Asia has emerged as the world’s fastest growing Web3 hub by 2025. The region leads retail adoption, liquidity and stubcoin integration.

Meanwhile, North America and Europe focus on institutional integration and protocol development. These complementary strengths are reconstructing the world’s cryptocurrency landscape.

Data Behind Asian Cryptographic Surges

From late 2024 to August 2025, Asian countries solidified their role as the world’s fastest-growing hubs for adoption of Web3, blockchain and cryptocurrency. The region’s surge is supported by deep retail infiltration, intense trade liquidity and rapid, stable intake. Meanwhile, North America and Europe have progressed along parallel tracks, focusing on institutional integration, core protocol development and infrastructure scaling.

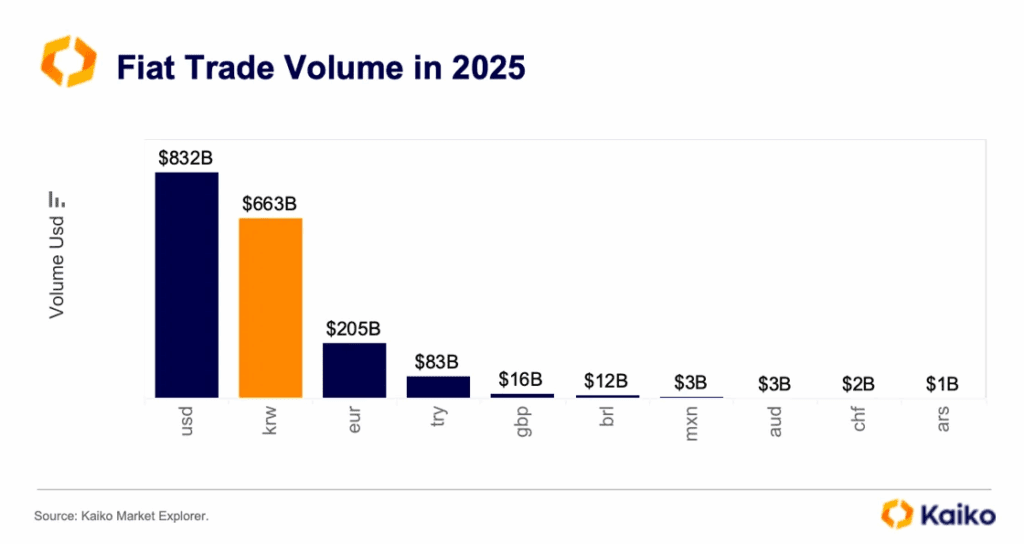

Geography of the Chainalysis ‘2024 Cryptocurrency Report ranked Central and South Asia and Oceania (CSAO) among the top of the global Crypto adoption index. Another dimension has been added to Kaiko’s market data. South Korea’s winning trading volume rose to the world’s second Fiat this year with Crypto, indicating both the depth and strength of the local order form.

“Central and South Asia and Oceania are driven by vibrant retail markets and innovative local exchanges, continuing to surpass their weight in grassroots crypto adoption. The region shows deep liquidity and consumer demand rapidly translate into real-world use cases.” – Kim Grauer, Research Director at Chainalysis

Asia: Scale, Speed, and Stubcoin Utility

Asian Crypto Landscapes blend a diverse market structure with a huge user base. Although CSAOs ranked CSAOs at or near the top for grassroots adoption, East Asia also stood out for their high transaction volume and exchange activities. Kaiko’s research revealed that the Korean platform not only posts heavy BTC and ETH sales, but also dominates Altcoin trading, with the KRW-based pair leading a large share in the global liquidity pool.

Stablecoins have evolved from trading tools to everyday payment methods. Visa and Allium Labs’ on-chain analysis is filtered for authentic payment flows and demonstrates consistent growth in peer-to-peer transactions, e-commerce payments, and cross-border remittances across Asia.

“Stable coins are becoming a universal settlement across the region. In Asia, there are significant adoption in commercial and remittances. In the US and Europe, institutions are moving from pilot to production, with chain payments and Treasury flows.” – Cuy Sheffield, Head of Crypto, Visa

On the supply side, the Asian developer ecosystem is expanding rapidly. Electric Capital’s 2024 Developer Report tracked the strong growth of full-time contributors to open source Web3 projects in major Asian markets. Developer retention has improved, with new repositories extending to Defi, GameFi, identity solutions and infrastructure. This surge complements Asian retail-driven demand and creates a self-enhancing cycle of user recruitment and product development.

North America and Europe: Facility Depth and Builder Gravity

North America and Europe maintain a lead in institutional market depth and protocol-level innovation. Chain Orisis data shows that both regions rank high across all total chain values received, but flows are skewed towards greater transfers, defi activity, and professional transactions. The IMF’s Crypto-Assets monitor provides macro context and tracks capital flows that guide total market capitalization, asset control, and institutional allocation.

“While the Asian developer community is rapidly expanding, especially with full-time contributors to open source Web3 projects, North America and Europe still lock in core protocols and infrastructure development. The strengths of each region are complementary.” – Maria Shen, general partner of electricity capital

Developer density remains Western strength. The geographical collapse of electricity capital indicates that the US and Europe are home to a large cohort of senior engineers and protocol maintainers. Many reference implementations, interoperability standards, and security tools occur here before scaling globally. This role as the core of innovation complements Asian prowess in user acquisition and market liquidity.

The Western market also shows stable and ridiculous adoption, albeit from a different angle. Visa’s analysis highlights the stub coinflow of the chains tied to the institutional finance ministry, cross-border corporate payments, and fintech integration. Unlike the flows that are more and more retail in Asia, these are increasingly embedded in existing financial operations and B2B channels.

The fluidity structure is also different. Western exchanges usually focus depth on BTC, ETH, and narrower sets of measures, reflecting regulatory environments and institutional preferences. Kaiko’s comparative analysis shows a deeper order form at the top of the West, but Asia is broad in many pairs. Coingecko’s quarterly review supports this, demonstrating the turnover concentration of majors in Western platforms and more diverse asset activity on Asian platforms.

Convergence strength of a mature Web3 ecosystem

When read together, the data paints complementary images. Asia excels in grassroots adoption, rapid stable integration and a rapidly growing builder base. North America and Europe dominate with protocol innovation, institutional grade infrastructure, and high trust liquidity pools. The strengths of each region deal with the gap between the opponents.

The next step in Web3 growth is cross-pollination. Asia can enhance consumer apps and suppression with better risk control and market analysis. The West can accelerate moving Stablecoin pilots to scaled financial instruments and tokenized assets. Developer education, security audits, and co-investment in open standards will raise the ecosystem globally.

Of course, the definition of “Asia” may vary from agency to institution or individual. The political system and economic scales are also very different. Therefore, it is difficult to identify a single common trend.

But the local story is no longer just about competition. As the latest data and expert commentaries show, Web3 maps are shifting towards mutual reinforcement. The retail-driven boom taking place in Asian countries meets the depths of Western institutional and infrastructure. Among them is the most reliable path to a mature, resilient global crypto economy.

Post East meets west here. The way Asian Web3 complements Western Web3 first appeared in Beincrypto.