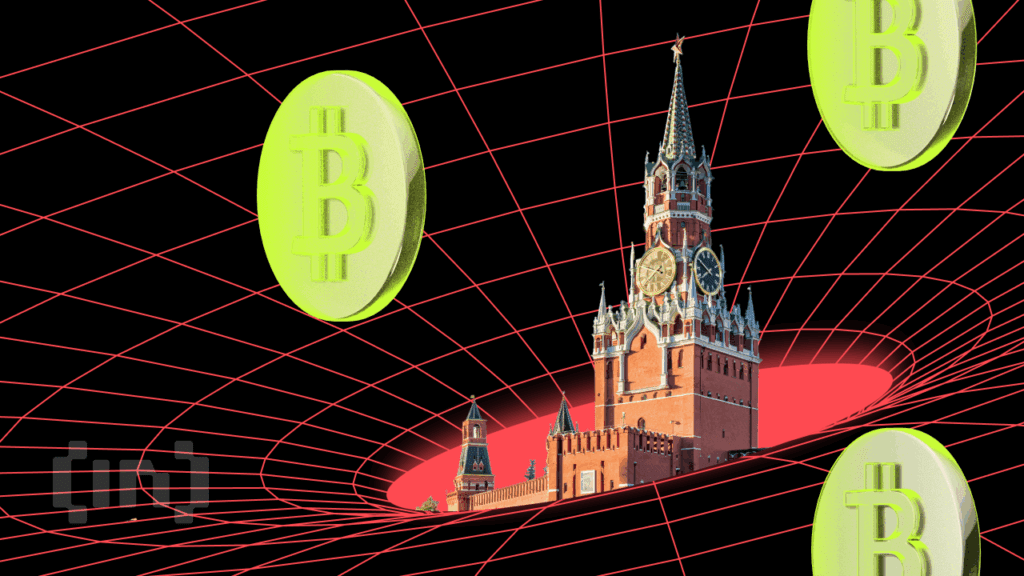

Russia is trying to integrate cryptocurrencies into international commerce. The government announced today that it will legalize its use in foreign trade payments.

This decision is a strategic response to Western sanctions. By establishing a legal framework for cross-border cryptocurrency payments, Russia can circumvent the limitations of traditional banking channels.

Sponsored Sponsored

Russia legalizes use of cryptocurrencies in foreign trade

Russia’s Ministry of Finance and Central Bank have officially agreed to legalize cryptocurrencies to resolve international trade agreements.

The decision formalized the Experimental Legislation Regime (ELR), launched in September, which initially allowed pilots of cryptocurrencies for cross-border transactions.

The move is widely seen as a strategic move to provide Russian companies with an alternative payment channel. Doing so could ease tensions caused by Western sanctions on traditional World Bank access.

The new law comes with stricter regulations and increased oversight. According to Finance Minister Anton Siluanov, despite the strategic goal of sanctions relief, regulators remain focused on managing the inherent financial risks associated with decentralized cryptocurrencies.

Proposed oversight measures include strict anti-money laundering (AML) and know-your-customer (KYC) standards enforced by the Federal Financial Supervisory Service. Meanwhile, all cryptocurrency transactions are processed through a regulated infrastructure under the direct supervision of the Central Bank of Russia.

Sponsored Sponsored

The new legal framework applies only to foreign trade payments, and the prohibition on using cryptocurrencies for domestic payments within Russia remains in place. The regulator developed this core policy to protect the financial stability of the ruble.

Response to Western sanctions

Russia’s decision to legalize cryptocurrencies for foreign trade payments is a strategic response to severe economic pressure imposed by Western countries after the February 2022 invasion of Ukraine.

The international community, primarily led by Western countries, responded to this aggression with an unprecedented cooperative economic policy aimed at isolating Russia from the global financial system.

The most devastating of these sanctions included cutting off major Russian banks from the SWIFT system. This secure messaging network plays an essential role in global financial transfers.

The measure crippled Russian banks’ ability to send and receive international remittances in currencies such as the US dollar and euro.

These sanctions have created significant obstacles for Russian companies conducting routine foreign trade and have caused significant difficulties and delays in international transfers. The subsequent legalization of cryptocurrencies in foreign trade is directly related to this financial bottleneck.

The new framework will allow Russia to conduct cross-border transactions through alternative means that can withstand sanctions. It will also facilitate trade with key allies such as China, India and Türkiye that are not part of the Western sanctions regime.