High lipids (hype) are storming the market with monthly revenues exceeding $110 million and permanent trading volumes reaching $2.5 trillion.

Called Crypto’s new “killer app,” the platform opens opportunities for explosive growth, raising questions about risk and sustainability.

Sponsored Sponsors

High lipid surge

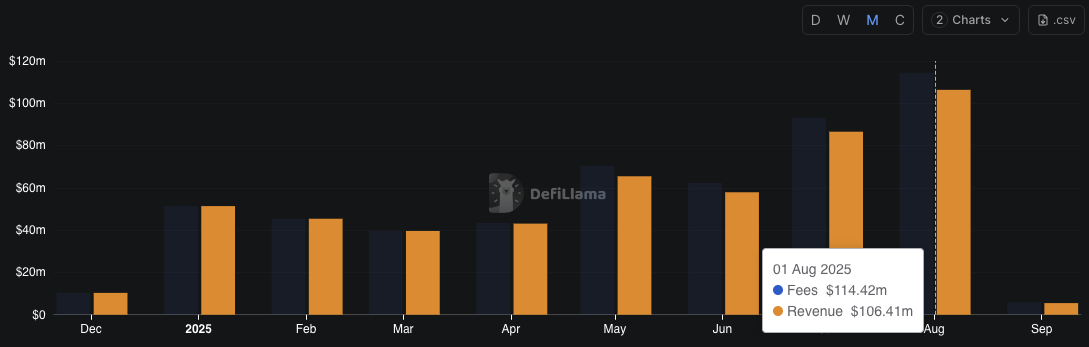

Over the past 30 days, Hyperliquid’s revenue has exceeded $110 million, increasing its cumulative revenue to $661 million. This is a rare growth trajectory of non-obligatory perp dex. Data from Defillama shows that protocol charge generation continues to rise steadily despite the “late summer” of the market.

In August alone, Hyperliquid’s revenue and fees reached $106 million and $114 million, respectively, according to Defillama. These figures were higher than the $86 million and $93 million in July. In July, high lipids accounted for 35% of total revenues for the blockchain sector.

Sponsored Sponsors

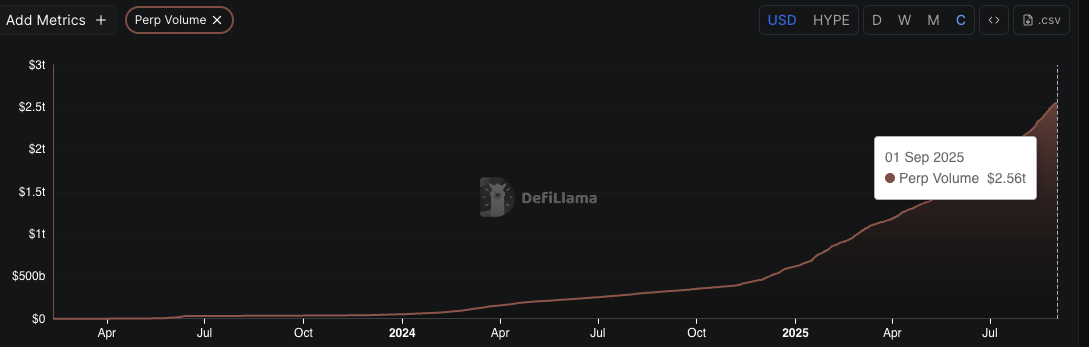

Beyond revenue and fees, Hyperliquid’s permanent volume is over $2.5 trillion. In fact, even during the so-called “late summer,” according to X users, the platform still recorded more than $1 trillion in trading activity.

This growth is in stark contrast to Solana’s Dex activity. According to Will Clemente, Solana-based Dex has been declining since Memocoin Frenzy earlier this year, but Hyperliquid users and volumes are “trend all year round.”

The next potential app?

Recent surges of Hyperliquid also caused a mixing reaction. With its simple products, CEX-like experiences, and the ability to rapidly scale ecosystems, Hyperliquid could become the new “killer app” of crypto.

Sponsored Sponsors

However, from another perspective, some users argue that high lipids still face structural risks such as manager control and potential downtime. In fact, Hyperliquid faced a short front-end outage that prevented users from placing, closing or withdrawing orders, even though back-end operations continue to be affected.

“If high lipids go down, can users withdraw funds? (For example, submit proof). Can high lipids get worse, can they steal the user’s funds?” X User Ryan asked.

Meanwhile, competition in the Perp Dex race is heated with newcomers like Lighter. Features such as order match/clearing verification and unified yield-margination make writers considered “formal competitors.”

Hyperliquid’s scale advantage and current user base remain dominant, especially as revenue and trading volume remain strong. If the Roadmap Running Milestone is executed, Hyperliquid has the foundation to continue Crypto’s next big momentum shift.

Nevertheless, the hype has shown signs of a retracement and is currently trading at USD 44.63. Technical shows $50-51 as the main resistance has been turned to support, with the target being $55, $58, $73, and bullish momentum being maintained.