Ethereum prices are still firmly held, up 1.1% over the past 24 hours to around $4,770. The assets are at an all-time high of less than 2%, extending their three-month profit to 85% and trading above 70% for a year.

The rally was one of the most powerful of the major altcoins, but traders are now split into two scenarios: short pullbacks or breakouts that take ETH over $5,500. There is a reason why both happen.

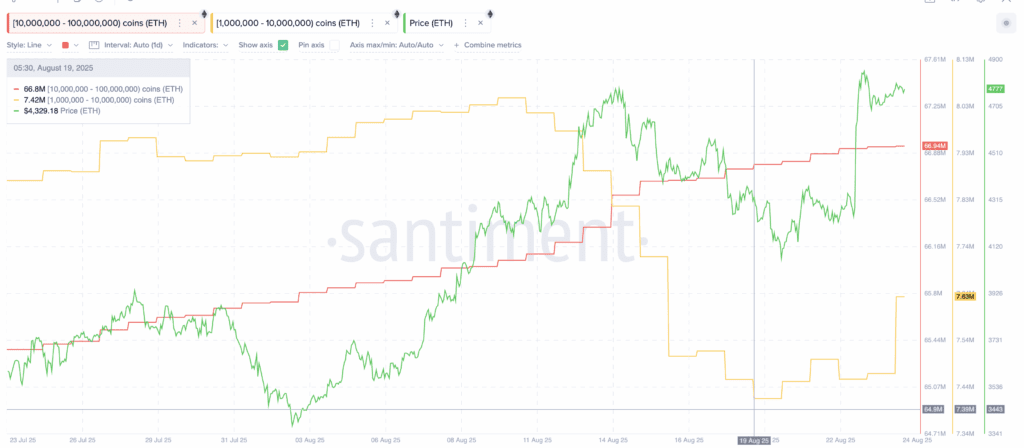

Large-scale owners continue to accumulate

The Ethereum Price is resilient at nearly $4,770, and large holders were quietly added to the stash. The wallet, which owns ETHs from 1 million to 10 million, increased its supply from 7.42 million ETHs ($353.9 billion) on August 19 to 763 million ETHs ($363.9 billion) at the time of press.

This means that 210,000 ETH, worth around $1 billion at its current price, has been absorbed over the past few days.

At the same time, the 10 million-100 million ETH cohort increased their holdings from 66.8 million ETH (31.863 billion) to 6694 million ETH (31.93 billion dollars) and added around $668 million ETH of around 140,000 ETH.

This steady accumulation shows fundamental confidence, even when Ethereum trades are shy of its highs. However, while spot buying strengthens the base, on-chain activity shows signs of profit.

This is where metrics such as vibrancy and cost-based heatmap add another layer of context.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Vibrancy suggests pullback, but limited

Ethereum’s vibrant indicators that measure whether coins are held or used have climbed to the best monthly readings above 0.70. Higher vibrancy means longer coins are being moved, which is often associated with profits.

The surge in vibrancy in early August fell from $4,748 to $4,077 within days. Similar cooling is now possible, but the scale may be smaller due to the strong demand zone below.

Ethereum’s cost-based delivery heatmap shows one reason why pullbacks are restricted. The tool shows where the coin last changed hands, highlighting the price range with concentrated ETH purchase activities.

Three important clusters have been formed.

$4,592–$4,648 ETH Approximately 4,648-4,704 to ETH $4,648-700,000 ETH $4,704–$4,761, and almost 545,000 ETH

Together, these stacks suggest heavy demand between $4,590 and $4,761. When ETH immerses in this zone, buyers can quickly absorb sales pressure and limit negative risks. This is more evident when large holders, including whales, pick up ETH during the assembly. If Ethereum prices drop a little, they might want to do the same thing.

Important Ethereum price levels to watch

From a chart perspective, Ethereum recently honored the 0.618 Fibonacci expansion at $4,948. This is often one of the strongest resistance levels. The decisive daily closure above opens a pass that is a $5,496 milestone heading towards a 1.0 expansion, effectively $5,500.

On the downside, if you can’t keep a $4,610 zone tailored to both Fibonacci support and cost-based clusters, you could potentially move to $4,400. However, that will be againDon’t forget that ETH whales and other large holders will sell.

Will this post raise the price of Ethereum or will it cost $5,500? It first appeared in Beincrypto.