Ripple’s XRP has spurred around 10% of its value over the past week as sales intensifies across the broader crypto market.

While the rally tokens’ history-high $3.66 during the market boom in July has benefited many holders, the rising volatility is beginning to test investors’ sentiment. What does this mean for a token holder?

XRP traders stick to profit despite losses

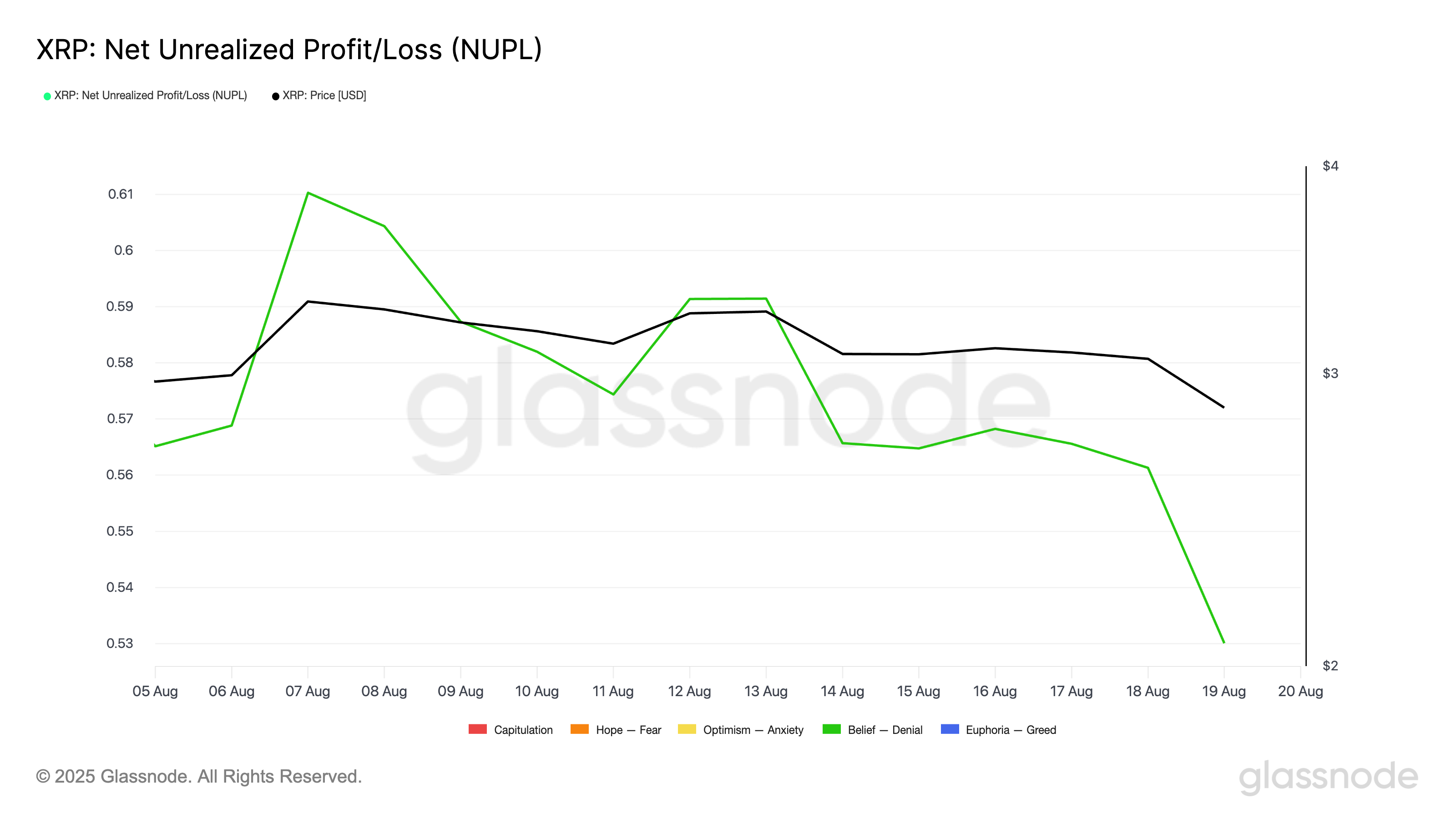

According to GlassNode, XRP’s net unrealized profit/loss (NUPL) metric measures show that the market is in the current belief band and investors are holding profit despite increasing losses.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The NUPL metric measures the difference between unrealized gains (if the holder is still green) and unrealized losses (if the position is underwater).

According to data providers on the chain, the belief-dong zone reflects the transitional stage of market sentiment. At the belief stage, investors are confident, most positions are profitable, and optimism dominates. In the rejection phase, the price starts slipping, but the holders refuse to admit the recession, hoping for a rebound.

The owner’s confidence is beginning to shake as XRP’s NUPLs and tokens fell 11% last week in this zone. Nevertheless, many continue to cling to hope, denies the possibility of a deeper recession.

XRP futures reveal bullish bias despite price pressure

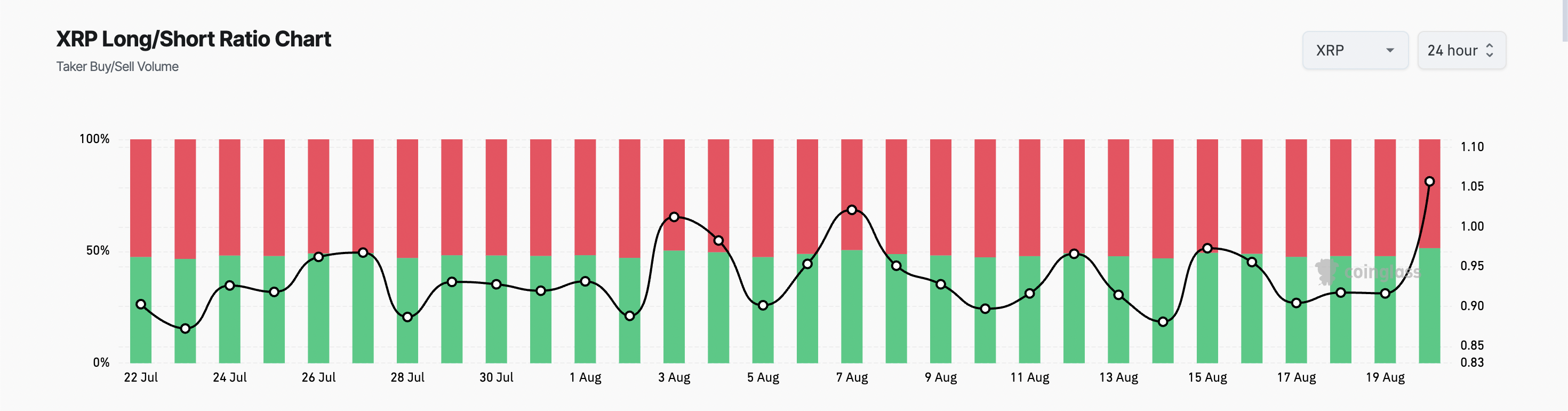

The rise in XRP’s long-/short ratio has underscored optimism among futures market participants who continue to bet on price rebound despite recent losses.

According to Coinglass, this ratio is currently at a 30-day high of 1.05, indicating that it has acquired a longer position than shorter traders.

The long/short ratio tracks the balance between traders betting on price increases (long) and those betting on price decreases (short pants). When the ratio exceeds 1, the long position will dominate and signal bullish emotions. Conversely, a ratio below 1 suggests that the shorter positions are heavier and bearish expectations.

The XRP ratio shows that traders continue to maintain hope for rebounds despite the continued rise in market volatility and sales pressure.

XRP at the tipping point

At press time, XRP trades for $2.887. If bullish bets rise and market sentiment gradually reverses positively, the token could reach $3.222.

Meanwhile, as selloff persists and bear pressure rises, XRP could continue to decline and drop to $2.637.

The price of the XRP post drops by 11% as it appears to be stuck between hope and reality.