Bitcoin prices have been in the bottom since winning a new all-time high at $123,731 on August 14th. Currently, the major coins are trading at $115,892, with a focus on 7% DIP within a week.

While this pullback has sparked concern among traders, on-chain data suggests that potential rebounds led by Bitcoin’s biggest investors could be on the horizon.

BTC may be in a new bullish phase, analysts say

In a new report, Pseudonymous Cryptography Analyst Sunflowrquant said “a new bullish phase in BTC may be beginning in the short term.”

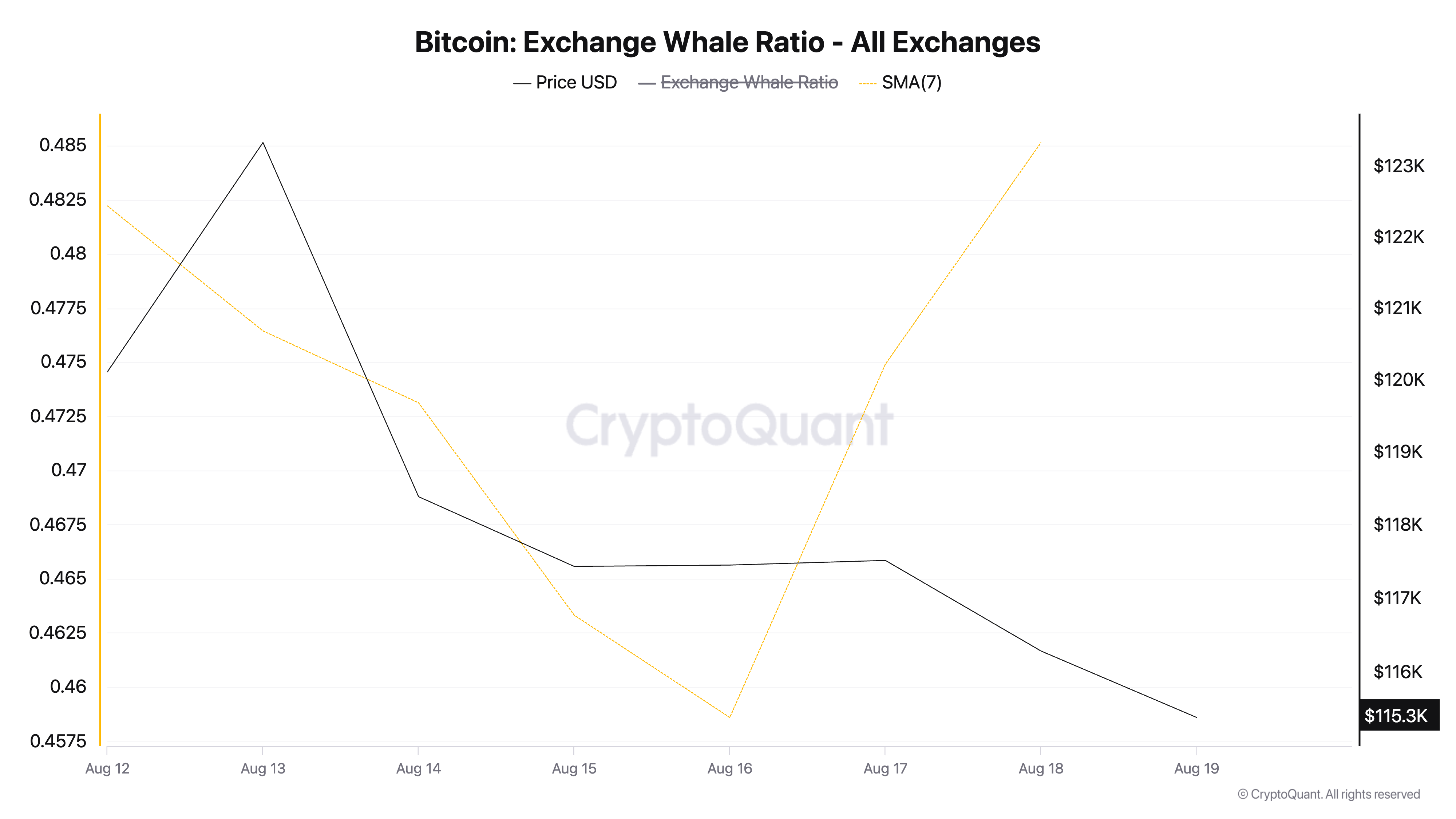

Sunflowrquant assessed the exchange whale ratio of BTC and found that metrics historically appeared in zones along the bottom of local prices.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The Exchange Chhale ratio in BTC measures the amount of coins flowing into exchanges from the top 10 of the largest transaction. The rising ratio usually indicates an increase in activity from large investors in preparations ahead of major market movements.

“As this ratio increases, it shows that large investors (whales) are becoming more active in exchanges, often interpreted as a sign of preparation before the major markets move,” the report explained.

Analysts also observed historical performance of BTC’s exchange whale ratios and found that coins enter the bottom phase every time the metric rises and tests the 0.50 level.

“Looking back in recent years, whenever the exchange whale ratio is tested at the 0.50 level, we mark the local bottom at price, followed by a period of consolidation and subsequent upward movement,” the analyst said.

This metric, observed using a 7-day moving average, is currently sitting at 0.48, approaching the 0.50 mark.

If history is consistent, this pattern suggests that recent declines in BTC prices may be approaching fatigue, with the foundation being laid for new gatherings.

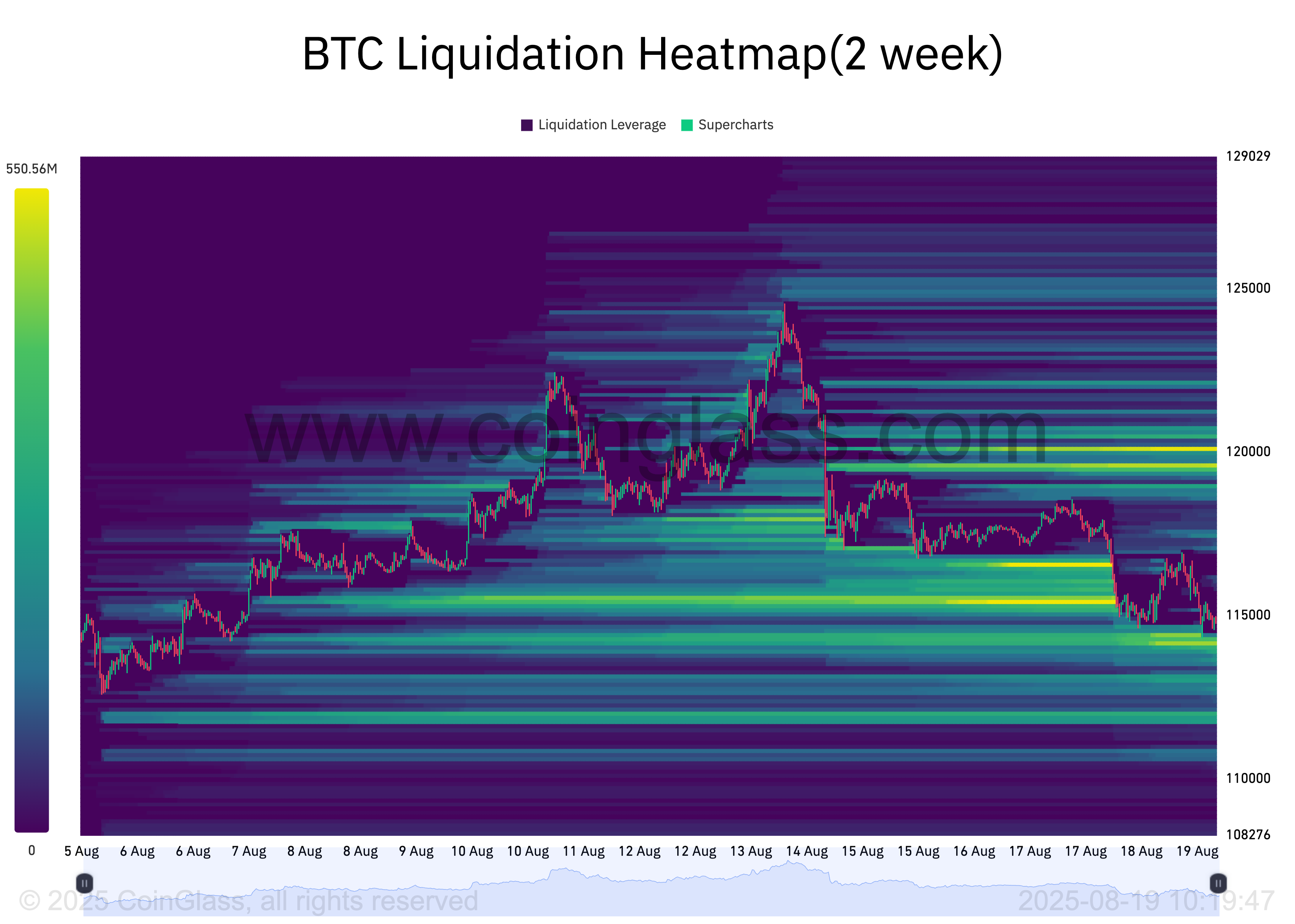

Bitcoin liquidation heatmap refers to a price magnet of $120,000

Measurements from the BTC’s liquidation heat map support this bullish outlook. Coinglass data shows that leveraged location and liquidity concentrations outweigh the prices of coins near the $120,000 region.

A liquidation heatmap is a visual tool that tracks clusters of leveraged trading positions (longs and shorts) in the market and highlights price levels that are likely to cause large amounts of liquidation.

Typically, when capital clusters form the market value of assets above, they attract short-term bullish momentum as traders try to capitalize on these liquidity zones.

So, they may attract short-term bullish momentum for BTC as traders try to misuse them.

If sales continue, the risk of BTC will drop to $111,000

If Sunflowrquant’s Outlook proves correct and BTC finds the bottom right away, after the integration period, the coin can rebound towards $120,000.

However, if sell-side pressures intensify in the short term, BTC risks extending the decline to $111,961, the last seen level on August 3rd.

Post Bitcoin displays bottom signs before the next bull movement first appears in Beincrypto.