PI, the native token of the PI network, has been trending horizontally since the beginning of the month, reflecting the sales of buying and selling in the market.

However, technical indicators are beginning to flash early bullish signals, suggesting that PI may be preparing for an upward breakout. But despite these bullish clues, 106 million PI tokens set to be released within this month threatens to derail potential gatherings.

Sponsored Sponsors

As buyers accumulate quietly, PI shows hidden strength

The PI/USD one-day chart rating shows that the token Chaikin Money Flow (CMF) is steadily climbing despite the sideline price movements. This creates a bullish divergence that suggests an increase in flow into tokens.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Sponsored Sponsors

The CMF measures whether trading pressure is dominant and tracks volume-weighted flow of money in and out of assets over a set period. As the CMF rises, when prices level off or move sideways, as seen in PI, this forms a bullish divergence, indicating that buyers are quietly accumulating tokens, even though prices are not yet responding.

This trend suggests that PI demand is building slowly, and if more buy-side pressures are built, it could potentially be set up a stage of upward breakout that exceeds a narrow range.

Additionally, the PI is tilted towards the 20-day exponential moving average (EMA), confirming the gradual accumulation of bullish pressure.

The 20-day EMA measures the average price of assets over the last 20 days, giving more weight to recent prices. The decisive move above the 20-day EMA shows a shift in market sentiment from neutral or bearish to bullish, reflecting increased buying interest and momentum.

For PI, approaching this level suggests that tokens are testing the strength of current market support. Successful violations can pave the way for even higher profits, especially when accompanied by sustained purchasing pressure.

PI network faces testing in September

Sponsored Sponsors

Despite these bullish signals, future token unlocks for PIs could limit assets to within their current range.

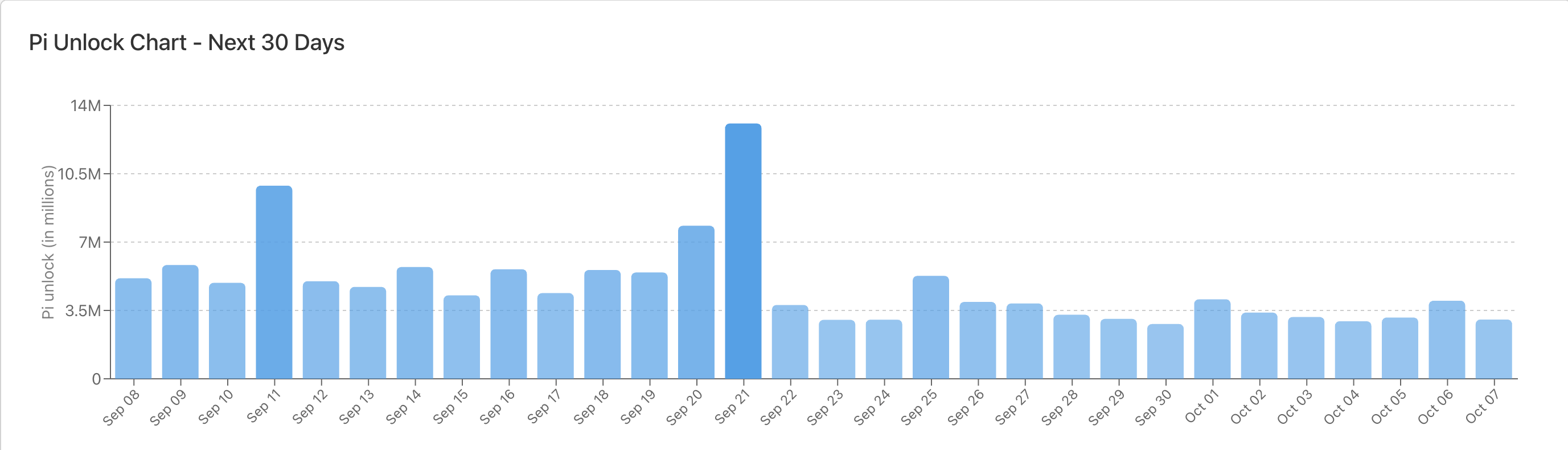

More than 106 million Pi tokens are expected to be released for the remainder of the month, putting a lot of sales pressure on an already-restrained market, according to Piscan.

If demand cannot absorb this inflow, potential upward breakouts could be denied. In such a scenario, the PI could continue trading sideways or even go below its range, potentially putting a drop at risk towards an all-time low of $0.32.

Conversely, buying pressure can boost new supply and when absorbed, the token could push towards $0.40.