Bitcoin prices are divided into unknown territory and reached the finest fresh, top-notch, over $124,000. BTC has risen nearly 8% over the past week.

The move comes as an important on-chain shift lineup in the Bulls’ favor. Active purchases in a lasting future have been built for days. However, this time, the Bulls may be aiming to aim higher than the highest ever high zone today, as they have gained a advantage in Bitcoin’s price action.

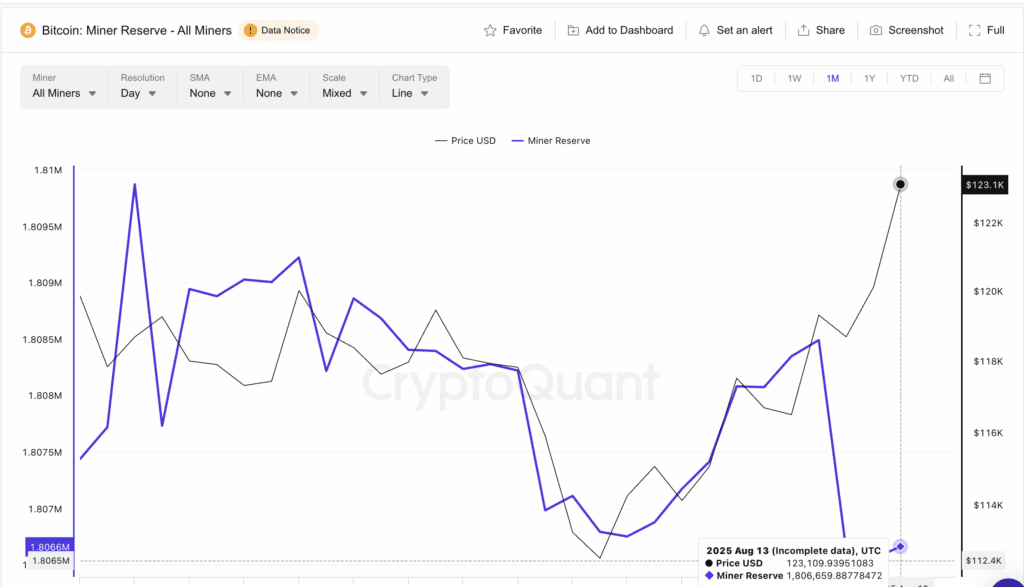

Minors fill retreats as selling pressures ease

Earlier this month, the miners expanded from 1,806,790 BTC on August 2 to 1,808,488 BTC on August 10. This increased the risk that supply waves would collide with the market. This rise reflects high sales pressure from miners. This is a move that is often seen as a headwind of gatherings.

However, when Bitcoin prices were about to break out, reserves fell to 1,806,630 BTC, which has since been stable, indicating that immediate sales risk has been mitigated. This plot twist retreat cleared the runway for buyers to push the market higher without the liquidation overhead of heavy miners.

Minor Reserve: Total BTC held by the miner. Rising reserves could indicate incoming sales pressure. In many cases, a decline in reserves removes the main supply side threat.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Taker purchase volume indicates that the bull is ready

Taker buys volume. The total estimated market purchase orders lifted seller liquidity and surged to $143.1 billion on August 11th amid attempts to breakout.

The important parts are as follows: For a purchase order to be satisfied in the market, you need to “hit” a sell order that is already sitting on the order form. So despite their purchases, they are doing it right away at the seller’s price and are not waiting for a dip or a better deal.

In other words, high taker purchase volume means that the offensive buyer is removing liquidity from the seller of the order. They quickly clean up the sellers, so if pressure continues, they can increase the price.

The metric remains rising at $12.24 billion, indicating that traders are chasing prices at ASK instead of waiting for a dip.

Historically, such sustained buyback attacks often precede successful breakouts. In this case, it wasn’t a question of whether or not the assembly would break into new highs and when.

Important Bitcoin Price Levels to Watch

The immediate test is at $124,300, as momentum leaps heavily towards the bull. This stands as the last important barrier before a higher target acts.

A clean break above this level and daily closings open the Bitcoin price pass towards $127,600, and can represent the following key benefits in line with the 1.0 Fibonacci expansion:

Conversely, if Bitcoin isn’t over $121,600, a bullish setup could face a sharper pullback, especially in combination with minor reserve rebounds.

Post Bitcoin is the best new hit ever – what is the Bulls’ next target? It first appeared in Beincrypto.