Measurements from the daily chart show that Bitcoin (BTC) has been stuck in a narrow trading range since August 29th. Faced with stiff resistance at $111,961, he holds support at $107,557.

Despite this calm performance, some BTC traders are not at all brink of f-sitting and are steadily increasing their exposure to King Coin.

Bitcoin futures traders double as prices stall

sponsor

Bitcoin climbing estimated leverage ratio (ELR) across the Crypto exchange reflects increased investor confidence and increased appetite for risk, even amidst the inactive performance of the coin.

According to data from Cryptoquant, BTC’s ELR has been steadily rising since August 12th. It’s been ongoing ever since BTC surged to an all-time high of $123,731.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Interestingly, prices have struggled to regain their upward momentum, but leverage in the derivatives market continues to rise. This shows that traders remain unshakable by short-term corrections, instead doubling their exposure to coins.

sponsor

The ELR of an asset is used by the average leverage used by traders to perform transactions in cryptocurrency exchanges. It is calculated by dividing the public interest on an asset by the exchange reserves for that currency. Once that falls, investors will grow cautiously about the short-term outlook for tokens and avoid high-leverage positions.

Conversely, like BTC, climbing ELRs show that traders have not retreated from the market but instead increase risk exposures, especially during such a calm price performance period.

Rather than expanding the back amidst stagnation, BTC traders are taking on more leveraged positions, demonstrating their confidence that the current integration is temporary.

Why is the Bitcoin Bull Cycle beginning?

In a new report, Pseudonymous Crypto-Analyst Perinaipa noted that it could be in a “disruption” phase where price movements tend to accelerate.

sponsor

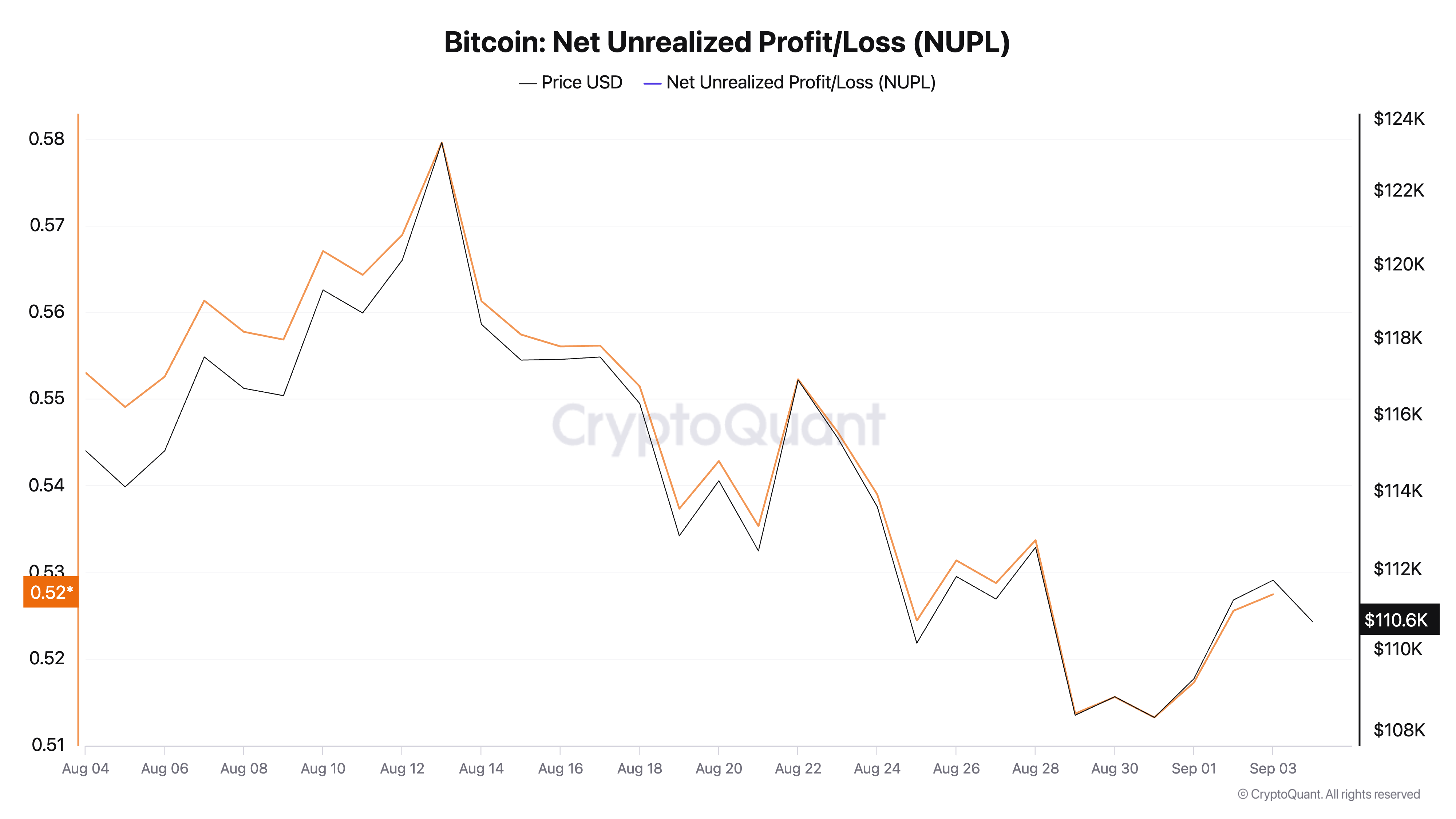

This is based on Coin’s valuation of Net Unrealized Profit/Loss (NUPL) metrics, according to Pelinaypa. Nupl helps to measure whether the market is primarily profit or loss and identify stages of the market cycle.

Historical ratings of this metric reveal that NUPL values between 0.7 and 0.8 coincided with peaks in the BTC market in 2013, 2017 and 2021.

“The market is currently in a ‘faith and optimism’ stage. This usually reflects the central stage of the bull cycle. Based on historical patterns, Bitcoin could move from $120,000 to $150,000 in the future stages,” Perinaipa said.

sponsor

This suggests that BTC is not yet approaching its historic peak zone, but is already at a stage where momentum is beginning to build up again.

Is the bull or bear the first thing that breaks?

sponsor

The main crypto positioning for short-term rebounds is possible with a break of $111,961 over resistance. If this occurs, BTC could extend its profit to $115,892.

Meanwhile, when buy-side pressure weakens, BTC could stay in range or fall below the $107,557 support level.