API3 is a decentralized Oracle solution aimed at making real data accessible via blockchain APIs, with token prices exploding nearly 90% over the past seven days, peaking at over $1.80.

However, it has dropped by nearly 10% over the past 24 hours, causing confusion among traders. Is this the beginning of a deeper correction or a shorter cooldown before?

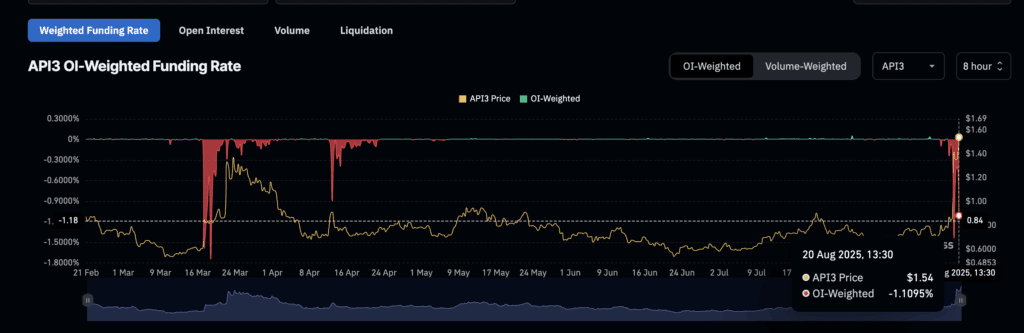

As funding rates drop, shorts stack up

The funding rate for API3 has reversed deeply negatively over the past 24 hours. On August 19th, the OI weighted funding rate was -0.47%. By August 20th, it had plummeted to -1.10%. That is, most traders are currently paying to hold short positions and betting heavily on price drops.

This shows positive short side emotions. However, the price of API3 has not collapsed. It immersed slightly from the peak, but the API3 Bulls have not completely retreated. So despite the bearish bet, the seller is not taking control at the time of the press.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Smart Money buys Bright while remaining CMF and Exchange Data

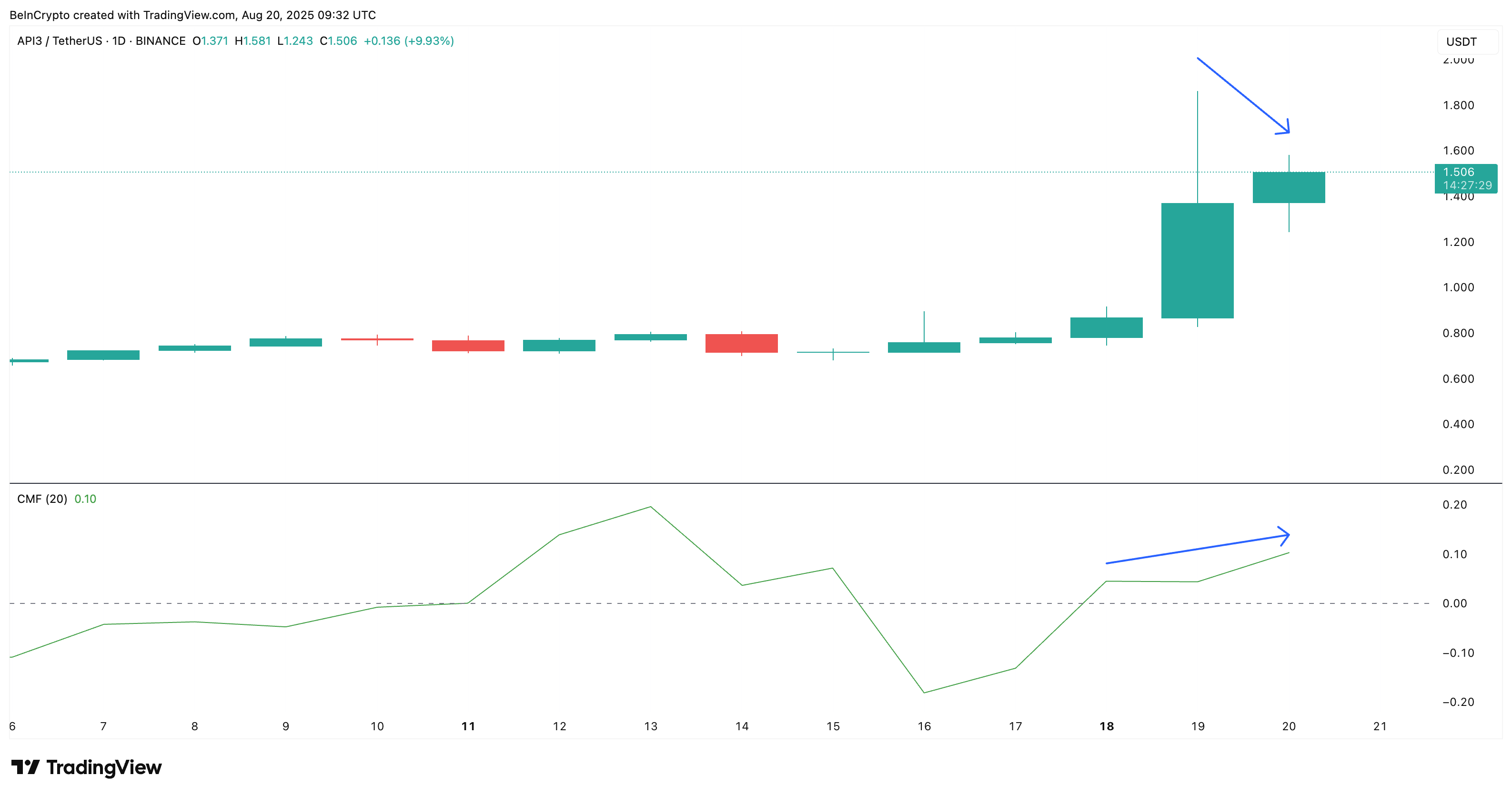

Under the hood, the buyer is still intervening. The daily chart chaikin money flow (CMF) has steadily risen from 0.04 to 0.10 in the past few hours, even with API3 prices slightly cooled. CMF suggests accumulation by increasing despite a small priced pullback.

CMF is a volume-weighted indicator that indicates whether money is flowing through tokens based on price and quantity.

Exchange Reserves check this. Over the past seven days (during the assembly), API3 exchange balance has dropped by 30.5% and is currently sitting at 28.63 million tokens.

At the same time, the top 100 addresses increased their holdings by 25.98%, while the smart money wallet jumped by 204%.

API3 Price Chart shows bullish bias

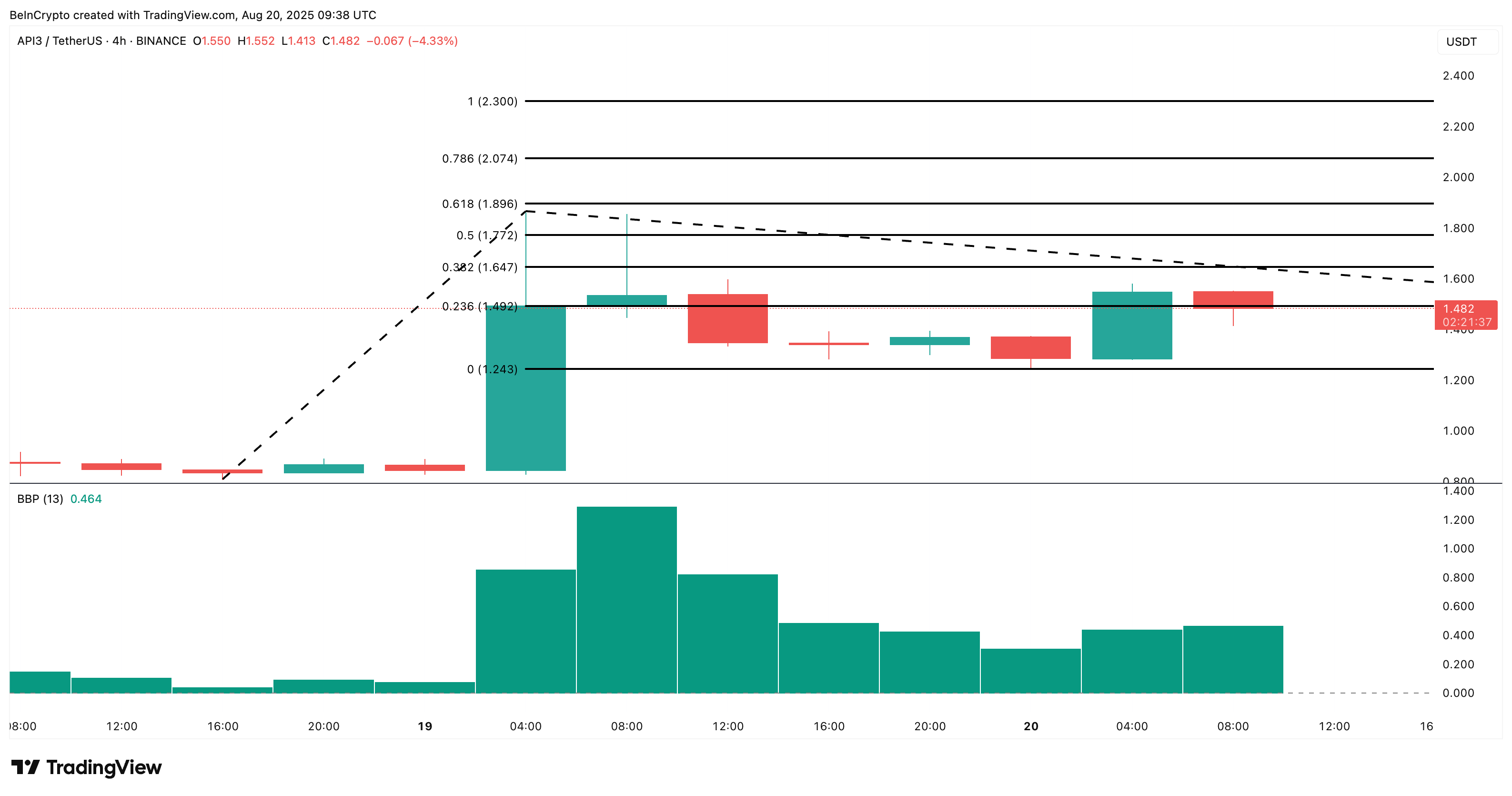

On the four-hour chart, API3 still shows bullish momentum. The price bounces off the 0.236 Fibonacci level, close to $1.49, while the Bullbear Power (BBP) index remains positive at 0.464.

This suggests that the Bulls are not complete and that if the purchase continues, short crowds and bearish bets could be quickly liquidated. This will increase the price and will sit at $1.64 and $1.77 for the time being.

As bullish momentum appears to be picked up, it appears that the green bar is rising, so it seems more likely that the API3 price rally will continue. The BBP indicator measures the strength of the bulls vs bears by comparing the high and low values with the moving average.

However, if the buyer gets cold at a price under $1.24, the same shorts could win the round, potentially negating bullish prospects. The long is then exposed and liquidation could deepen the drop rapidly.

The first appearance was a rally where API3 post-rally packed between bullish purchases and bearish biases.