As volatility rises and uncertainty returns across the digital asset market marketplace, trading activities have witnessed immersion in global crypto market capitalization over the past few days.

Despite the wider slowdown, some US-based coins are hitting trends and appear poised to earn potential benefits in the third week of August.

Skale (SKL)

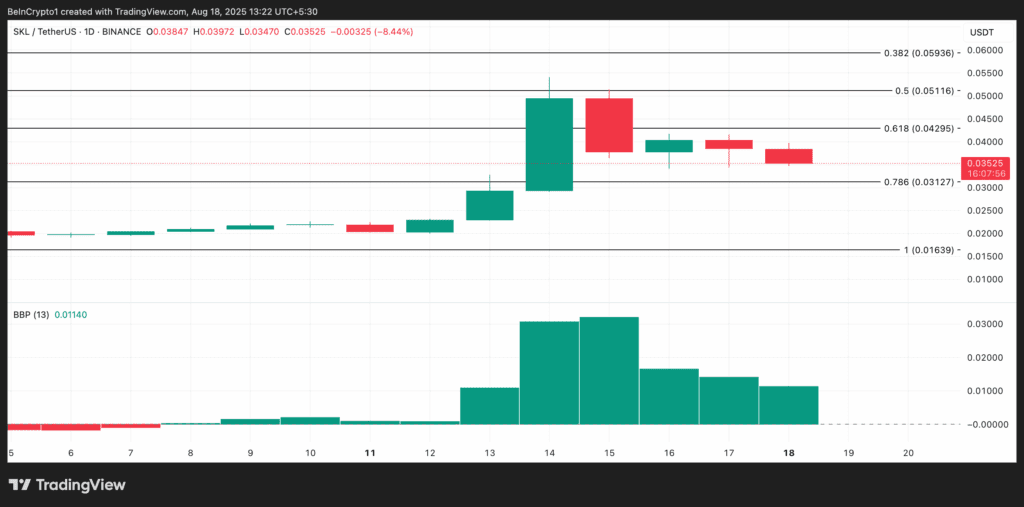

SKL ignored the less inactive performance of the broader market to record profits of over 50% over the past seven days. At the time of this writing, Altcoin is trading at $0.035.

Skl’s Elder-ray index setup suggests that bullish slopes in market sentiment still remain. For context, the indicator has consistently displayed the green bar since August 8th, informing you of ongoing purchasing activities. However, the gradual shrinkage of these bars over the past few days suggests that purchasing power is slowly fading.

Despite this slowdown, the indicators have not yet changed negatively. This means that purchases still exceed sales and there is a careful bullish edge.

If the buyers continue to control, the price of SKL can be increased to $0.042.

Meanwhile, if sales continue, SKL could drop to $0.0312.

Venice Token (VVV)

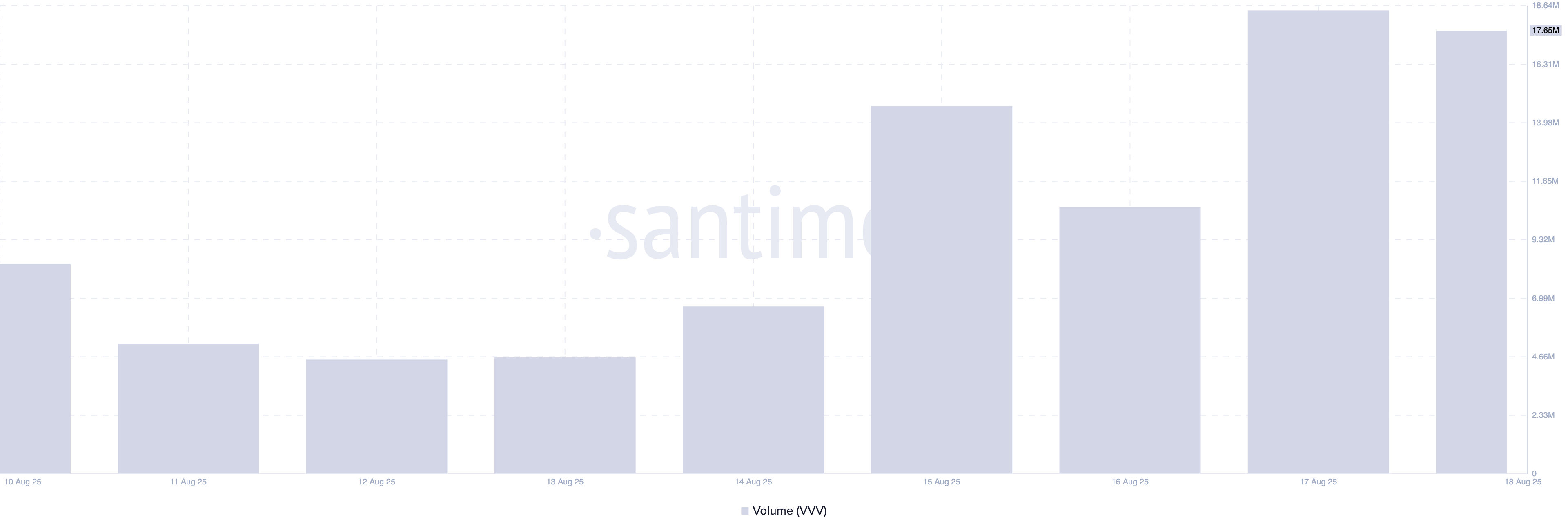

The AI-powered VVV is another VVV made with US Altcoin to watch this week. VVV, which trades at $3.93 at press time, has risen 34% over the past seven days.

During that period, its daily trading volume has also skyrocketed, highlighting the strong demand for Altcoin. According to santiment, this has risen 204% since August 11th.

As assets trading volumes rise along the price, the price movement indicates that they are supported by true market profits rather than thin liquidity. In the case of VVV, this means that more traders are actively purchasing tokens, suggesting confidence in the short-term outlook.

If this growing demand continues, VVV prices could rise above $4.18.

However, once you start making profits, the token may lose some of your recent profits, with support levels of around $3.83, resulting in a lower level.

Bertram Pomerania (Bad)

Meme Coin Bert has been collecting 37% over the past week, making it one of the US assets to watch this week. At Press Time, it trades at $0.053, significantly surpassing the 20-day index moving average (EMA) and forms dynamic support at $0.045.

This important moving average measures the average price of an asset over the last 20 days, giving more weight to recent price changes.

The short-term trend is bullish when an asset is traded at a price above the 20-day EMA. Being on this line means that recent purchase pressures are strong enough to keep Bert priced higher than the average for the past 20 days.

If this continues, its price could skyrocket to $0.064.

vice versaif the seller regains control, the Meme Coin price could be less than $0.051towards the 20-day EMA.

Post 3, made with US coins to monitor in the third week of August, first appeared on Beincrypto.