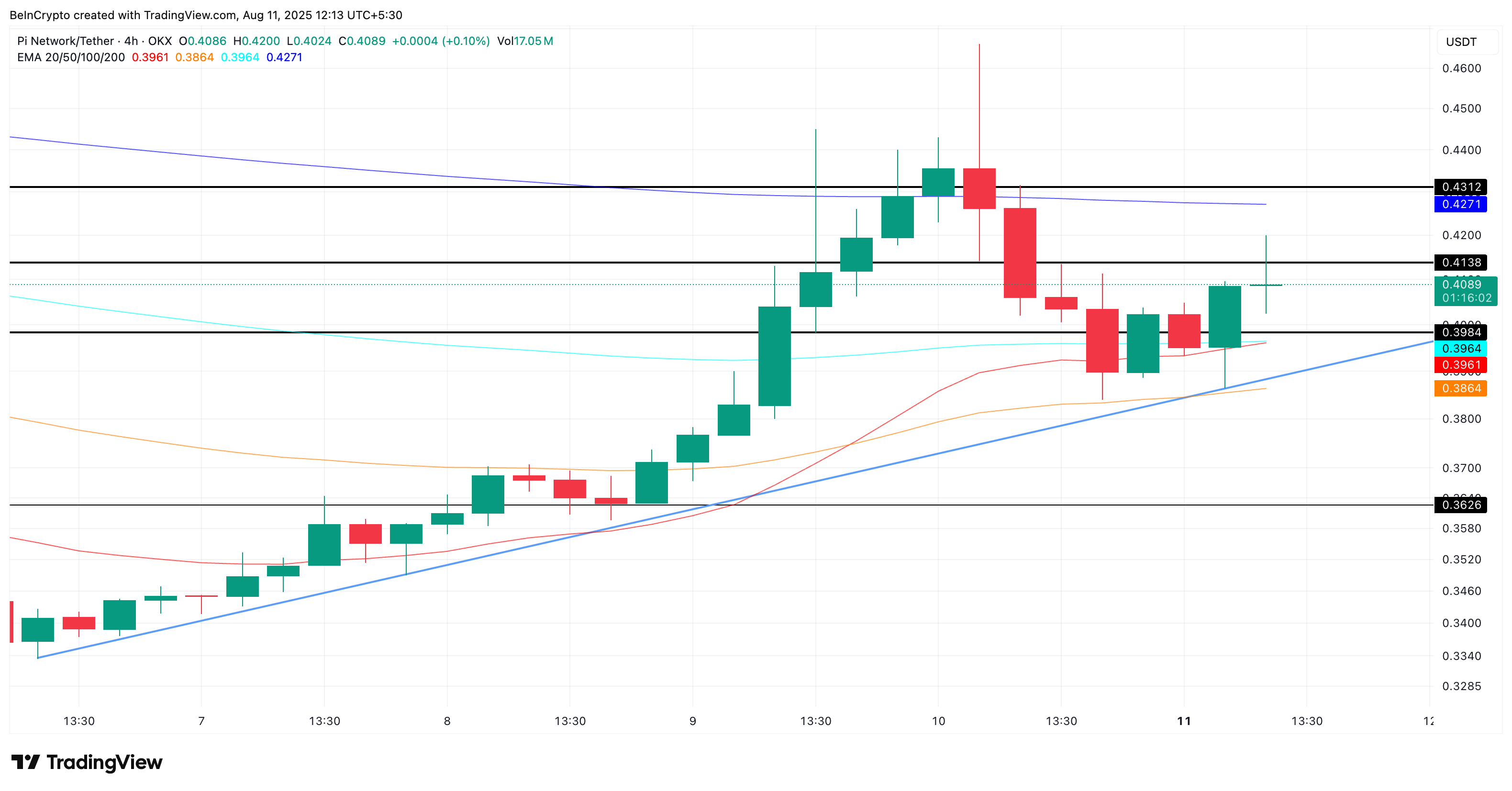

4-hour chart holds PI coin prices in a bullish structure

On the four-hour chart, Pi Coin holds a second bull metric, a triangle in ascending order, a bullish continuation pattern. PI prices exceed the 20-period exponential moving average (EMA) or the red line and 100-period EMA (Sky Blue), indicating short- and medium-term trend intensity.

But that’s not all. The bullish “Golden” crossover is almost there, with the 20th EMA line closed to the 100th EMA line. While the line touches, all that remains is that everything happens. It’s the third bullish metric.

Once the crossover is landed, the key elements from the chart:

Upside Breakout: Moves above $0.41 and above $0.43 can open the door for a sharp rally. Support: $0.39 is the first strong floor, followed by 20 cycles of EMA and 100th period of EMA. Bearish Flip: Only when the price falls below $0.38 (50 EMA) will the structure become short-term bearish.

If ADX continues to climb and RSI maintains bullish divergence, breakouts from this pattern are more likely and may encourage what “one big move” traders are watching. However, a decline below $0.38 will negate the bullish outlook.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.