Ethereum (ETH) prices have just fallen below $3,800 to celebrate its 10th anniversary and have been cooled after a temporary test of $3,900 earlier this week. Traders around the world are still stuck at the psychological $4,000 level, but the latest on-chain data suggests that the rally may not be as strong as it looks.

Despite an increase of over 50% each month, prices only rise by 2% per week, with cracks beginning to appear below the surface. The setup is a brew bull trap, which can leave slow buyers vulnerable.

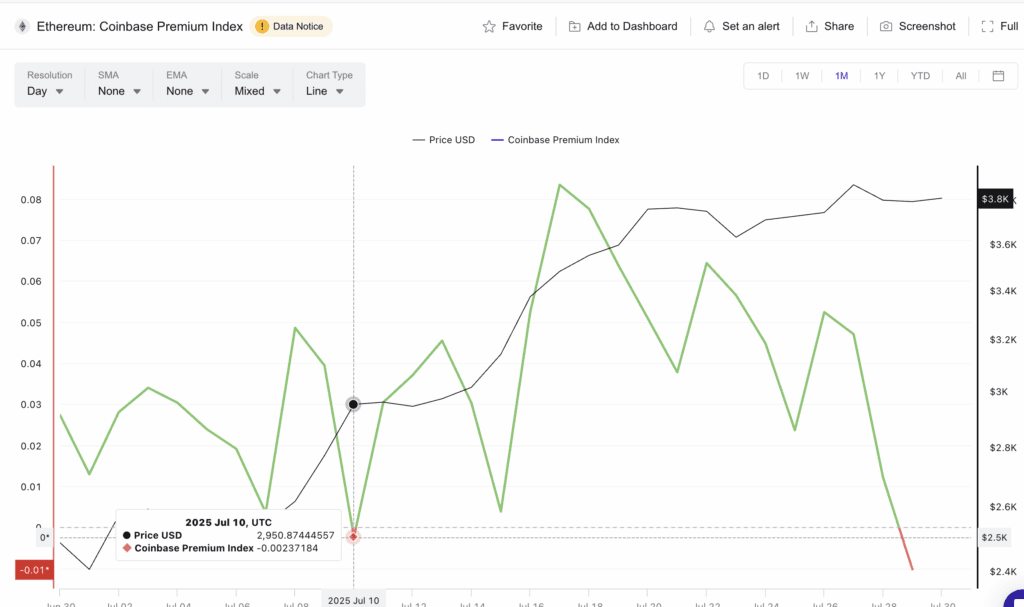

Coinbase Premium Index is very negative

One of the most important signals comes from the Coinbase Premium Index. This indicator measures the difference between Coinbase’s Ethereum price and other global exchanges.

Historically, positive indexes have shown stronger purchasing activities from US-based institutions. However, the index plummeted to -0.01, the lowest level since May.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

In the context, on July 10th, the index briefly soaked minus at -0.0023, and ETH prices were hardly responsive. This time, the decline is much deeper and suggests that despite all the optimism of the ETF in July, US buyers are retreating.

While the broader market remains buoyant, premiums reverse negatively, indicating a potential demand gap from a large number of US players. Without a strong institutional bid, the foundations of climbing at ETH may weaken, making it easier for the assembly to lose steam or reverse it soon.

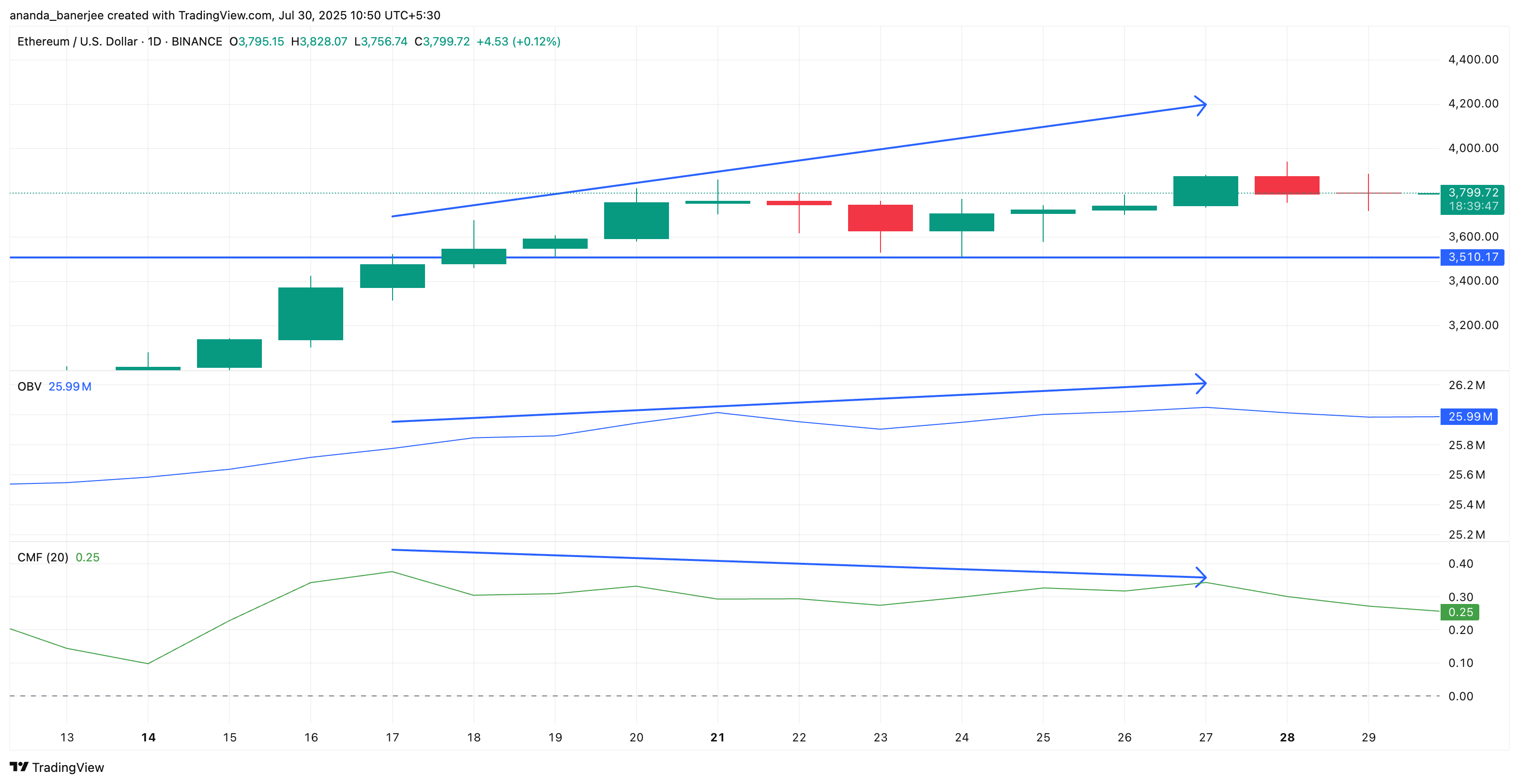

CMF and OBV talk contradictory

Chaikin Money Flow (CMF) adds another layer to this trap’s story. Over the past week, the CMF has achieved a lower high, indicating that money flow is slowing despite the higher price.

Chaikin Money Flow tracks buying and selling pressures based on price and volume.

This difference is often a precursor to lessen purchasing pressure. Even if the ETH price chart rises, there will be less dollars flowing into the crypto.

Conversely, the balance volume (OBV) is slightly higher, tracking rising prices. The OBV suggests steady participation, which may mislead misleading retailers.

obv measures cumulative amounts to indicate whether actual demand supports movement.

The CMF’s bearish divergence suggests that large players are shrinking, and if sentiment changes, the market becomes vulnerable to a quick reversal.

When both of these indicators are seen together, they draw pictures of meetings that have lost their true beliefs under the hood. This imbalance is truly the way bull traps are formed. The volume looks decent, but the actual flow of money is running out.

Ethereum Price Action shows a fragile wedge structure

Ethereum price action adds the final part of this puzzle. Assets are rising within the upward (upward) wedge. This is a pattern that is often considered bearish as it indicates slowing upward momentum.

Several trading sessions instantly violated the top trend line of the wedge (marked by the red arrow), reaching $3,858, seducing the breakout buyer, but quickly only corrected it to fall below $3,510.

Such a false breakout is a classic bull trap action that causes fear to be missed before turning the direction over. As long as Ethereum prices stay inside this wedge, the risk of another false breakout remains high.

To negate bearish structures, Ethereum prices must be kept above $4,024 and above the significant psychological and technical resistance level of $4,024. Otherwise, Eth Retest support could be displayed for $3,510.

Post Ethereum could set up a bull trap as US demand fade first appeared in beincrypto.