Hedera’s native token Hbar has flown nearly 5% over the past 24 hours, bringing new sales pressure. This happens because the weaker markets are weaker than the cryptocurrency price.

The bearish sentiment surrounding the price of HBAR tokens continues to be reinforced, with on-chain data pointing to an increasing number of pessimism among traders.

Futures traders bet on HBAR

The long/short ratio of HBAR is currently at 0.93, indicating the preference for short positions among futures market participants.

This metric measures the percentage of bullish (long) positions in the futures market for assets (short) positions (short) positions. If the ratio is 1 or higher, there is a position longer than a shorter position. This suggests bullish sentiment, with most traders expecting the value of their assets to rise.

Meanwhile, like HBAR, ratios below one indicate that more traders are betting on price declines rather than price increases. It reflects growing skepticism about the token’s short-term price outlook as trainers anticipate further downside movements.

This bearish trend in HBAR’s derivative positioning could be fed to its spot price weaknesses, particularly if it doesn’t violate positive market catalysts or broader emotional changes.

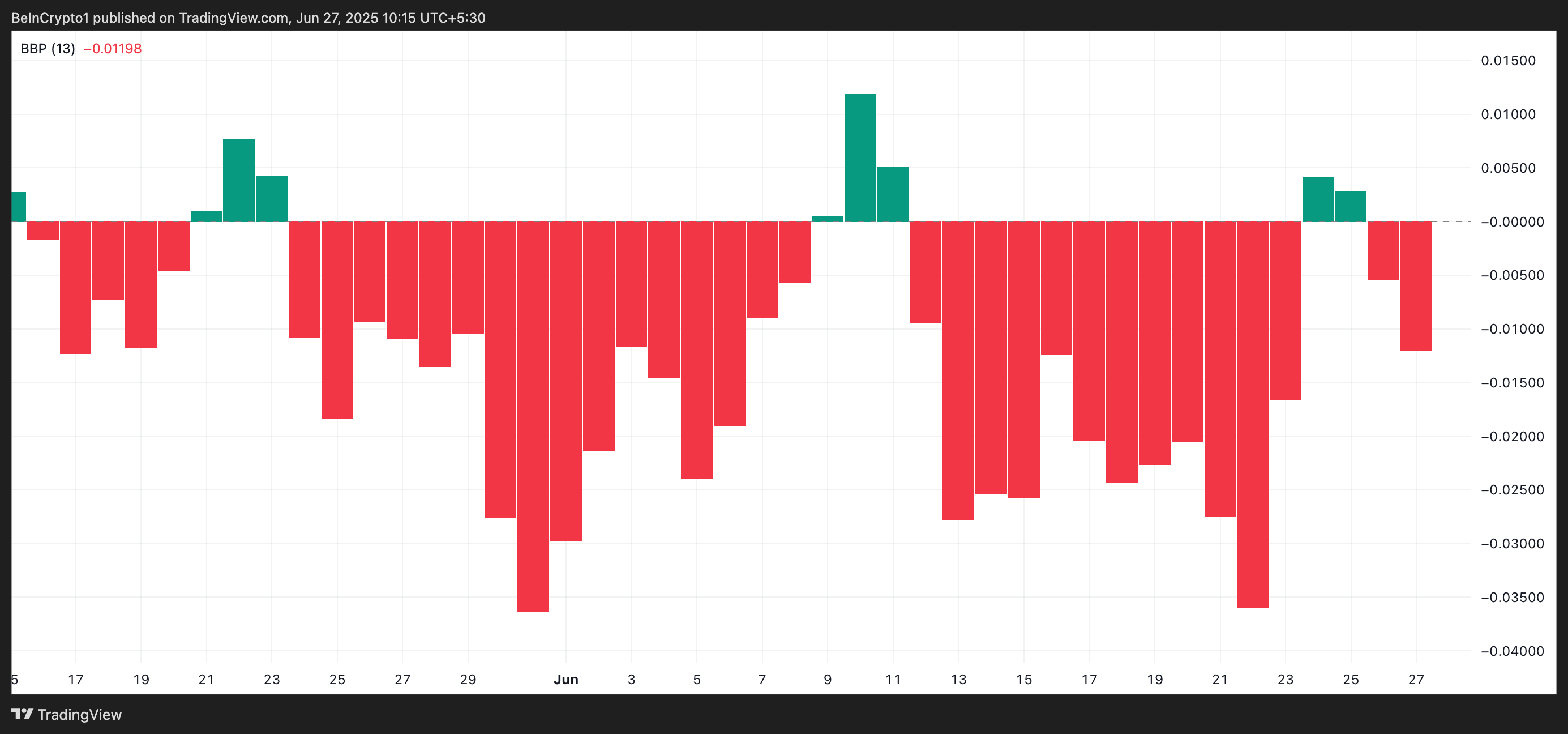

Additionally, HBAR’s Elder-Ray Index measurements add to this negative outlook. At the time of writing, the indicator is at -0.011.

The Elderley Index measures the strength of bulls and bears in the market by analyzing the differences between the price of an asset and their index moving average (EMA). If the Bulls dominate, a positive elderly reading occurs. That is, prices are trading above EMA, indicating strong buying momentum.

This suggests that HBAR sellers are in control and could continue to cut prices in the short term.

HBAR faces critical tests as support for $0.126 as price eye

HBAR has been declining since peaking at $0.156 on June 25th. The value of Altcoin, which currently trades hands for $0.143, continues to slip amidst the weakness of the sustained market.

The chain and technical readings pointing to a growing bear pressure as July approaches, could bring the Hbar price down to $0.126, and it was last visited in April. This level currently exists as an important support when selling momentum.

Meanwhile, a revival of new demand could negate this bearish projection. If the buyer intervenes with enough strength, the HBAR price can be tried to break more than resistance at $0.156. If successful, the token could rally further towards the $0.166 level, marking a reversal of bullish trends.

For now, whether or not the price of HBAR tokens collapses or rebounds depends largely on whether market sentiment changes in favor of the coming days.

Post Hedera faces mounting pressure – Will July bring about breakdowns or bounce? It first appeared in Beincrypto.