Ton is entering a high level of expectation as the two main catalysts emerge simultaneously. It’s a digital asset financing strategy tailored to a $250 million buyback program and a Telegram Ecosystem.

But behind this optimism, the market still faces heavy “walls” and major zones of resistance.

Institutional push

Toncoin has attracted attention for its series of institutional-level moves. The official announcement of Ton Strategy’s $250 million repurchase programme shows capital growth expectations and aggressive capital management, but not all repurchase programs will help raise token prices.

Sponsored Sponsors

At the same time, Alphaton Capital recently launched a digital asset financing strategy focused on the Telegram Ecosystem. The company is expected to initially accumulate tons worth around $100 million, create additional institutional demand channels, expanding storage and utility possibilities.

Previously, verb technology had more than $780 million in ton assets, marking a strategic shift towards toncoin as its main reserve asset.

Tons at important junctions

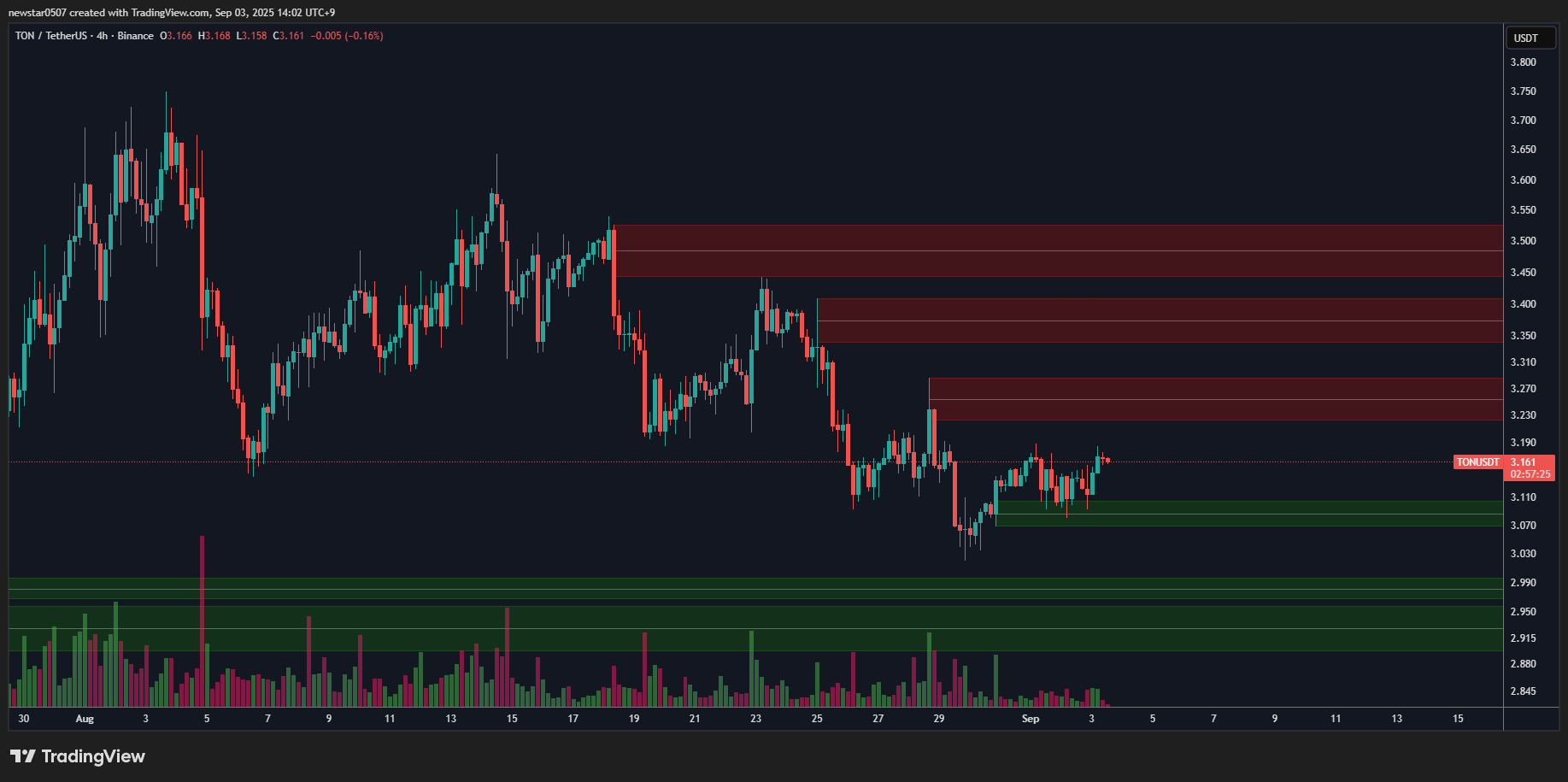

On the market side, Toncoin trades in the $3.1-3.4 range, well below its recent short-term peak. Typically, the emergence of Treasury funds and buyback programs helps reduce circulating supply and strengthen emotional retention.

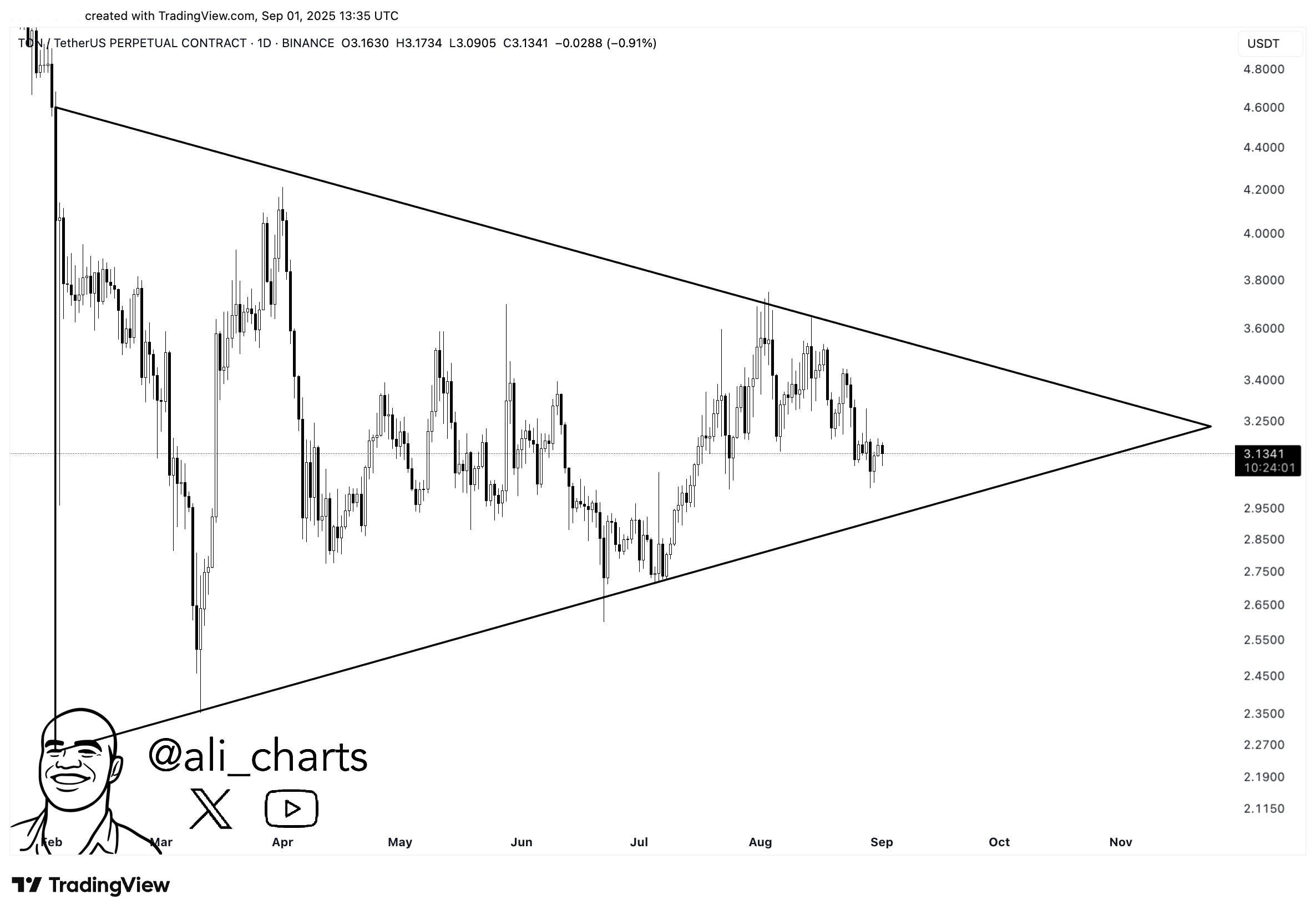

From a technical perspective, some analyses show that TONs integrate within triangular patterns. It is often a precursor to a major price movement. Analyst Ali points out that prices could sway as much as 50% if a critical breakout occurs.

However, in the short time frame, the market faces a major “selling a wall.” Before reaching $3.525, Tonne will have to break through three more sales barriers.

In the short term, the dynamics of supply demand are clear. Ton has been repeatedly rejected in the $3.4-3.45 zone, widely seen as a strong supply block. Without sufficient purchasing pressure, the price could retest the $3.00-$3.27 level before choosing the next direction. In a less optimistic scenario, Ton could even retreat towards $2.68.

“The market structure shows that eql is formed, which often serves as a fluid magnet. A clean sweep here can promote movement into the imbalance zone,” says one X user.