A new allegation has surfaced, claiming that Binance has deliberately curtailed Solana’s momentum to protect BNB tokens, and is putting the crypto market in controversy.

This adds to the list of the biggest exchanges in trading volume metrics accused of using WinterMute market makers to affect prices.

Is Binance secretly holding Solana in favor of BNB?

Analyst Marty Party has sparked a debate about X (Twitter) and claims that Binance has worked with market maker WinterMute to ensure that Solana’s market capitalization does not exceed BNB.

He shared what is called a “receipt” and questioned how the vinance exchange would raise Sol for trading activities if the proof of reserves (POR) did not indicate Solana holdings beyond the customer deposit.

At the time of this writing, Solana was trading at $203 with a market capitalization of $109.7 billion, falling behind BNB’s $865.97 price and $120.6 billion in capital.

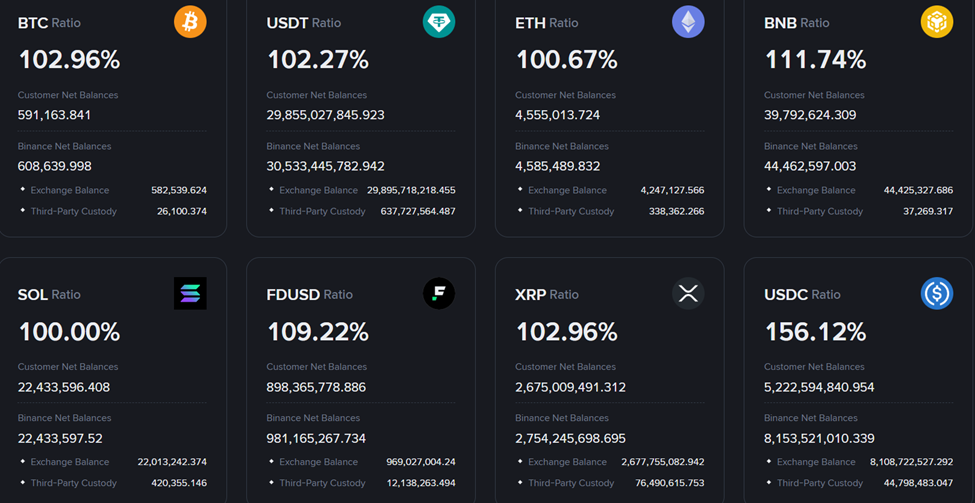

In fact, Binance’s proof of preparation does not show Solana Holdings beyond the Sol Tokens customer deposit of 22.433 million. The holdings consist of an exchange balance of 22.013 million and 420.35 with third party custody.

On the other hand, this is not the first time that it has been linked together in a market controversy.

Five months ago, the report suggests that WinterMute was involved in a coordinated sale that tanked small tokens such as ACTs. Binance is also said to be related to activities.

Similarly, seven months ago, Binance faced scrutiny over $20 million worth of crypto transactions tied to WinterMute.

Beincrypto reported that this has led to intense debate over the opaque relationship between exchanges and market makers. Beincrypto also investigated the role of market makers, beyond providing intrinsic liquidity and preventing price fluctuations.

Critics argue that when Binance uses WinterMute to influence liquidity flows and suppress Solana, it represents a direct conflict of interest.

More closely, it will undermine both the reliability and open market fairness of the PORS framework.

Industry voices are calling for action in markets at a crossroads

The allegations rekindled questions about Binance’s advantage and vulnerability in a centralized exchange-driven market.

“So, is the ‘new system’ even worse than the old system? Why are all of us embracing this fragile…rotten, operational system? Will Binance be arrested someday? Arrest them. I will prosecute them. ”

These statements underline the growing frustration among Tradfi veterans who have entered the encryption. Many of them believed that the blockchain market would offer a more transparent alternative to legacy systems.

Instead, repeated charges of manipulation and conflict of interest can burn skepticism.

The accusations come at a pivotal time for Solana, who has seen explosive adoption across defi, nfts and meme coins.

That rise places it as a potential challenger to Ethereum’s scaling domination, and now clearly becomes Binance’s BNB token.

Whether the claims are proven accurate or not, the controversy reflects the fragile trust that underpins the crypto market.

On the one hand, Solana’s community is seeing a surge in networks towards mainstream adoption. Meanwhile, critics say that the established players could be an engineering ceiling actively to maintain their own dominance.

Tensions leave regulators, investors and developers facing the same unanswered questions. How much electricity should centralized exchanges provide for market outcomes?

When Solana approaches BNB, post-binance faces allegations of market games.