So far, Solana (Sol) has struggled to free herself from Muted’s performance, and the price action has now primarily turned sideways. The coin faces consistent resistance at $213.04, but the support is stable at $200.09.

Interestingly, amid this unshiny price action, on-chain data shows a quiet accumulation of bullish momentum, with Coin’s short-term holders (STH) leading the charge.

Sponsored Sponsors

Solana’s emotions move from surrender to careful self-confidence

According to GlassNode, Sol’s Hodl Waves is a metric that tracks the length of the coin being held, revealing that short-term holders are becoming increasingly active.

These investors, who have held coins for a month to three months, currently manage 13.22% of SOL’s distribution supply, increasing collective holdings by 11% since the start of September.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Sponsored Sponsors

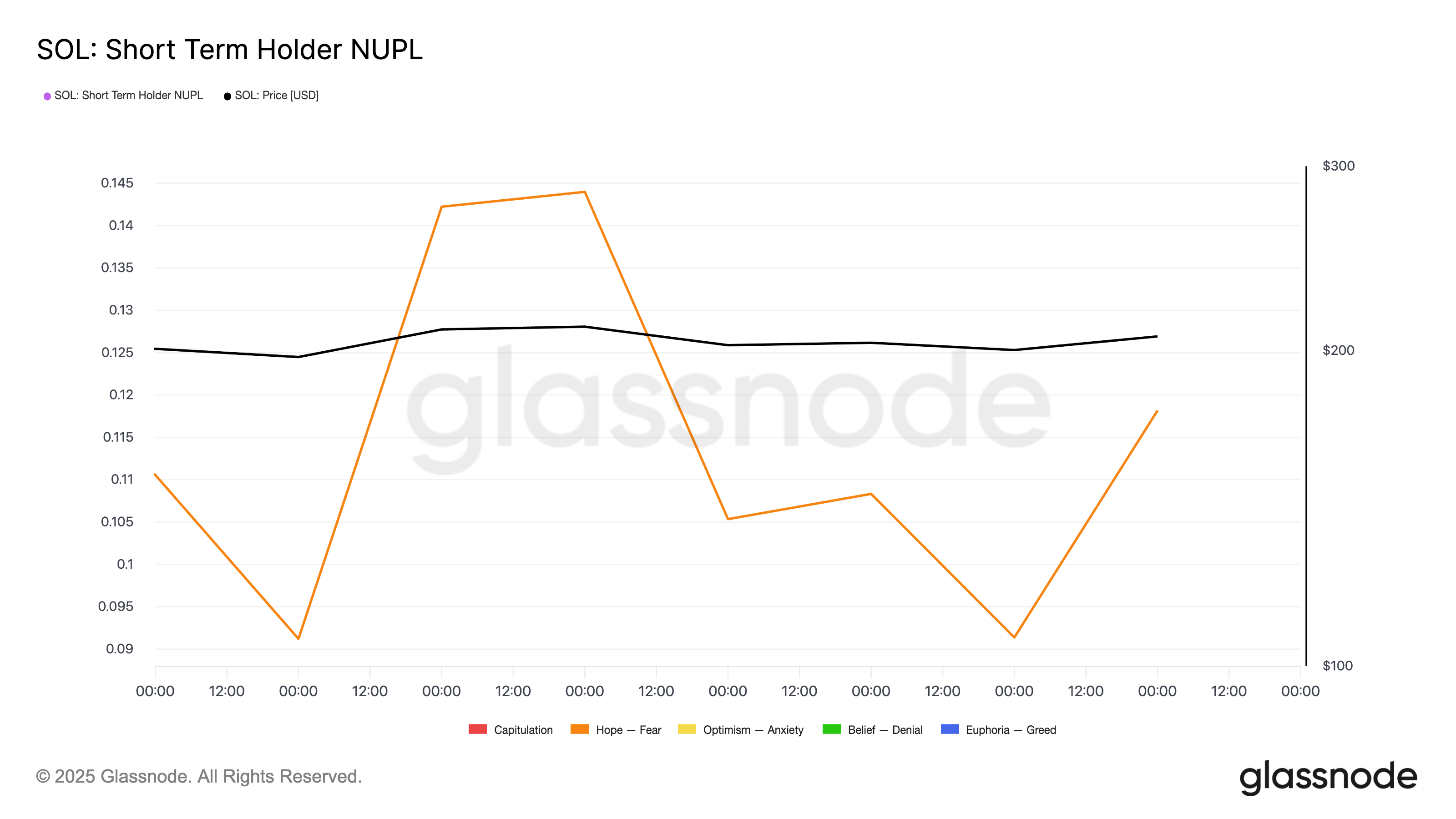

Furthermore, Sol’s STH Net Unrealized Profit/Loss (NUPL) metrics indicate that sentiment is shifting away from the surrender. At the time of the press, it stands at 0.118, suggesting that these investors are beginning to regain confidence.

STH-Nupl understands whether this group is in a state of euphoria, optimism, hope or fear and measures the overall unrealized profit or loss of short-term holders.

With the current reading of 0.118, this metric places Solmarket’s emotions in a delicate zone between hope and fear.

According to GlassNode, this suggests that while STH has moved from deep surrender, their beliefs remain tentative, and confidence is gradually returning. At the same time, investors will remain cautious about potential pullbacks.

Sponsored Sponsors

Accumulation could break $213, and selloff could sink $200

In general, price movements are sensitive to shifts in short-term holder accumulation. So, as Sol Sths continues to increase supply, when purchase pressure is added, the value of the coin will be promoted, exceeding current resistance to $213.04.

Successful meetings above this level could send coins to $218.01.

However, if STHS reduces accumulation and resumes sales, Sol Risks will surge at $200.43 under support. In this scenario, the coin’s price could drop to $191.75.