The recent passage of Stablecoins’ groundbreaking US regulations, the Genius Act, has intensified global attention. To discuss the growing and ridiculous landscapes of Asia, Beincrypto sat down with Dr. Sam Seo, chairman of Kaia. As one of Asia’s leading cryptographic platforms, Kaia is at the forefront of shaping the regional Stablecoin strategy.

Stablecoins are in the spotlight in Asia

Just a day after clearing the house, President Donald Trump signed the Genius Act, the first US federal law to administer stablecoins. The groundbreaking law requires the issuance of one-on-one preparations, periodic audits and restrictions to licensed banks, credit unions, and certain approved non-banks, while banning algorithms or non-package coins.

This move has already sparked a wave of corporate interest. Within weeks, major US retailers like Amazon and Walmart began exploring their own stubcoin to reduce card network fees, reduce speed payments and integrate loyalty programs. Supporters see this as a step towards mainstream adoption. Critics warn that deposits can be withdrawn from traditional banks and accelerate digital currency strategies.

This timing has led European investors to rely on euro-denominated trading and stubcoins in the euro family to reduce FX risk as the US dollar has faced the most sharp first half decline since 1973. The dollar remains dominant, but the regulatory clarity of the Genius Act could strengthen its position in crypto as Asia considers ways to benefit from USD-based liquidity without compromising its local currency.

Dr. Sam Seo, chairman of the Kaia DLT Foundation, discussed with Beincrypto how Asian policymakers and platforms respond, and why the local Stablecoin Alliance is important for the region’s long-term autonomy.

SEO didn’t hesitate to choose Stablecoin when asked about the most important trends in the Asian digital asset market.

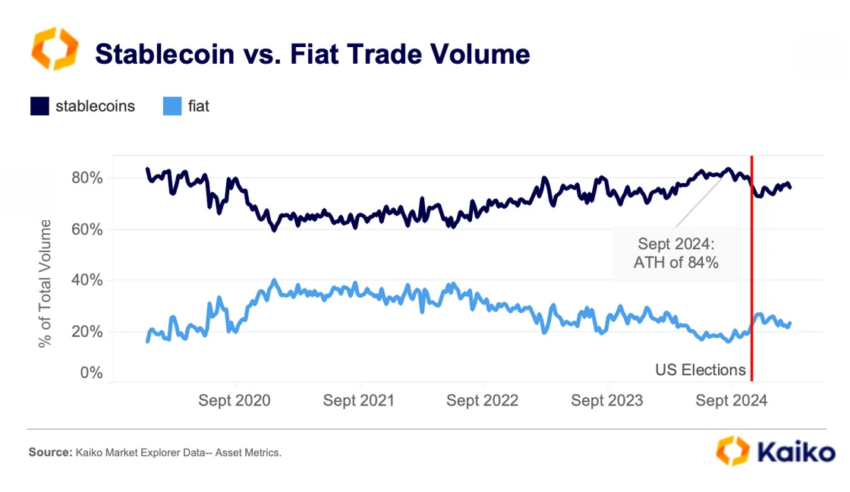

“The most trendy one is the stubcoins,” he said. “Even before the act of genius, the increased use and volume of Stablecoin actually sparked discussions and attracted a lot of attention in Asia.”

He emphasized that Stubcoin adoption is rapidly expanding across Asia, far from a phenomenon confined to the US or Europe. The USD backed coins are also used very well by Asian individuals and businesses. The surge extends beyond speculative trading, and Steubcoin is increasingly embedded in everyday trading, cross-border commerce and local regulatory agenda.

Leaders and local defenders

When asked which countries are driving innovation, SEO pointed out two major countries.

“Perhaps because Singapore or the United Arab Emirates were very advanced in terms of regulating stubcoins. In Singapore, not only the Singapore Dollar, but also the 10 other major currencies, the Arab Emirates have created many regulatory frameworks related to crypto and stableocoines.

Early actions in Singapore were placed ahead of other Asian jurisdictions in establishing clear and enforceable rules. Dubai and the UAE, led by Abu Dhabi, are also building a comprehensive regulatory framework for digital assets, including Stablecoins.

In contrast, several countries are focusing on stubcoins that are pinned in their currency, SEO said.

“Japan, South Korea, Hong Kong, China and the Philippines are focusing more on currency-based stubcoins as they care about their people and their currency.”

This reflects sharing priorities. It protects the domestic currency system and prevents the country’s currency from being evacuated by foreign-supported coins.

Genius Act: Both Threat and Opportunity

The Genius Act has created a clear framework for regulated USD stability, such as USDC and PayPal USD. For Asia, SEO sees both dangers and possibilities.

“If the local currency is not stable, Fiat currency is not used much as it could significantly increase the use of US dollar stubcoins. However, this could be an opportunity for Asian countries if they prepare the proper use of regional and US dollar stubcoins.”

SEO said USD stable coins regulated under the Genius Act could unleash new capital flows in Asian tokenized asset markets, from government bonds to real estate. He also emphasized that stubcoins are generally issued and traded on public blockchains, making them transparent to all participants. At the same time, privacy can be stored through selective anonymization of user data.

Japan’s strict model and the need for balance

Japan’s Payment Services Act allows only banks, trust companies and authorized remittance providers to issue silly and silly things that require full backup assistance and regular audits. SEO sees this as a powerful safeguard for the circle.

“Stubcoin regulations are a way to protect Japan’s currency and the Japanese market. By requiring strong reserves within a particular jurisdiction, it can prevent money from actually leaving the country.”

But he also warned against going too far.

“If the reserve requirements are too strict, it can prevent non-local players from decreasing interoperability with the stability backed by one of the most important roles of digital currency, which is the sects of other countries. A balance between non-local players is required.”

Payments, e-commerce, and inclusion

SEO believes that Stablecoins can push Web3 into mainstream Asia, especially payments and e-commerce.

“Absolutely yes,” he asserted. “In some countries in Vietnam and Indonesia, for example, QR payments are almost dominant rather than credit card payments.”

By integrating stubcoin into a QR-enabled wallet, millions can trade without the need for bank accounts or cards, and it must go through the complexity of the bank’s authentication process.

“Having Stablecoin as another currency means of currency means increasing payment transactions and reducing the difficulty of payments, so there’s no need to reinvent the interface.”

The European Edge and the Asian Alliance Gap

SEO noted that Europe enjoys easier liquidity adjustments thanks to the Euro and the MICA framework. Asia doesn’t have this advantage because there are multiple currencies alongside regulatory diversity.

“While Asia doesn’t require a single currency, the multi-currency stubcoin alliance is very effective. Different currencies can improve liquidity between stubcoins in bags.”

Such alliances can provide the foundation for cross-border interoperability and reduce friction between regional markets.

Kaia’s roadmap for regional cooperation

Kaia focuses on expanding real-world use cases for stability and adoption in Asia. It already has native support for USDT and plans to carry stub coins backed by Yen, Rupiah and Hong Kong dollars. The second phase is to build a seamless currency swap and efficient cross-border settlement on-chain FX market. This increases liquidity, reduces transaction costs, and allows for faster payments.

The final stage is to standardize Asian stubcoin issuers and expand the regional network effects.

“We’re definitely working on that,” SEO said of his collaboration with Kaia with Line Messenger, one of the region’s most popular. “One day, line users in Japan and other countries can use different, ridiculous things within Line Messenger, but we also need proper regulations.”

Kaia will work closely with Line to explore Stablecoin integration and hope that once the legal framework is ready, Line users will be able to seamlessly send and receive Stablecoins nationally and internationally.

Kaia is a Layer 1 blockchain platform released in August 2024. It combines Kakao’s Klaytn, the dominant tech giant in Korea, with Naver’s Finschia. Naver’s Line Messenger has a large Asian user base in Japan, Taiwan and other countries.

Kaia Chain Network onboarded Tether’s USDT in May this year. We are also discussing creating potential KRW, JPY and other currencies collateral stubcoin with other Stablecoin and Fintech companies.

The Definitive Choice of Asia

For SEO, the strategy is clear. Build local currency stability, selectively integrate USD liquidity, and connect them through a regional interoperability framework.

“Stablecoins are no longer just cryptographic tools. They are becoming a connective organisation for Asian digital finance. They can link payments, tokenized markets, and everyday commerce.”

Genius law may solidify the regulated role of dollars in global crypto. Whether Asia responds with fragmentation or unified strategies will determine the financial autonomy of the region over the years.

Post-genius Act and After: Kaia explains that Asian perspectives first appeared in Beincrypto.