Since early June, Cardano has been trading within a narrow range, facing strong resistance around $0.59, finding consistent support for nearly $0.55.

However, a historic pattern similar to the ADA’s previous market cycle is beginning to unfold, indicating that Altcoin may be in the final stages of pullback before witnessing a bullish comeback.

ADA enters the final accumulation stage

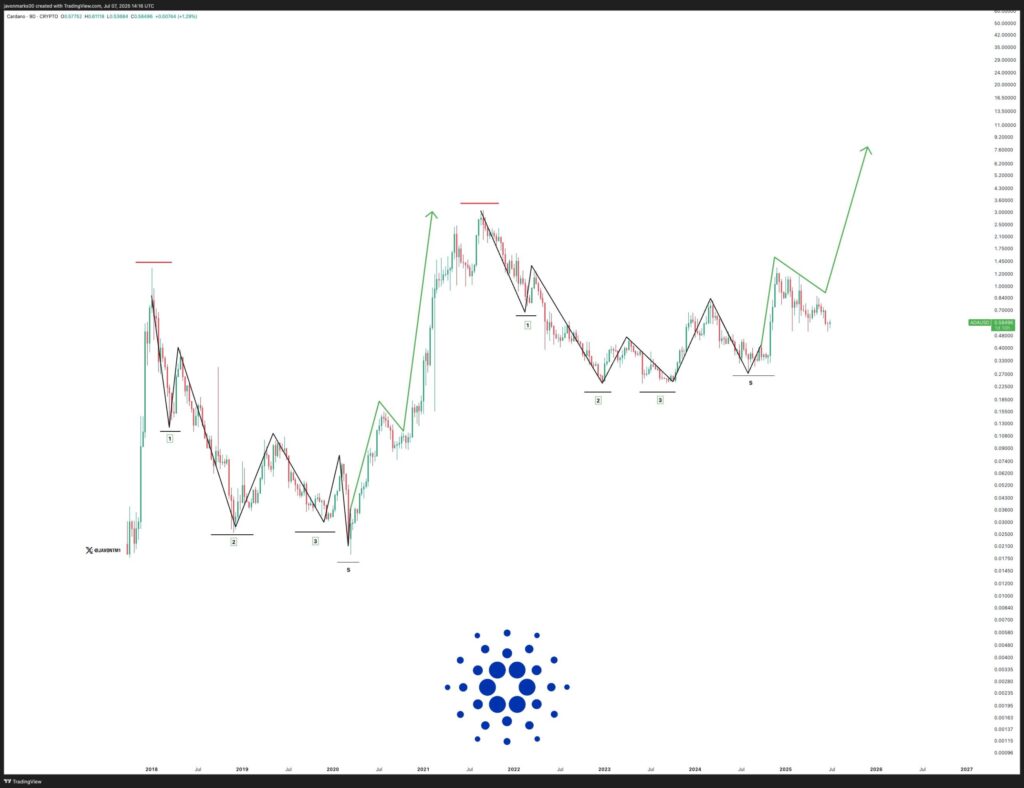

In a July 7 post on X, Crypto analyst Javon Marks noticed that the ADA price movement reflects the structure of the last major accumulation stage ahead of the explosive 2021 rally.

In the price chart mark added to the post, he painted similarities between the ADA’s past and present market cycles, discovering that between 2018 and 2020, the coin went through a three-wave correction to form a round bottom, eventually leading to an explosive breakout past $3.09 in 2021.

A similar structure has been gradually rolling out since 2022, with the ADA having completed its multi-wave correction again and forming a price base. This repetition suggests that if the pattern applies, the coin may be preparing for another major gathering.

Such fractal patterns are often seen in long-term market cycles where investors’ behavior and market psychology are regenerated at repeated stages. As the ADA continues to reflect its historic structure, breakouts from the current accumulation zone could pave the way for bullish phases and drive prices towards previous and previous highs.

According to the mark, if the pattern is preserved, “this will result in an inverse of 383% or more from here…”

ADA traders bet on breakouts

Marks’ forecasts represent much of the long-term outlook, but despite recent pullbacks, the short-term outlook doesn’t look that bad.

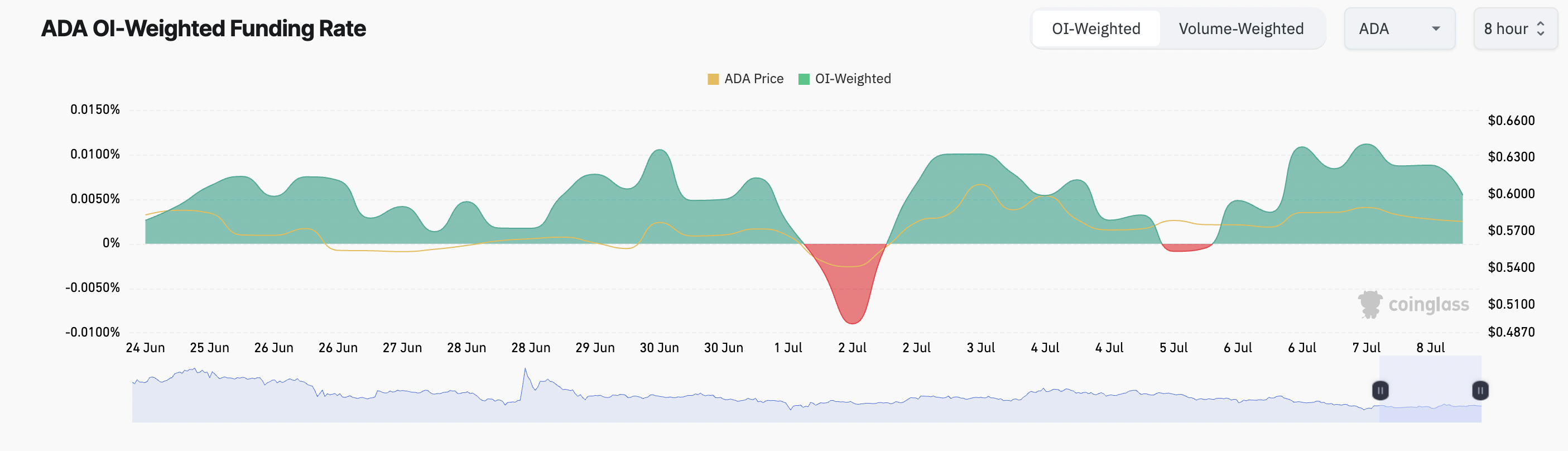

Coinglass says the coin’s funding rate is still positive, indicating that traders are continuing to rise in positions and are confident in their assets’ short-term trajectory. At press, this is 0.0054%.

Funding rates are periodic payments between traders on permanent futures contracts to line up contract prices with spot prices. If the funding rate is positive, there is a higher demand for longer positions than shorts.

This trend suggests that more traders are betting on ADA prices exceeding the narrow range and recording new profits in the short term.

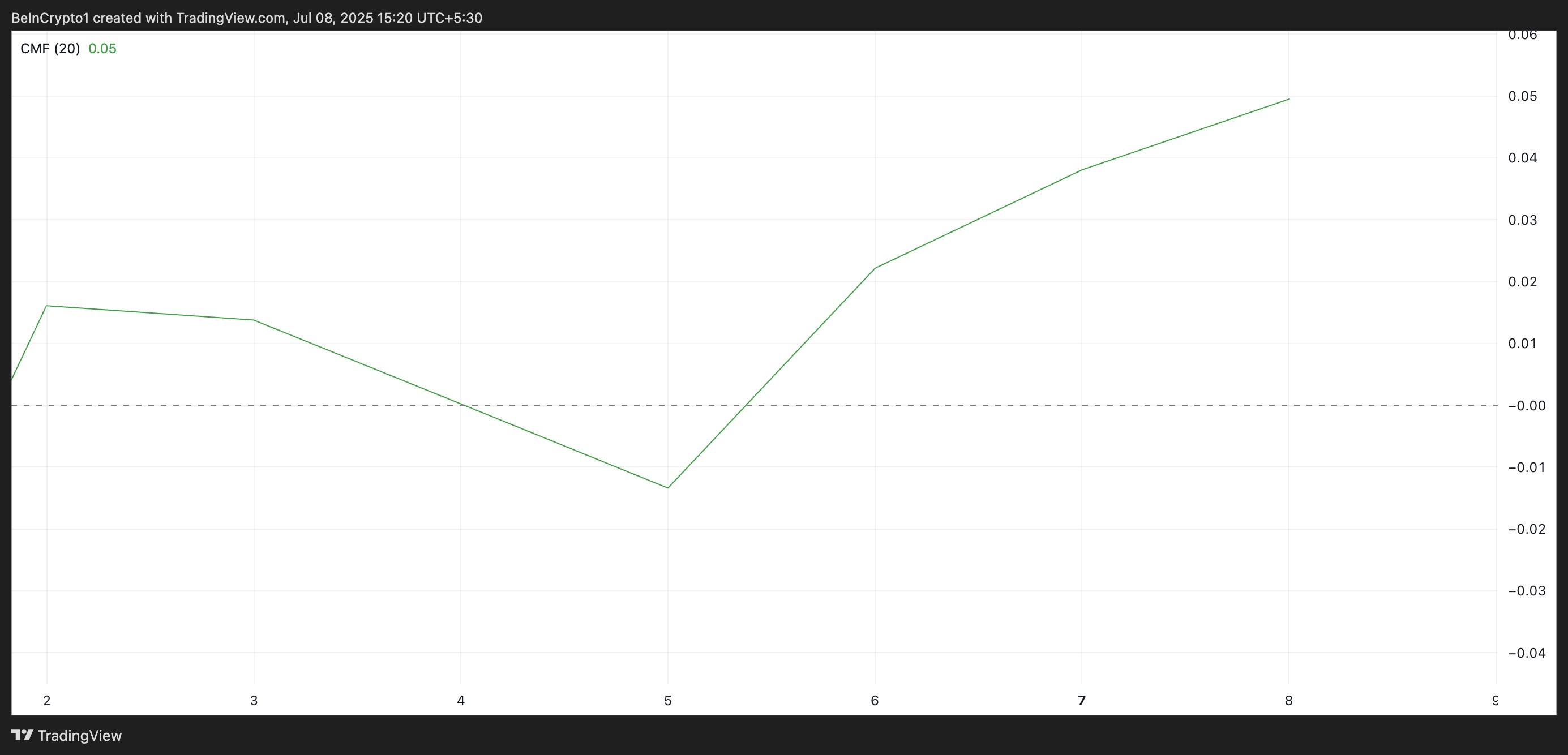

Additionally, while prices are stagnant, Ada’s Chaikin Money Flow (CMF) will climb, suggesting that buy-side pressure will rise steadily. At Press Time, this momentum indicator, which tracks how assets enter and exit assets, is on an upward trend at 0.05.

When the CMF indicator rises during the asset’s horizontal price action, accumulation refers to. This depicts a scenario in which ADA investors are gradually purchasing in anticipation of future breakouts.

Can an ADA hold $0.58? Market Eyes $0.593 Clue Resistance

At press time, the ADA trades for $0.58. If market sentiment becomes bullish and demand accelerates, the coin’s price could be about to exceed resistance at $0.593.

A barrier violation could cause an extended rally to $0.64.

Meanwhile, if sales activities are strengthened, Cardano’s price can be pushed down to support at $0.55.

The price of the Post Cardano (ADA) suggests a final pullback before the first major breakout appeared on Beincrypto.