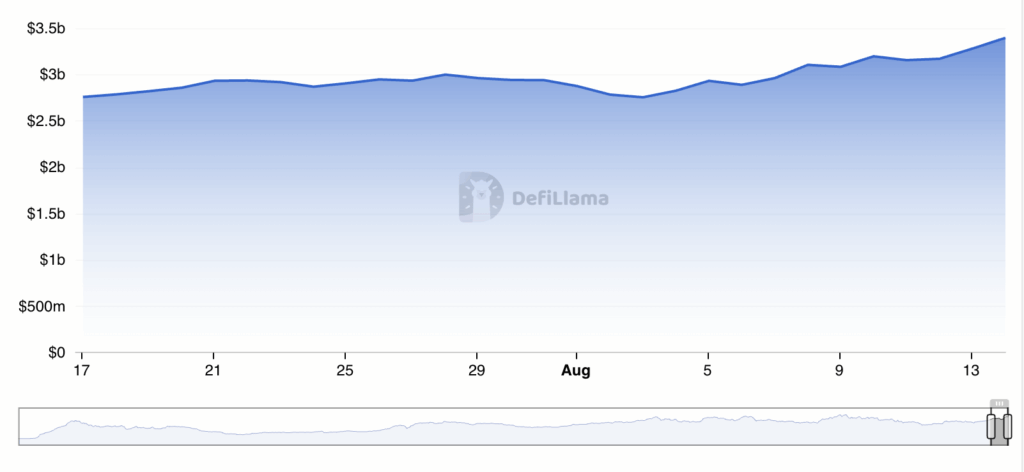

Arbitrum’s Decentralized Financial (DEFI) locked total value (TVL) reached the beginning of the year of $3.39 billion.

This growth will be spilled into Layer-2 solutions (L2) like Arbitrum, caught up in an increase in activity (trading activity) in the Ethereum network.

Arbitrum sees record liquidity amid the rise of the Ethereum Network

According to Defillama, Arbitrum’s TVL has steadily climbed over the past four weeks to reach an annual high of $3.39 billion.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The rising TVL shows increased liquidity and usage in the network. This suggests that more capital is trapped in smart contracts for transactions, lending, or other decentralized financial activities.

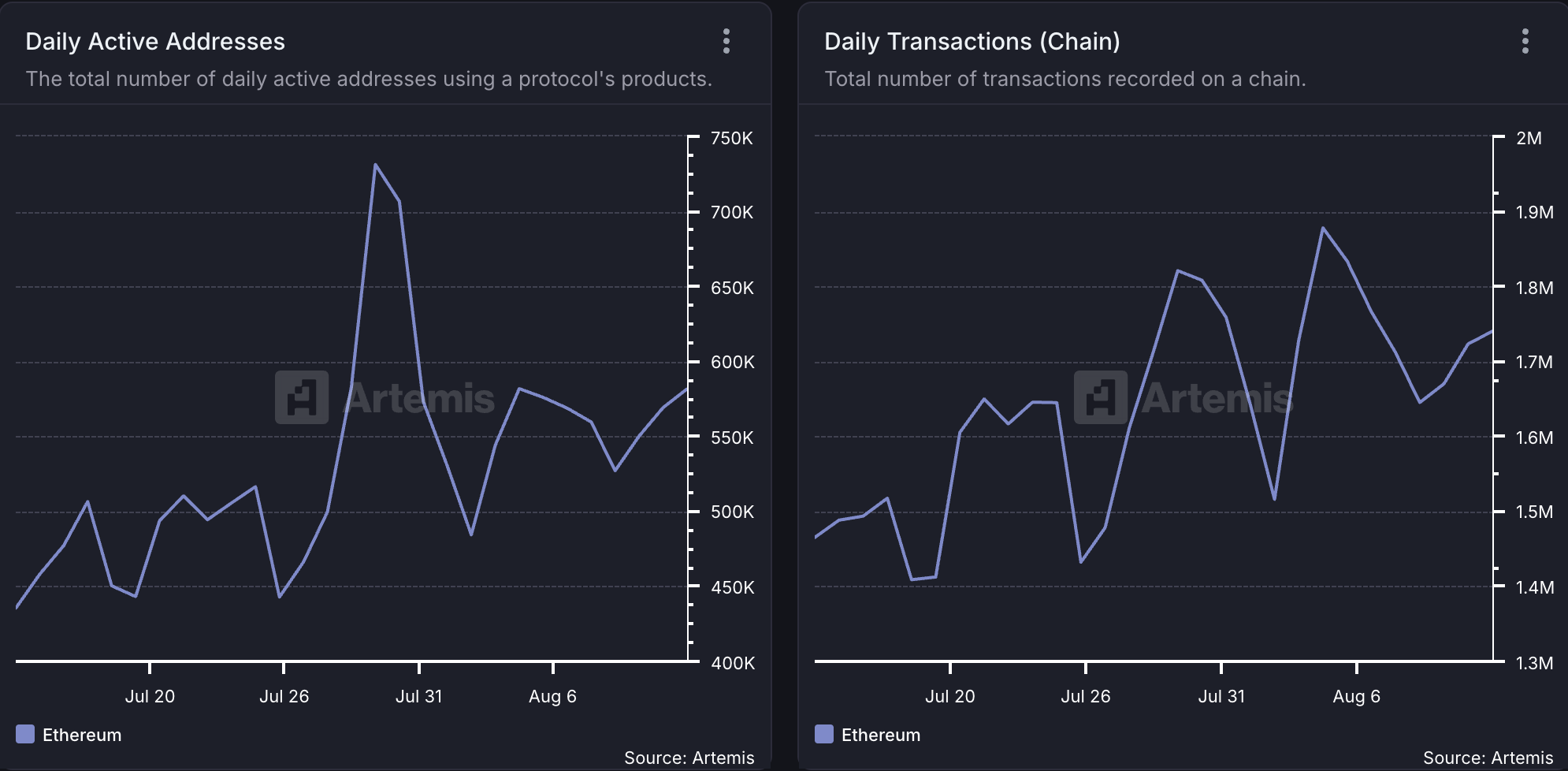

In the case of Arbitrum, the rise in user demand reflects Ethereum’s recent network activity. According to Artemis, Ethereum’s daily active addresses have skyrocketed by 33% over the past few weeks, with transaction volumes increasing by 10%.

When Ethereum experiences such an increase in user demand, much of its activity will flow to L2. These networks offer faster transaction time and fee reductions, attracting users who want to avoid crowds in their main Ethereum chain.

As a result, L2s like arbitrum often increase their liquidity and involvement whenever Ethereum is increased activity.

As market interest grows heated, ARB rockets

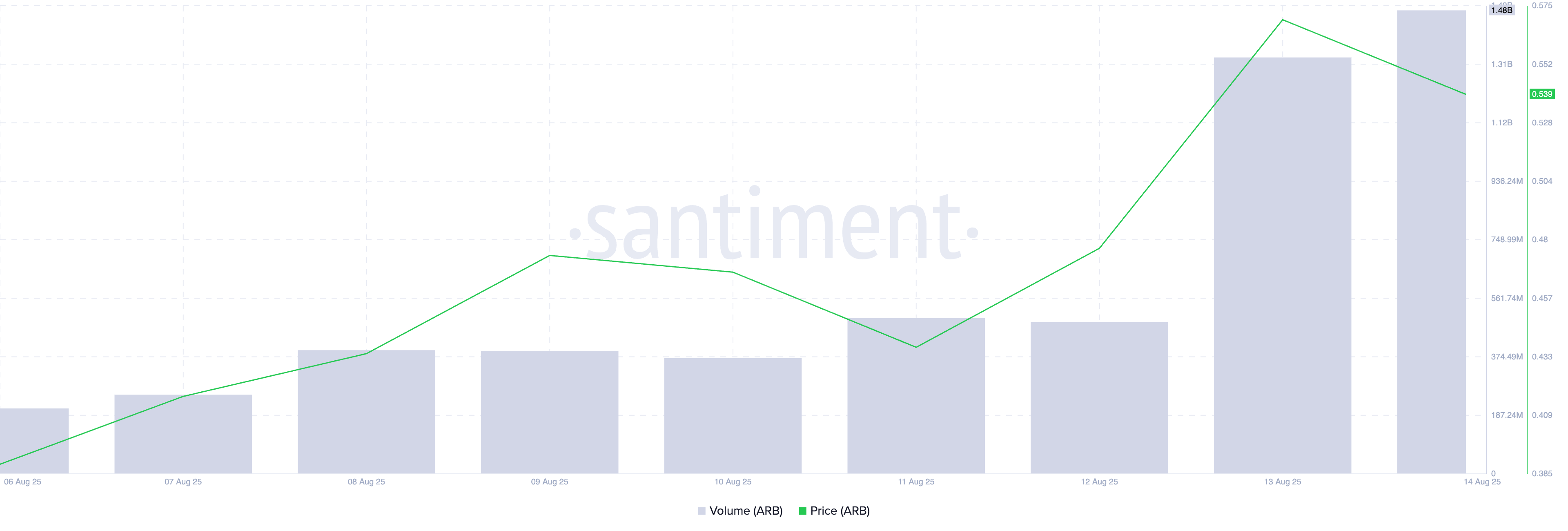

At press time, ARB trades for $0.54, up 12% over the last 24 hours. During that period, its trading volume has increased by 155%, currently totaling $1.48 billion.

When the price and trading volume of assets rise simultaneously, it shows strong market interest and bullish sentiment.

The rise in ARB prices indicates supply and demand is being provided, but its high trading volume confirms that movement is supported by significant participation rather than thin liquidity. This trend can often attract more traders and investors and in the short term, driving further profits for ARBs.

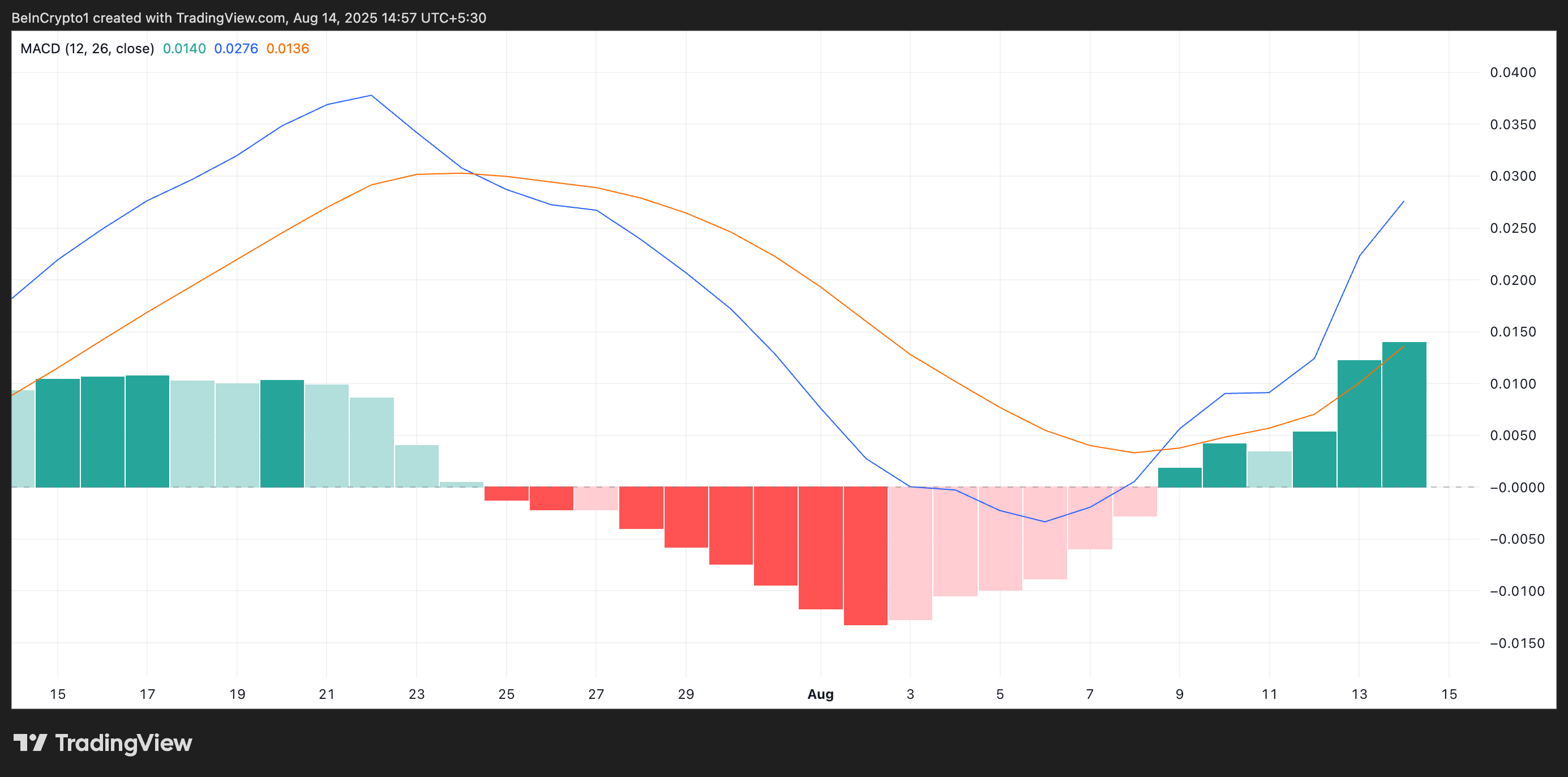

Additionally, the bullish crossover of the ARB’s moving average convergence divergence (MACD) setup supports this bullish outlook. At the time of writing this article, the token’s MACD line (blue) is above the signal line (orange) to check for buy-side pressure.

Additionally, the histogram bars that make up the MACD indicator have been growing gradually since August 6th, with the size of the green bars expanding. When this happens, it suggests that the upward trend is gaining strength.

Can the bull push the ARB into $0.74?

A sustained accumulation of ARBs could raise the price to $0.62. A successful violation of this level of resistance could drive the price of the ARB to $0.74, reaching its last in January.

However, if the sale begins, there is a risk that Altcoin’s price will plummet to $0.45.

Post Arbitrum TVL hit Ytd Ytd High as layer 2 demand first appeared as Ethereum activity was fuel-fueled.