Skale (SKL) has expanded over 100% in the past week, offering 44% gain in the last 24 hours alone. The token is currently trading near the $0.039 mark after temporarily testing a higher level.

This explosion has been caught in the eyes of traders chasing momentum, but with few on-chain or technical metrics, it suggests that the rally could face a cool down or integration in the next session.

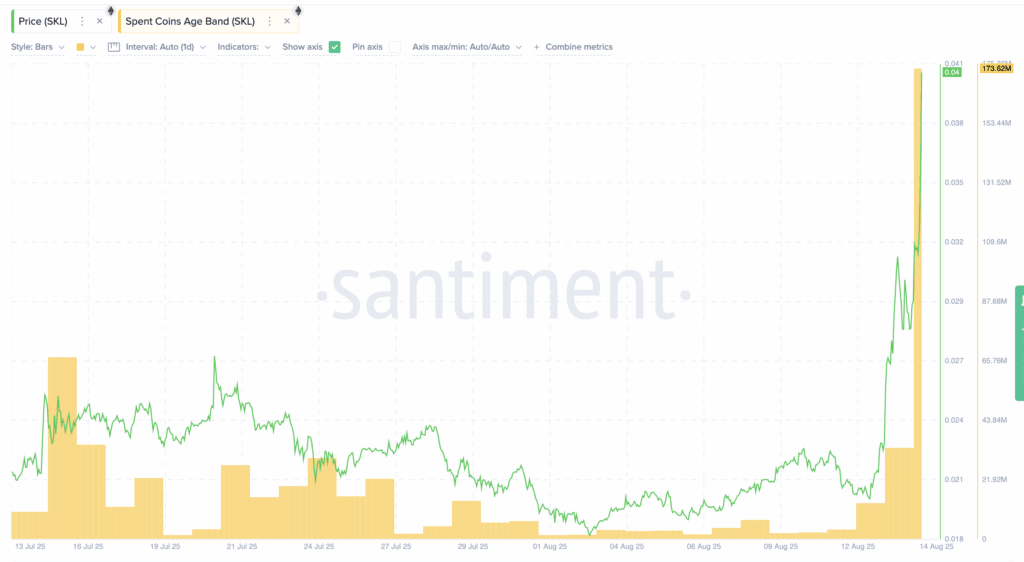

Dormant coin wakes up: spikes that often precede the pullback

We look at used coin age bands to show when long-term indoor coins have begun to move. This usually occurs after a sharp meeting. In the last session, this metric increased from 3336 million to 17,362 million SKL (approximately 5.2×, or about 420%).

In July, small local peaks (July 15th, July 24th, July 29th) followed by Skale Price Dips in subsequent sessions. A large block of dormant coins suddenly moves, usually means that supply is back to the market. Historically, headwinds for the continuation of the assembly.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Whale trims while replacement supply rises

Cohort behavior is combined with exchange balance to see if “moved coins” could meet immediate fluidity.

The 10-100 million SKL cohort (Keiswing Whale) reduced its holdings from 3.27 billion to 3.14 billion SKL. This is a cut of 130 million SKL (4%). At the same time, Exchange Reserves rose 2.44% to SKL 19 billion, meaning that around 45.3 million SKL have flowed into the exchange in 24 hours.

In summary, the whales create a background where more coins are sitting in exchanges are ready for sale. Even if some whales move is an internal reorganization, net photos are more readily available supply than yesterday.

As mentioned in the chart, this cohort has previously dumped the supply of SKL, a move consistent with the price decline.

SKL Price Structure: Bearish wedge capped near $0.042

When the signal changes, price context is paramount. On the daily charts, SKL prices are pushing at the top of the spreading wedge that is rising. This is a pattern that resolves by pause or retrace unless the price is closed on top rail ($0.042) and held.

If the buyer doesn’t force a breakout, watching nearby levels is $0.036, then $0.033, $0.030 (current leg to Fibonacci marker). A deeper correction allows you to look up between $0.027 and $0.023. Note that when SKL prices create a new high, the FIB marker changes. The current setup only considers the previous low swing (0.018) and the latest swing high ($0.042).

Why are you tilting towards the pattern now? Three separate lenses refer to short-term fatigue, as the top of the wedge overlaps with dormant neutral activity and a surge in fresh exchange supply.

A powerful daily SKL price of over $0.042 in follow-through will neutralize the open room for immediate bear setup and higher movements. The dormant coin spikes are cooled, whales re-accumulate, and chain pressure is relieved as the balance is re-responsive.

The bearish metric in post 3 threatens to reduce the SKL price rally that first appeared on Beincrypto.