Ether.fi – a familiar name for the re-grid space – is undergoing a strategic change to officially move to neobanks from code origins.

From dominant restructuring platforms to ambitious leaders of decentralized banks, Ether.fi is redrawing the boundaries of modern Defi.

Conversion of Ether.fi

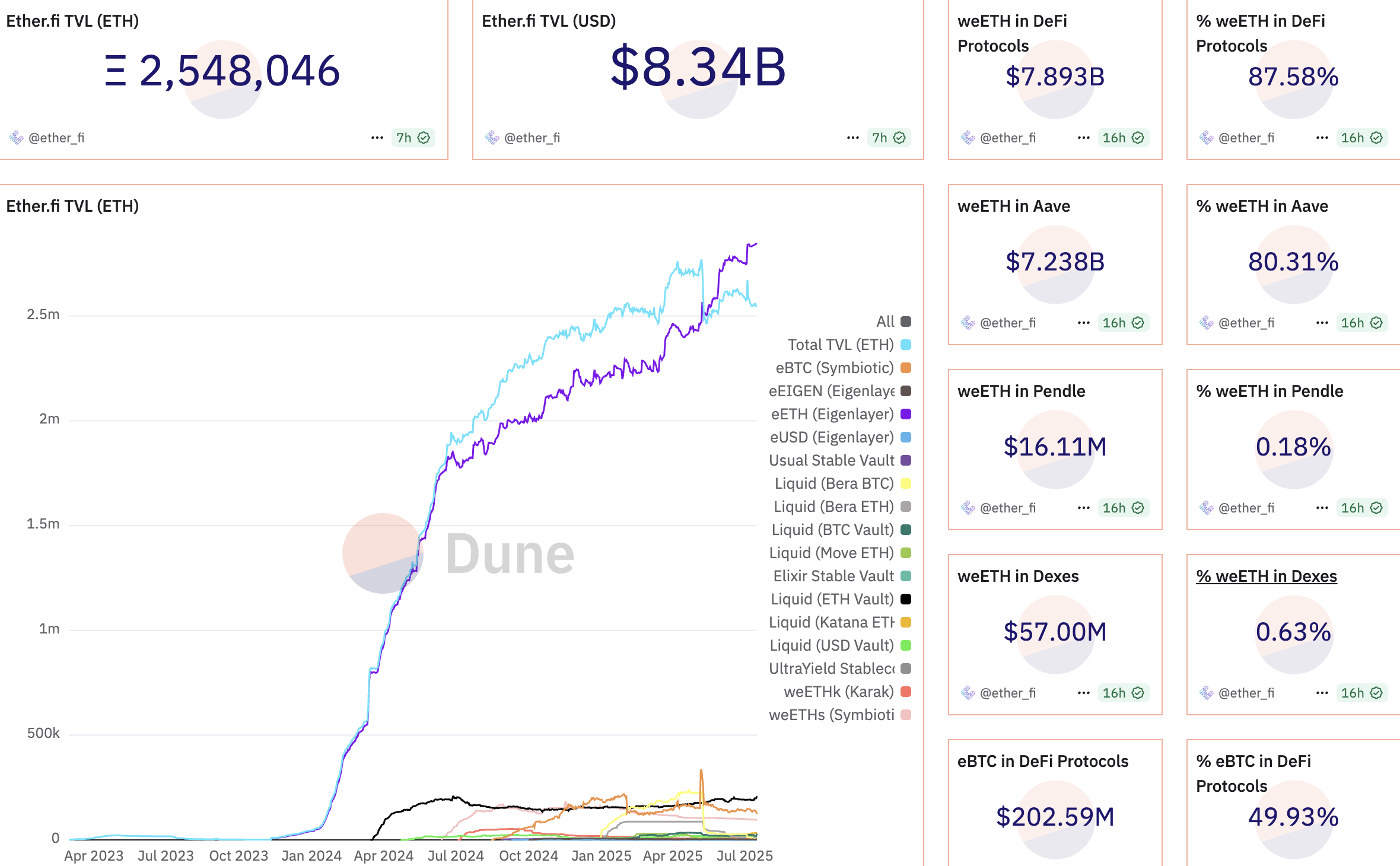

In the replenishment sector, Ether.fi is one of the top players, holding a market share of 31.4%. The main position belongs to 46.4% Eigenpie.

Ether.fi recorded approximately 2.6 million ETH deposited on the platform. The current total is locked (TVL) is around $8.34 billion. Beyond its role as a passive eld platform, the project gradually implements a digital banking model. This model aims to become a fully integrated, decentralized financial ecosystem, from staking and secured lending to daily spending.

Ether.fi’s new transformation strategy can be attributed to poor performance, in addition to diversifying products in highly competitive spaces. The project still holds significant market share, but this figure has dropped significantly from its previous peak.

According to Dune Data, the project once held a monopoly in March 2025 with a market share of over 55%. However, this figure fell to its current level within three months.

It’s not that Ether.fi’s pivots were without challenges. Its first product (an unlawful credit card launched in late April) shows modest performance compared to the vast size of traditional financial markets.

Furthermore, Ether.fi faces fierce competition with giants such as Coinbase, Revolut and Robinhood. These companies already boast an established financial ecosystem with millions of retail users.

The potential problem lies in the sustainability of the 3% cashback program. Currently, these rewards are subsidized by scrolling SCR tokens, which account for 50% of TVL on the scrolling network. However, if the volume of transactions increases rapidly, the cost of maintaining a cashback program can become unsustainable. This allows Ether.fi to adjust the cashback rate or explore alternative revenue streams.

“Despite these challenges, Ether.fi’s suite of products is structurally compelling, with each product being designed to drive demand for others through tight vertical integration. Multiple tailwinds (Tradfi companies add ETH to their balance sheets and record stable ETF flu), and look promising setups for accelerated growth over the coming months,” commented X-user.

Overall, the Ether.fi conversion is a clear indication that the Defi protocol is increasingly converging with the traditional banking model, but it is a more decentralized and transparent way. Ether as capital from traditional institutions is beginning to flow into the Ethereum market through vehicles such as spot ETH ETFs.

Nevertheless, maintaining growth momentum, maintaining user trust, and balancing short-term profits with long-term vision is a key challenge for the team behind the project.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.