Two long-term Bitcoin wallets (over $2 billion at current prices) holding a total of 20,000 btc have been reactivated today.

These wallets moved their balances to new addresses, causing fear of surrender for long-term holders.

Two dormant Bitcoin wallets move $2 billion in BTC

Beincrypto previously reported that the on-chain thruth analysis platform LookonChain has identified one source of transfers. This wallet was created on April 3, 2011 when BTC was trading for just $0.78.

At the time, the owner acquired 10,000 BTC for less than $7,805. The wallet was inert for over 14 years until early on July 4th, when the perfect balance was moved to the new address.

LookonChain found a second wallet from 2011 with a similar 10,000 BTC balance and made the same move. Historically, such moves have preceded sales from long-term holders, prompting quick and cautious responses from today’s market participants.

The Bitcoin Market Responds

Many traders have reduced their activities in anticipation of liquidation of potential whales. This hesitation is reflected in BTC’s trading volume, plunging 15% to $46 billion over the past 24 hours.

A decline in trading volume with prices falls indicates a weakening of market convictions. In such cases, the seller will take control. This dynamic allows for further decreasing stages of BTC. This is because lower quantities mean less liquidity and means that the coin’s price is more sensitive to large sell orders.

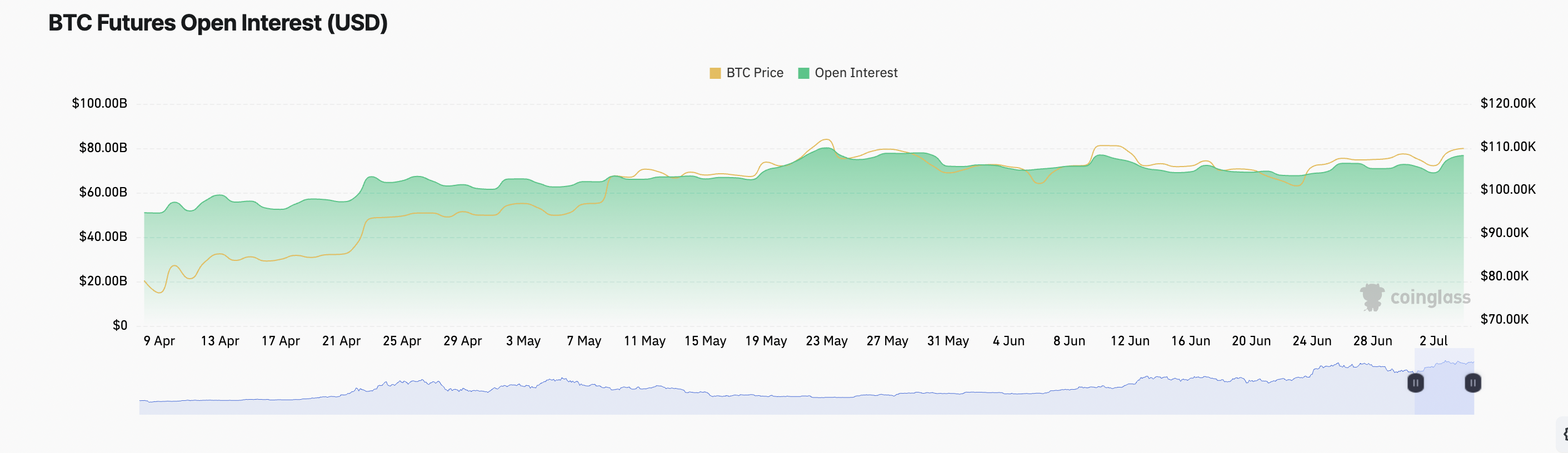

Furthermore, BTC prices have fallen by about 1% amid declining volume. However, this decline comes with an increase in open interest (OI) in futures, indicating that traders still have leveraged bets despite reduced participation in spot markets.

This was $76 billion, an increase of 1% over the past day.

Low oi, lower prices, and lower prices often suggest an influx of speculative positioning, especially from short sellers who predict further downsides. This setup increases market vulnerability and increases the likelihood of liquidation as price volatility increases.

This setup can cause even small swings at BTC prices to cause significant stop losses or margin calls, increasing downward pressure on the coin’s price.

Bitcoin prices depend on balance

At Press Time, BTC trades at $108,978 and is hovering just below the recent high. However, following today’s move of 20,000 BTC from whale wallets, the market remains in existence.

If the majority of these coins are sold deposited in exchange, they could increase the bearish pressure and push the price of Bitcoin down to $106,295.

Conversely, when the whales choose to hold and the broader market sentiment turns bullish, the coin can find fresh upward momentum. A decisive break of over $109,267 can pave the way for a rally heading towards the $110,422 mark.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.