Ethereum’s Recovery Rally has stalled over the past few days, with ETH trading sideways as a charge of sales pressure.

Hesitancy stems from long-term holders (LTHS) moving to secure profits. This behavior is not new, but its re-emergence threatens even more negative aspects.

Sponsored Sponsors

Major Ethereum Holders for sale

LTH NET’s Unrealized Profit and Loss (NUPL) metrics reveal Ethereum’s price struggle every time the indicator exceeds the 0.65 mark.

This is because profit levels reach saturation points and veteran investors prefer sales over retention, resulting in price stagnation and corrections.

Currently, Ethereum reflects the same behavior as past cycles. As LTHS recognizes significant profits, the sale is undermining the upward trajectory of ETH. Buyers hesitate to absorb sales pressure, making ETH vulnerable to expanded integration.

Sponsored Sponsors

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

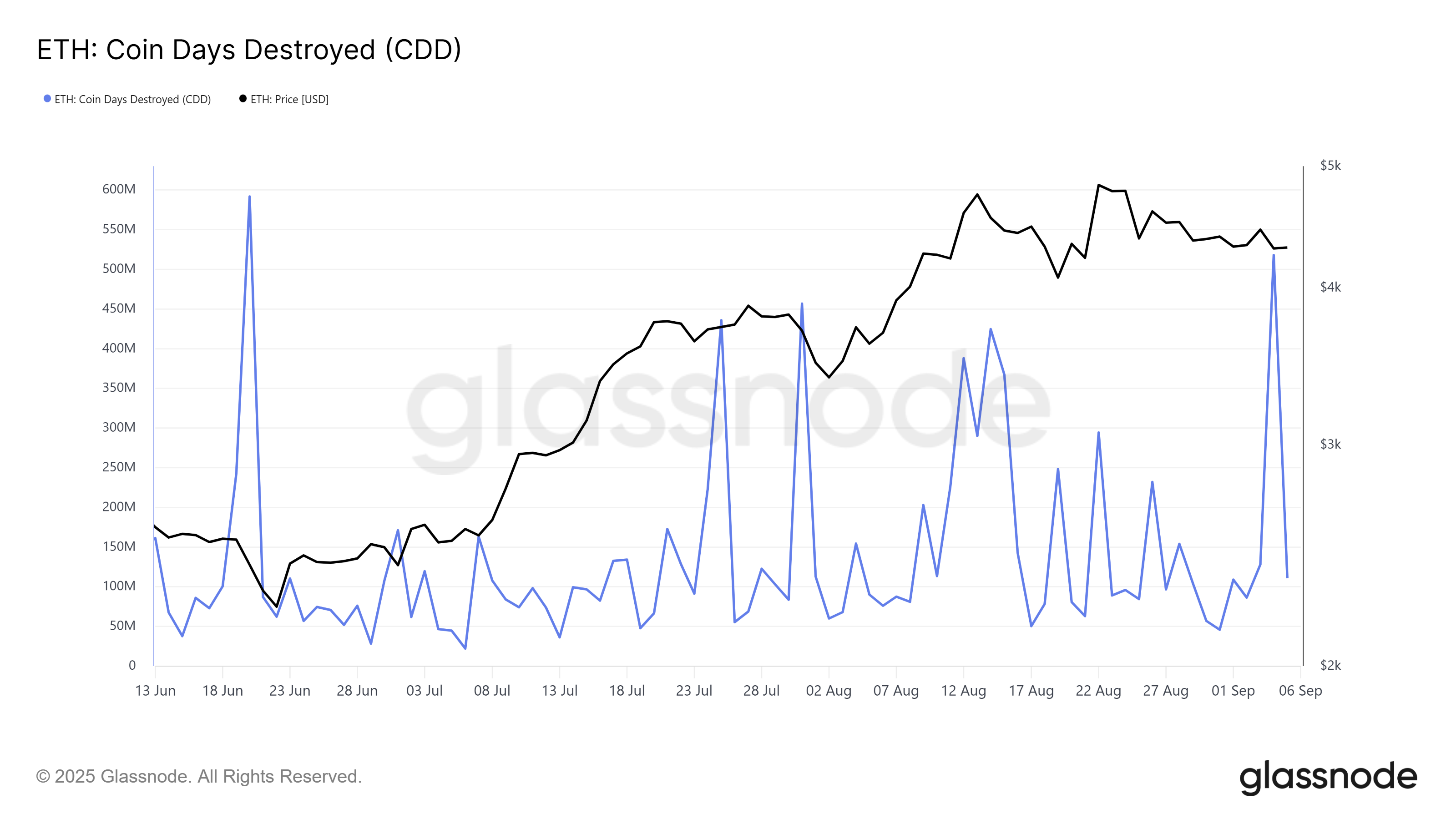

The Day of Destroyed Coins (CDD) metric supports this trend, indicating that LTHS is actively liquidated. Over the past 24 hours, CDD has registered its sharpest spike in two months, highlighting the rise in sales.

Such activities often indicate additional negative side risks. Sales at high levels indicate a lack of confidence in an immediate recovery. Unless offset by strong influx from other investor groups, ETH macro momentum suggests a cooling period.

ETH prices remain stagnant

Sponsored Sponsors

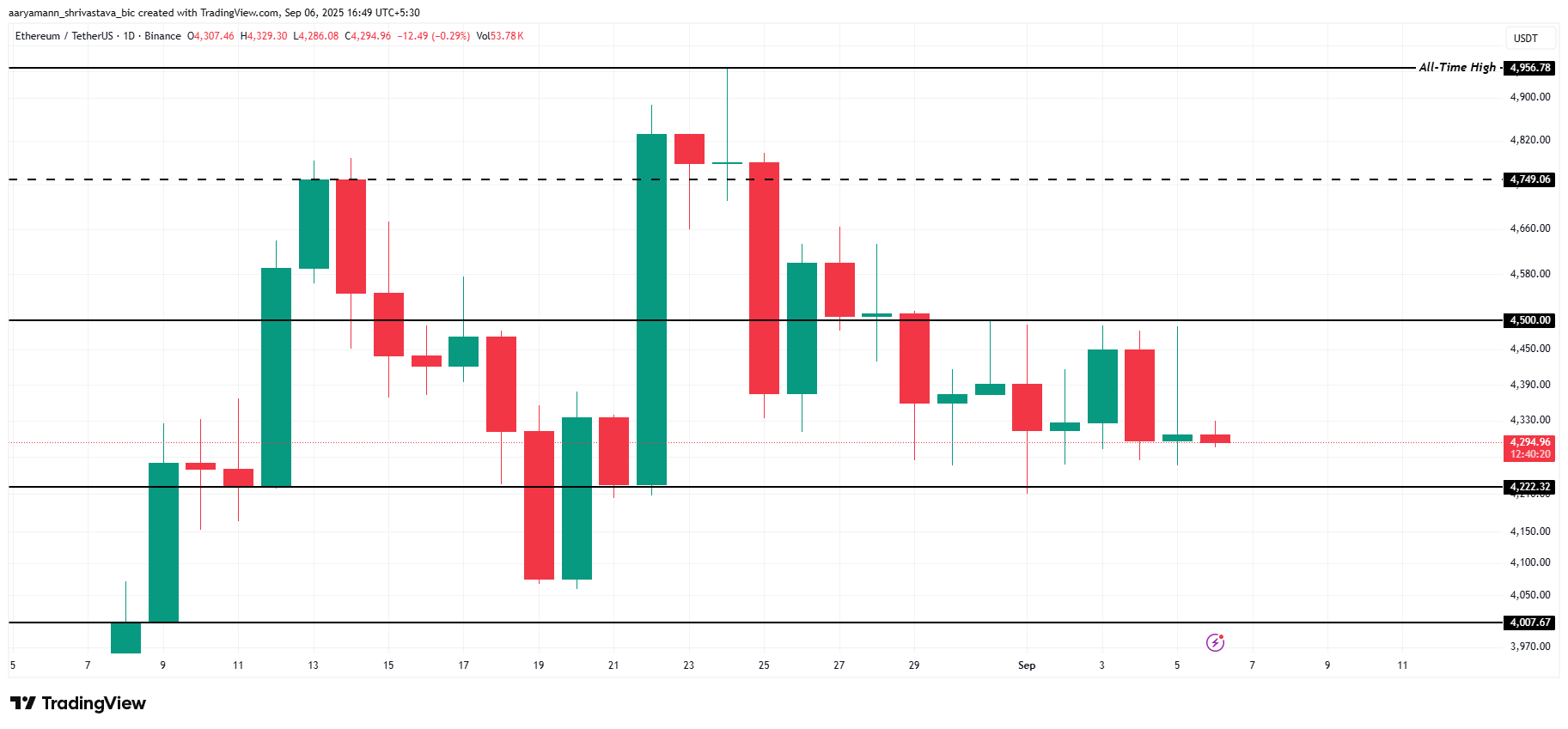

The Ethereum currently costs $4,294, exceeding the $4,222 support level. This challenge has repeatedly failed to violate ETH $4,500 over the past few days. This is the ceiling that serves as an important barrier to resistance for today’s Altcoin King.

This suggests that ETH may remain in scope in the short term. The profits on LTHS bookings limit the likelihood of rising, and ETH vibrates between $4,222 and $4,500 until market conditions improve or demand absorbs ongoing sales pressure.

Recovery could still be realized if other investors step in to buy ETH offloaded by LTHS. Supporting a successful violation and a $4,500 flip paves the way for ETH to retest $4,749.

This marks a potential reopening of a wider bullish trajectory.