Crypto inflows skyrocketed last week, surpassing one before six times. In the influx of capital into digital asset investment products, two names dominated the charts: BlackRock and Ethereum.

It marks a series of positive trends, driving managed assets (AUM) to an all-time high (ATH) of USD 244 billion.

Cryptocurrency will skyrocket six times as leads for BlackRock and Ethereum

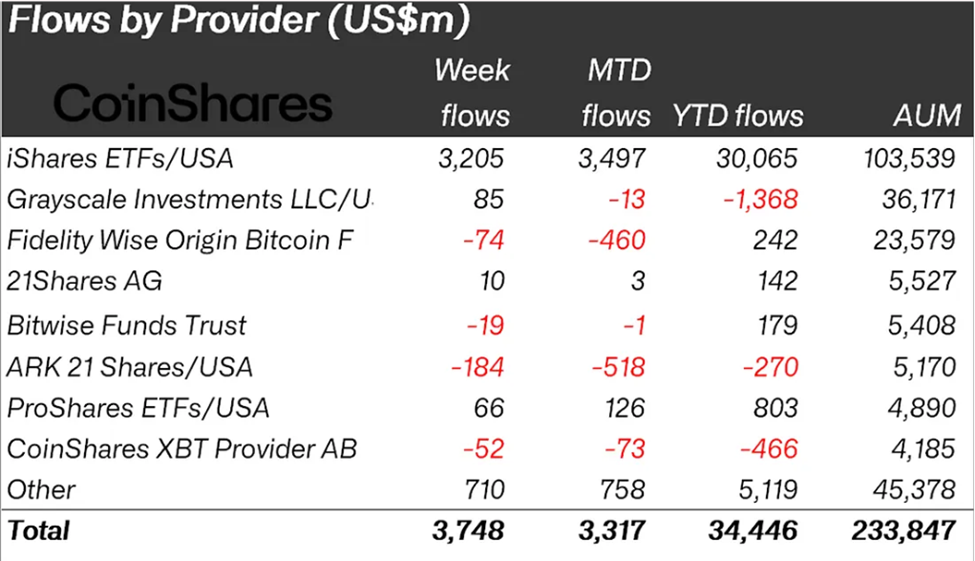

According to the latest Coinshares report, Crypto’s influx surged to $3.755 billion for the week ending August 16th. This was a 6.4-fold increase compared to the week that ended August 9th, when CryptoFlows reached $578 million.

James Butterfill, head of research at Coinshares, highlighted last week’s crypto influx as the fourth largest on record. He also praises it as a strong rebound after weeks of lukewarm emotions, as revealed in a recent Coinshares report.

Nevertheless, BlackRock’s iShares is an outlier and a major part of the flow, as the crypto influx surged to $3.75 billion. BlackRock’s financial products have led to more than 86% of last week’s crypto inflows with an aggressive flow of up to $3.2 billion into financial products.

“Unusually, almost all influx was concentrated on a single provider, iShares, and one specific investment product,” read the excerpt from the report.

BlackRock’s domination is because its financial vehicle, Ishales, remains one of the most popular equipment, allowing institutional investors to indirectly access the crypto.

For perspective, Harvard University, one of the world’s most prestigious institutions of higher education, has chosen BlackRock’s IBIT ETF (Exchange Trade Fund) as its gateway to the crypto market.

In the same tone, a recent report showed that 75% of BlackRock’s Bitcoin ETF customers are first-time buyers. This points to the appeal of asset managers and the level of trust that is inspiring even among beginner players.

Just a month ago, BlackRock’s Ethereum ETF inflow surpassed the Bitcoin Fund. Vote Turnout explains why BlackRock’s domination in cryptocurrency is parallel to Ethereum’s weight.

Ethereum donated 77% to last week’s crypto influx

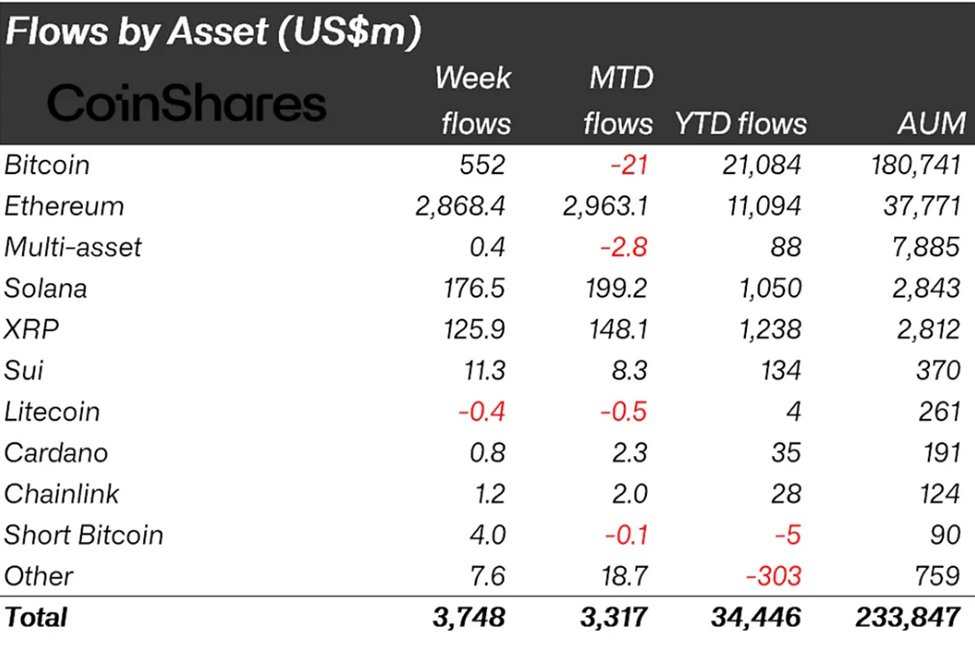

BlackRock accounted for over 86%, while Ethereum was also a key player, resulting in 77% of the total weekly influx.

“Ethereum continues to steal the show, with an uptick in a record US$2.87 billion inflow last week. Inflows far outweigh Bitcoin, and YTD inflow represents 29% of AUM compared to 11.6% of Bitcoin,” added Butterfill.

In particular, Bitcoin saw a modest inflow compared to Ethereum, resulting in a positive flow of $552 million.

Ethereum controls the crypto influx of asset metrics, adding to the weeks that effectively surpass Bitcoin. Among other cases, Ethereum recently pushed the crypto influx to a record weekly high of $43.9 billion.

Over the past few weeks, investor sentiment has been favoring Ethereum over Bitcoin. Attention has sparked a tailwind from the recent frenzy around ETHEREAM and was catalyzed by an agency employing the ETH-based Ministry of Corporate Treasury.

Tokenized assets rose to a $270 billion record as the agency gradually standardizes its Ethereum.

Against this background, analysts say Ethereum prices could be on the course to reach a $5,000 milestone, 20% above the current level.

The first post came in, with BlackRock and Ethereum Drive Crypto inflows of $3.75 billion.