High lipids (hype) have witnessed a rapid price surge, bringing Altcoin to a marked distance from the highest ever distance (ATH).

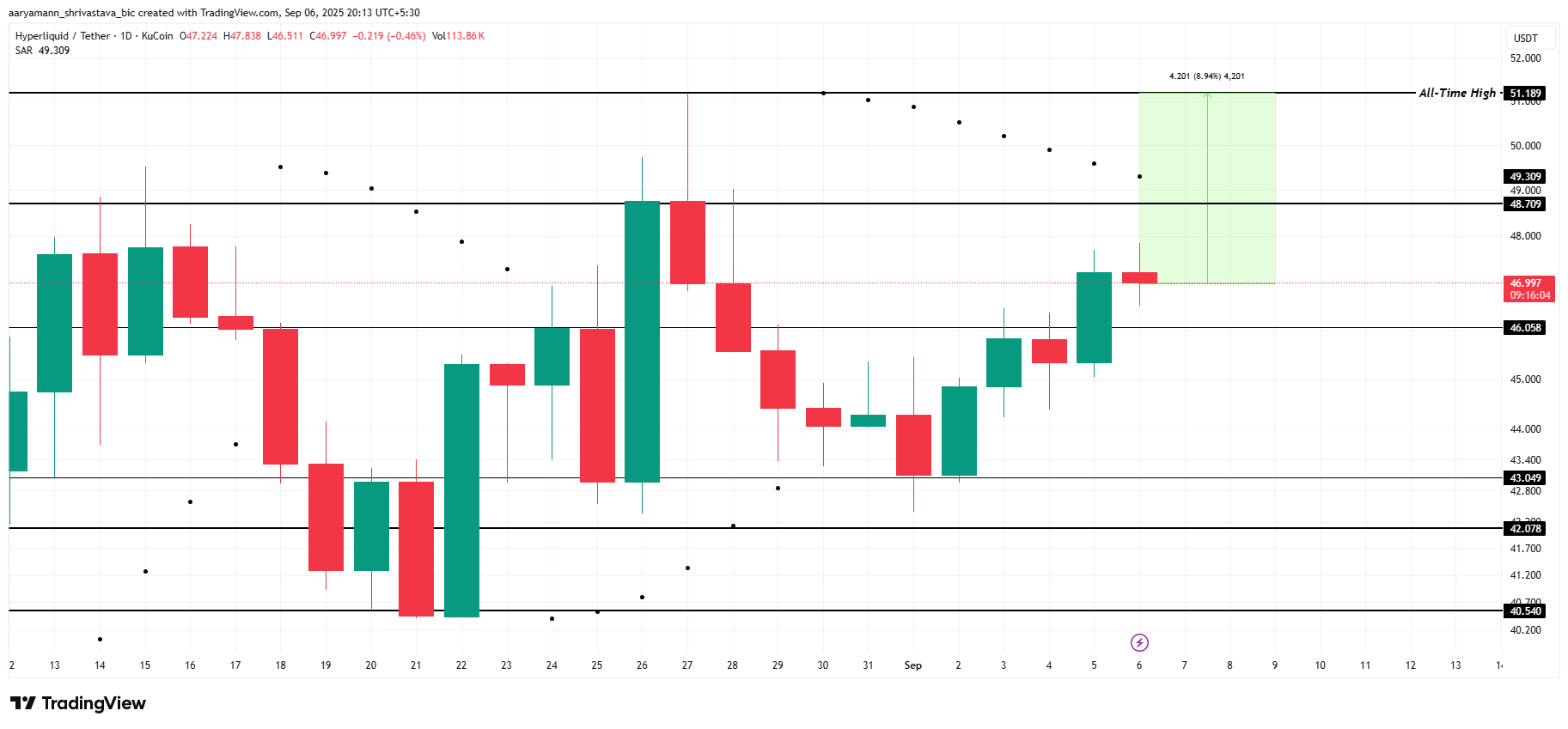

The hype, currently trading at $46.99, is just 9% off the $51.18 peak recorded in late August. Market indicators suggest that bullish momentum may continue to be strengthened.

Sponsored Sponsors

Hyperliquid has shots on ATH

The relative strength index (RSI) holds firmly above the neutral level of 50.0 and is placed in the positive zone. This indicates that high lipids are experiencing bullish momentum.

As RSI trends increase, traders may consider this as a confirmation of sustained upward pressure.

Sponsored Sponsors

Strong RSI measurements generally reflect an increase in purchases, and due to hype, this could create the momentum needed to retest previous levels of resistance and bring it closer to history’s highest.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

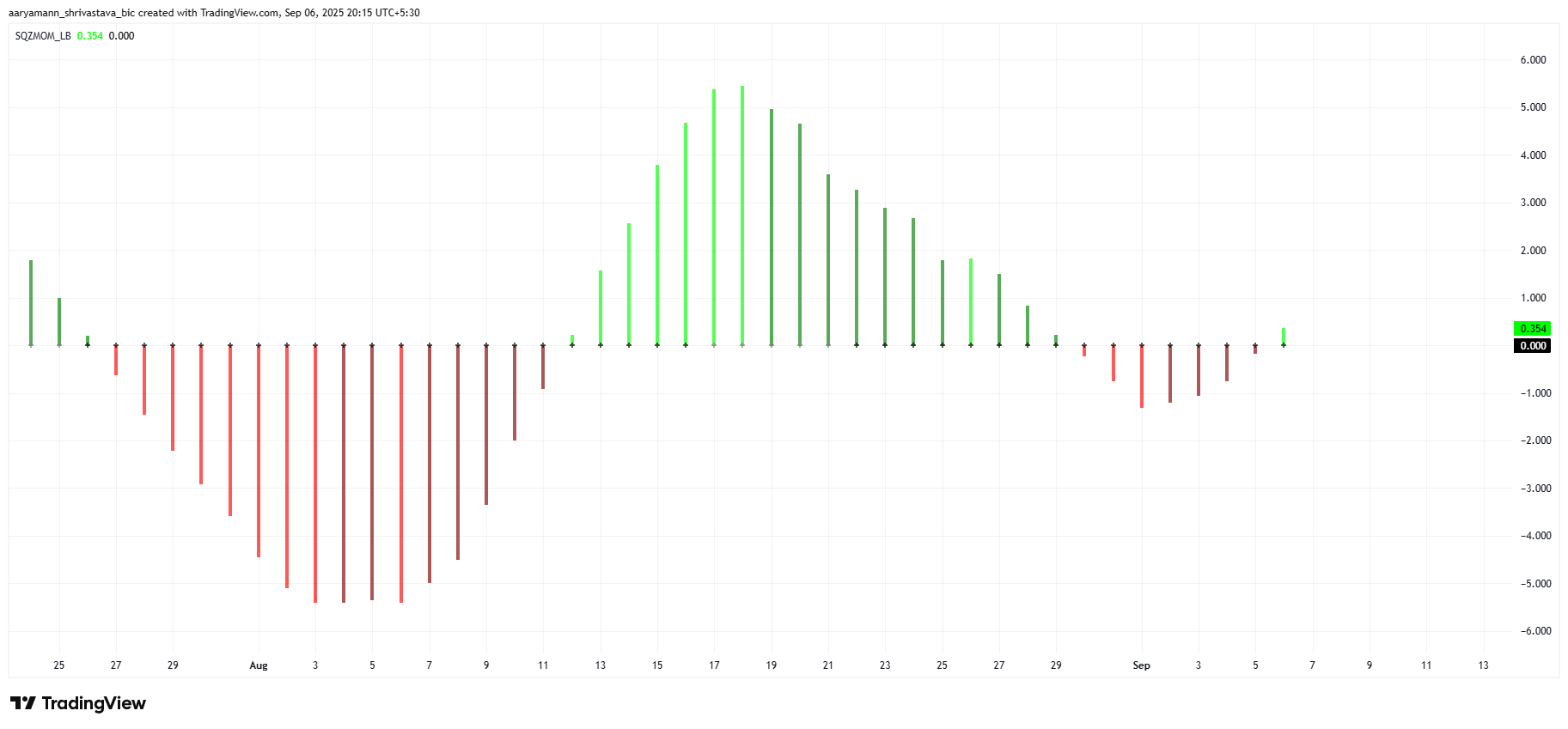

Squeeze momentum indicators also hint at potential breakouts. The green bar emphasizes the expansion of momentum, while black dots appear within the bull zone. This setup suggests that once the squeeze is released, the hype could be a warning to price action that accelerated.

Historically, this indicator narrows down has shown strong movement in both directions. As the current pattern refers to bullish continuation, high lipids can benefit from increased trading volumes and increased market participation, resulting in higher prices.

Sponsored Sponsors

At $46.99, the hype is approaching the $51.18 ATH. Current technical signals support the potential for continuous growth, and Altcoin shows resilience to sales pressure.

Hyperliquid supports it by violating $48.70, and the path to $51.18 is clearer. Breakouts above this level could mark new ATHs, strengthen market optimism and potentially trigger further influx from bullish traders.

However, if it does not exceed $48.70, it can lead to short-term debilitating. When the hype falls below $46.05, the bullish paper becomes invalid and the altcoin becomes vulnerable to further downsides and potential fixes before attempting another recovery.