The major Altcoin Ethereum has been trapped in horizontal channels since August 12th. Its price vibrates between resistance and support of $4,664 and $4,211, with traders waiting for a decisive breakout.

With liquidity cluster buildings now outweigh current prices and futures traders increasingly positioning, it appears ETH is poised for potential breakouts in the near future.

Sponsored Sponsors

Eth Bulls Circle $4,500

According to Coinglass, ETH’s liquidation heatmap shows a concentration of liquidity in the $4,520 price range. In the context, AltCoin is currently trading at $4,385.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Sponsored Sponsors

A liquidation heatmap is a visual tool that traders use to identify price levels where large clusters of leveraged locations are likely to be cleared. These maps highlight areas of high fluidity. Often there are bright zones that are color coded to indicate intensity and represent greater liquidation possibilities.

These price ranges usually act as magnets for price action. This is because the market tends to trigger liquidation towards these areas and open up fresh positions.

So, in the case of ETH, a liquidity cluster around the $4,500 price range indicates that its prices could be raised upward towards this level in the short term.

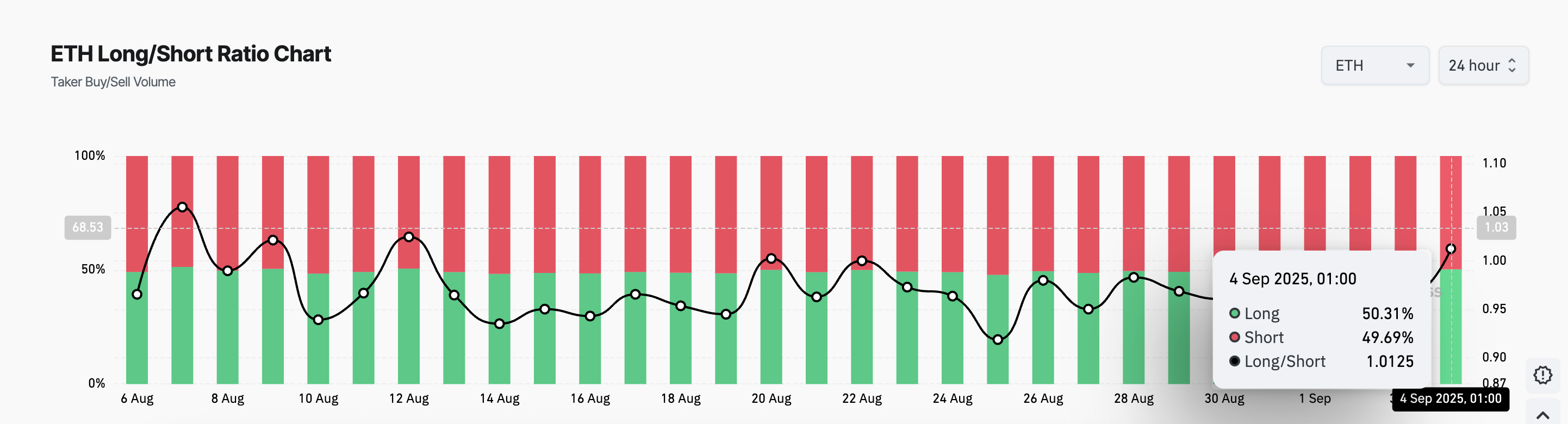

Furthermore, Coinglass data shows an increase in the long/short ratio of ETH, indicating a strong bullish slope of emotions among future traders. At press, this is 1.01.

The long/short ratio measures the balance of traders who hold bullish (long) and bearish (short) positions in the futures market. The above reading suggests that more traders are betting on price increases, while values below 1 indicate a stronger presence of bearish bets.

Sponsored Sponsors

With the current ETH ratio at 1.01, the market is small but notable indicates that it is leaning towards bullish expectations. This further confirms the potential upward movement cases.

If the Bulls win this battle, it’s the best ever.

If bullish momentum continues, the ETH can break above the top line of the horizontal channel, with resistance forming at $4,664. This level of violation could potentially revisit the coin’s record high of $4,957.

Meanwhile, if demand drops and ETH falls below support at $4,211, it could drop to another $3,626.