ARB is the native token of the leading layer-2 scaling solution Arbitrum (ARB), and is today’s top performance token. It’s up more than 16% today, backed by a growing speculation over a potential partnership with Robinhood.

Interestingly, on-chain data suggests that the rally may be short-lived, with key metrics as flash warning signs.

When Robin Hood’s speculation gets heated, Arbitrum outperforms its winners

ARB is currently up double digits and is currently trading at $0.36. This comes ahead of Monday’s fireplace chat between Johann Kerbrat, general manager of Robinhood Crypto, Vitalik Buterin, Ethereum co-founder, Vitalik Buterin, and AJ Warner, chief strategy officer for Offchain Labs, the team behind Arbitrum.

This upcoming meeting has fueled speculation that Arbitrum could be announced as a partner in Robinhood’s blockchain planning. Buzz, driven in part by the May 8 Bloomberg report, revealed that the US-based platform is developing a blockchain-based platform.

However, despite bullish price action, on-chain data shows that rallys could face several challenges in the short term. For example, Token’s liquidation heatmap shows a significant liquidity cluster with ARB prices below $0.29, suggesting that the pullback may be on the horizon.

A liquidation heatmap is a visual tool that traders use to identify price levels where large clusters of leveraged locations are likely to be cleared. These maps show areas of high liquidity, often color coded to indicate intensity, with bright zones representing greater liquidation potential.

When the heatmap shows liquidity clusters below the price of an asset, there are many leveraged long positions in the region with liquidation levels. This acts as a price retreat magnet as the market could move down to trigger their liquidation before continuing in either direction.

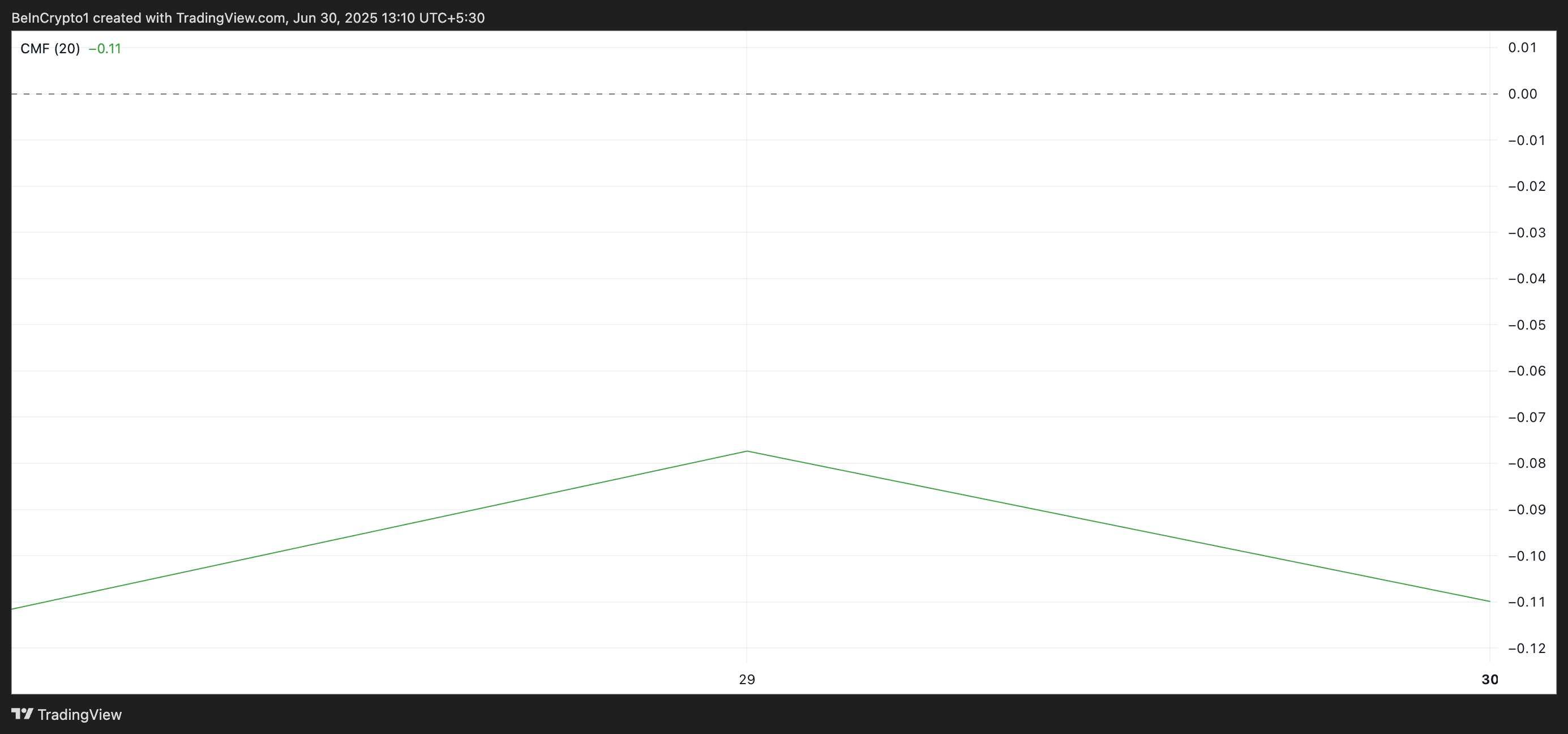

Additionally, while its prices are rising, Altcoin’s Chaikin Money Flow (CMF) indicators show a notable downtrend. At -0.12 on press, it forms a weak divergence with the ARB price.

This bearish release occurs when money flows down while prices are rising, indicating that the buying pressure behind the rally weakens. If this trend continues, the ARB can witness the correction immediately and reverse some of its recent profits.

Arbitrum Bulls faces critical tests

At current market prices, the ARB outperforms major support at $0.29. This price range represents an important barrier that prevents tokens from reconsidering their history low of $0.24.

If the ARB meetings do not have sufficient bullish support, breakdowns below this level are still possible.

On the other hand, the token can climb towards the $0.39 mark if you purchase pressure spikes.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.