Bitcoin has attempted to recover after recent volatility, with prices still stable beyond key support levels.

The Crypto King has benefited from a more stable market situation, but the signs point to the stage of integration rather than the extended assembly. Historical trends suggest that Bitcoin may be in the familiar cooling period.

Sponsored Sponsors

Bitcoin risk is declining

Quantile risk indicators highlight this development. Bitcoin’s new mid-August gathering marked the third few months of the cycle’s euphoria. This behavior is reflected on a quantile cost base of 0.95, in which 95% of the supply holds unrealized profits.

The latest euphoria continued about 3.5 months before demand showed fatigue. Currently, Bitcoin is trading on a quantile cost basis of 0.85 to 0.95, or between about $104,100 and $114,300. Historically, this range serves as an integrated corridor following the peak of euphoria, creating a lateral action as a balance between buyers and sellers.

Sponsored Sponsors

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

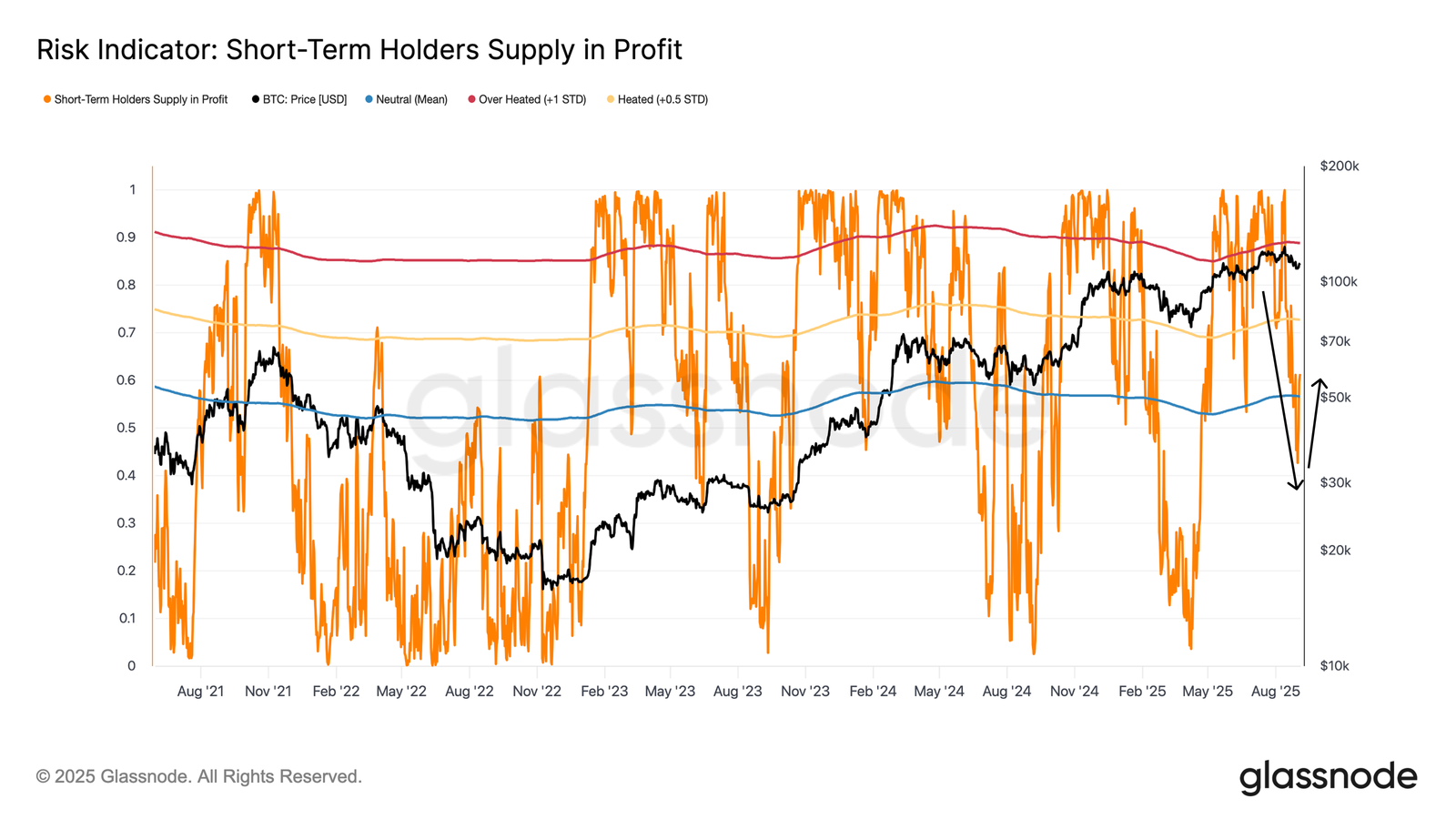

The percentage of short-term holder supply in profits is even more clear. As Bitcoin slipped into $108,000, the short-term supply of profits fell from over 90% to just 42%. This sharp reversal reflects fear-driven sales, a common feature of overheated markets.

Following that drawdown, the exhausted seller promoted the rebound to $112,000. Currently, over 60% of short-term holders are back in profit, making them neutral compared to recent extremes. However, confidence remains fragile.

A sustained recovery of over 75% of short-term holder supply, where more than $114,000 to $116,000 is profitable, is necessary to recover stronger demand.

Sponsored Sponsors

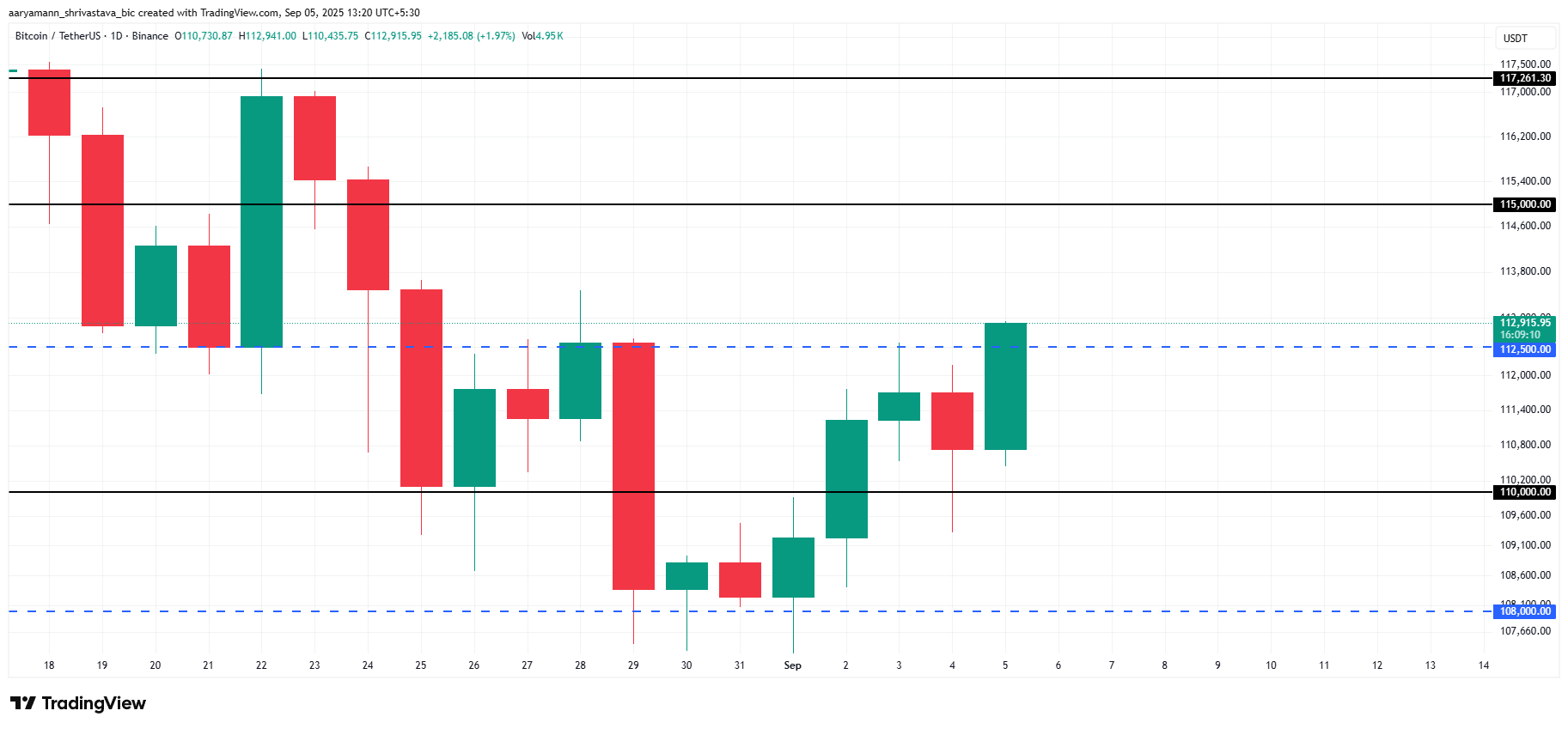

BTC prices may witness expanded integration

Bitcoin, beyond the $112,500 resistance, is encouraging and provides a path to $115,000. This level is important to attract new capital inflows. This increases the chances of validating recovery and sustaining upward momentum.

However, historical patterns suggest that integration is still highly likely. Bitcoin can settle for under $115,000 or fall below $112,500, with sideways price action dominating the short term as the market absorbs recent volatility.

As profits accelerate, Bitcoin could face a sharper decline. Returning to $110,000, or even this loss of support weakens emotions, invalidates bullish papers, and makes BTC vulnerable to extended integration or further downsides.