By the third week of August, some Altcoins had experienced a sharp drop in their exchange reserves. This trend reflects the growing demand for accumulation and out-of-exchange retention. Shifts are particularly noteworthy as the so-called Altcoin season is becoming more and more selective.

Which tokens are seeing this surge in accumulation, and what are the factors driving investor optimism?

1. Esena (Ena)

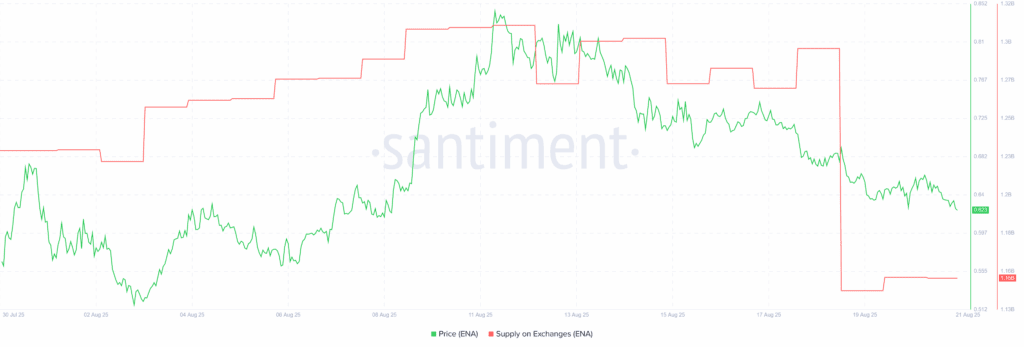

Data from Santiment shows that Ethena (ENA) Exchange Reserves fell from 1.3 billion to 1.15 billion in the third week of August. In other words, 150 million ENAs have left the central exchange.

This happened while ENA prices rose 30% in August, rising from $0.51 to $0.65.

Reservedrop coincided with the Ecena Foundation, which announces a $260 million buyback program. The plan allocates around $5 million daily to buy back the ENA from the market.

Tokenomist estimates that buybacks can remove 3.48% of the circulation supply. This absorption of sales pressure will boost long-term investors’ trust.

Plus, Ecena crossed a major milestone in August. Revenues exceeded $500 million, with USDE supply reaching a record high of $11.7 billion.

Together, these drivers have encouraged the ENA accumulation and the decline in exchange reserves.

2. Bioprotocol (bio)

Bio Protocol, a leading project in the Desci sector, achieved superior performance by over 265% in August.

Along with price gatherings, exchange reserves fell sharply. From early August until the present, reserves have fallen from 380 million to 294 million. This is down by more than 22%.

The third week of August saw the most dramatic movements. Investors have withdrawn 42 million bios in just one week, pushing the exchange’s reserves to the lowest levels this year.

Some catalysts explain this wave of accumulation. Bio launched a staking program in early August, which collected over 25 million tokens. Additionally, Arthur Hayes invested $1 million in bio this week, attracting market attention.

Bio Protocol has also rolled out new ways to reach new investors. Users will be asked to discuss their projects on social media to earn BIOXP. This gives you access to your first bioagent sales.

These factors were combined to increase visibility, attract new investors and accelerate accumulation.

3. API3

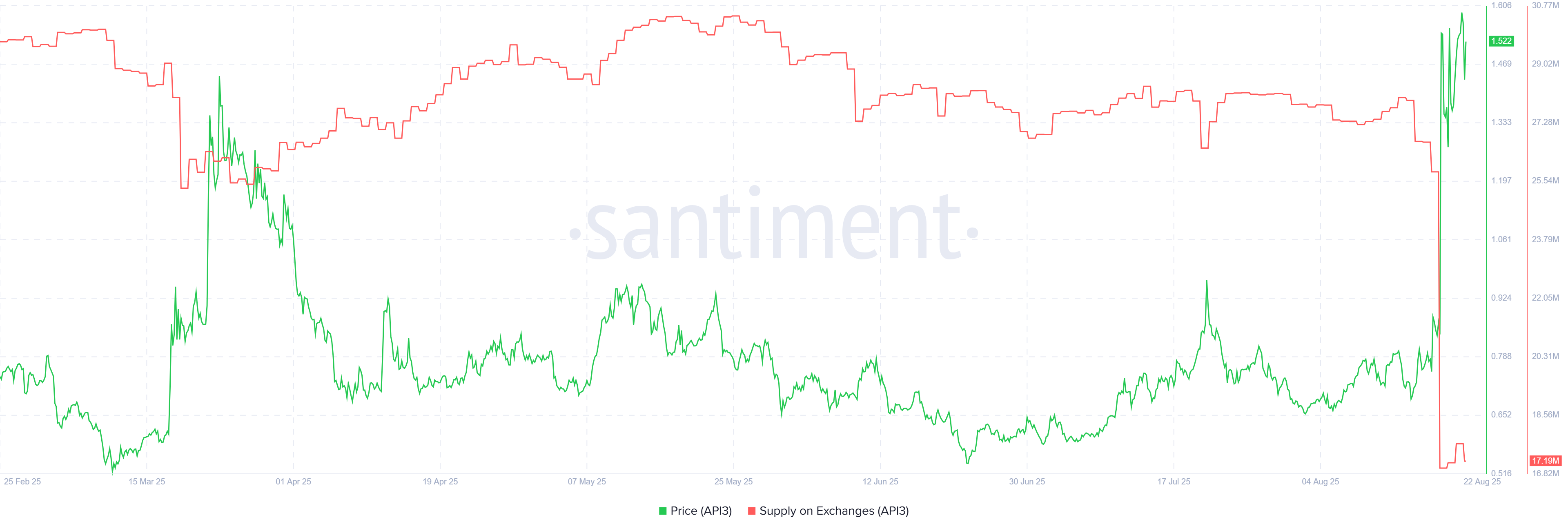

API3, an Oracle-focused project, regained investors’ profits in August, increasing prices by over 130%. At the same time, Exchange Reserves fell to its lowest point this year.

We recorded a turning point for the third week of August. Over 9 million API3s have been withdrawn from the exchange, bringing the exchange supply down to just 1719 million.

Catalyst was the list of API3’s Upbit. According to a report by Beincrypto, the token price exceeded 120% immediately after the list.

Investors focused on the Oracle sector with a chain link (link) rally. The strong performance of Links over the past month has spread to related projects. Artemis data confirmed in August that Oracle was the most performant sector on the market.

With a surge in API3 accumulation, price trading has been stable above $1.50.

These three Altcoins highlight the various drivers behind August’s selective Altcoin Rally. The broad Altcoin season has yet to emerge, but projects with unique catalysts, such as buyback programs, staking incentives and exchange lists, are attracting investors’ attention and capital.

The top three altcoins accumulated from the exchange in mid-August made their first appearance on Beincrypto.