After approaching an all-time high of nearly $4,878 just days ago, Ethereum prices are now below $4,300. Despite the dip, it can maintain a strong monthly increase of 15.3% and shows some resilience.

But while many short-term holders are jumping in to “buy dip,” things aren’t all good for short-term traders. Important bear signals are beginning to appear on the 4-hour chart.

Short-term buyers are growing, but reserves remain at the lowest

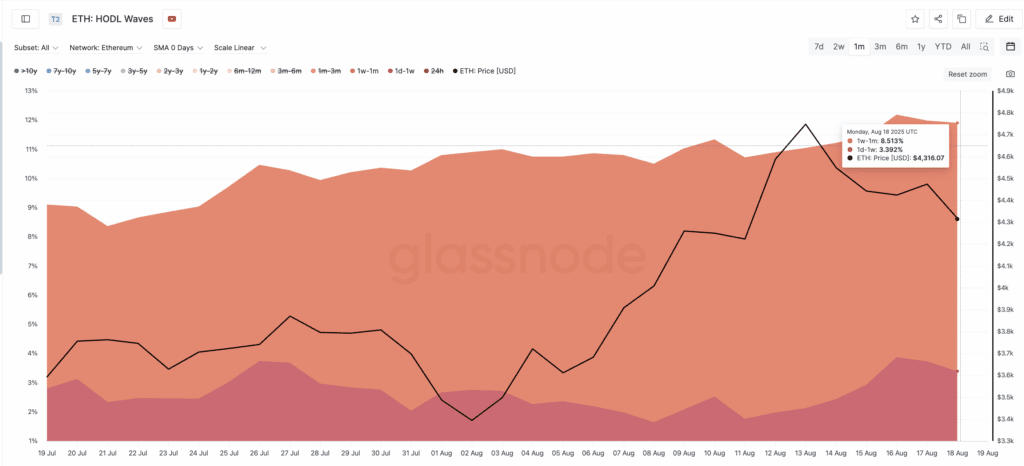

The Ethereum Hodl Wave chart shows that new buyers have been slowly piling up over the past 30 days.

Two important short-term cohorts – wallets for one day to one week and one week to one month increased their supply share.

The 1D-1W cohort grew from 2.8% to 3.39% The 1W-1M cohort jumped from 6.3% to 8.5%

It is a clear indication of a fresh purchase. This suggests that the dip viewing activity is picking up from traders who are likely to have been in the pullback these days. HODL waves indicate the percentage of coins held over different periods, helping to identify shifts between long-term and short-term holders.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

At the same time, Ethereum’s exchange reserves are still hovering to their lowest in nine years. Even after the whale-led influx of ETH, reserves have moved slightly from 18.389 million ETH on August 15 to 18.404 million ETH of reporting time. It’s still so low that fresh purchases continue to happen with every drop in Ethereum prices.

Low reserves usually mean less ETH is available for immediate sales. Another good sign if the trader is on the way forward.

One chart pattern can lower the Ethereum price to $4,000

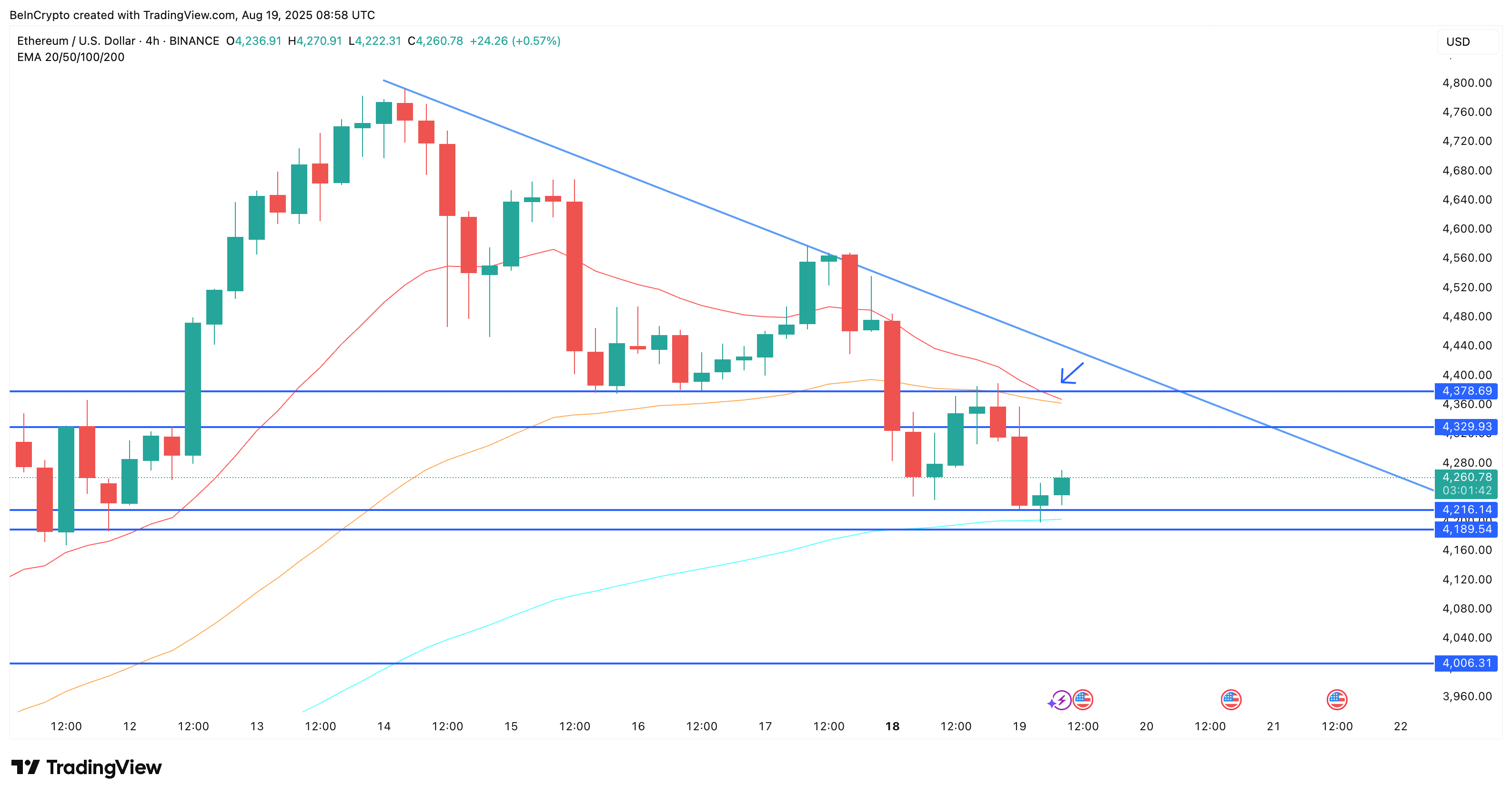

Despite bullish signs from buyers and exchange flows, the short-term chart shows potential issues.

On the four-hour chart, the 20th EMA or exponential moving average (red line) is about to fall below the 50-area EMA (orange line). If this happens, it is usually considered a sign of the arrival of sales pressure.

EMA is a type of moving average that gives more weight to recent prices and helps traders respond faster to recent market changes. EMA crossovers occur when the EMA crosses above or below the long-period EMA for a short period, and often indicate a change in the direction of price trends.

Furthermore, ETH prices now form a downward triangle, a bearish continuation pattern. Currently we are testing two important support levels: $4,216 and $4,189. Breaks below these can cause sharper sellers.

The heatmap further shows weak demand zones just below these levels. There is not much strong support at these levels. This means that if the seller controls it, ETH can drop rapidly to $4,006.

If Ethereum prices can regain $4,378, the bearish outlook will boil down a bit. By doing so, you could disable the bearish crossover and support the 20 and 50 Emma lines.

As new buyers stepped in, the eye recovery of Ethereum prices first appeared in Beincrypto.