Bitcoin has seen a slight decline in recent sessions, with prices slightly above the main support levels. Despite this pullback, analysts suggest that DIP could pave the way for fresh capital inflows.

Short-term holders (STHs) entering at current levels may provide fuel to gatherings towards higher price targets.

Bitcoin investors are waiting for profit

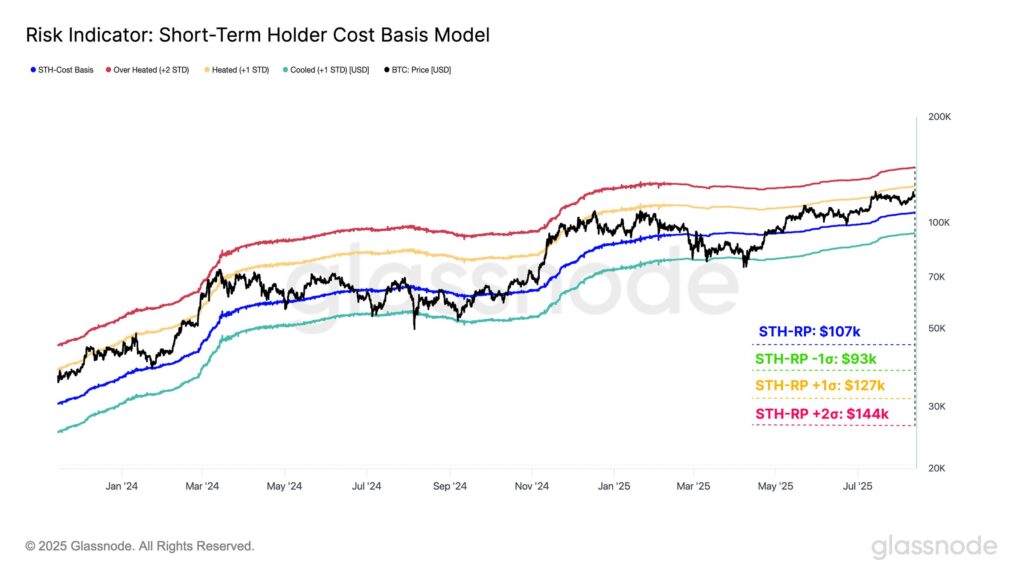

The STH cost-based model serves as a useful framework for understanding investor behavior. Establish the average entry price for a new Bitcoin wallet while applying a standard deviation band to highlight the overheated zone. These zones often coincide with the points where traders will start to withdraw as prices rise.

Based on this model, $127,000 will be the first major ceiling. Historically, this level has preceded the local top as early profits arise. The +2σ band, which is about $144,000, is where happiness usually reaches its peak and triggers a sharp correction. Until then, emotions suggest that there may still be a room facing upwards before massive sales pressure.

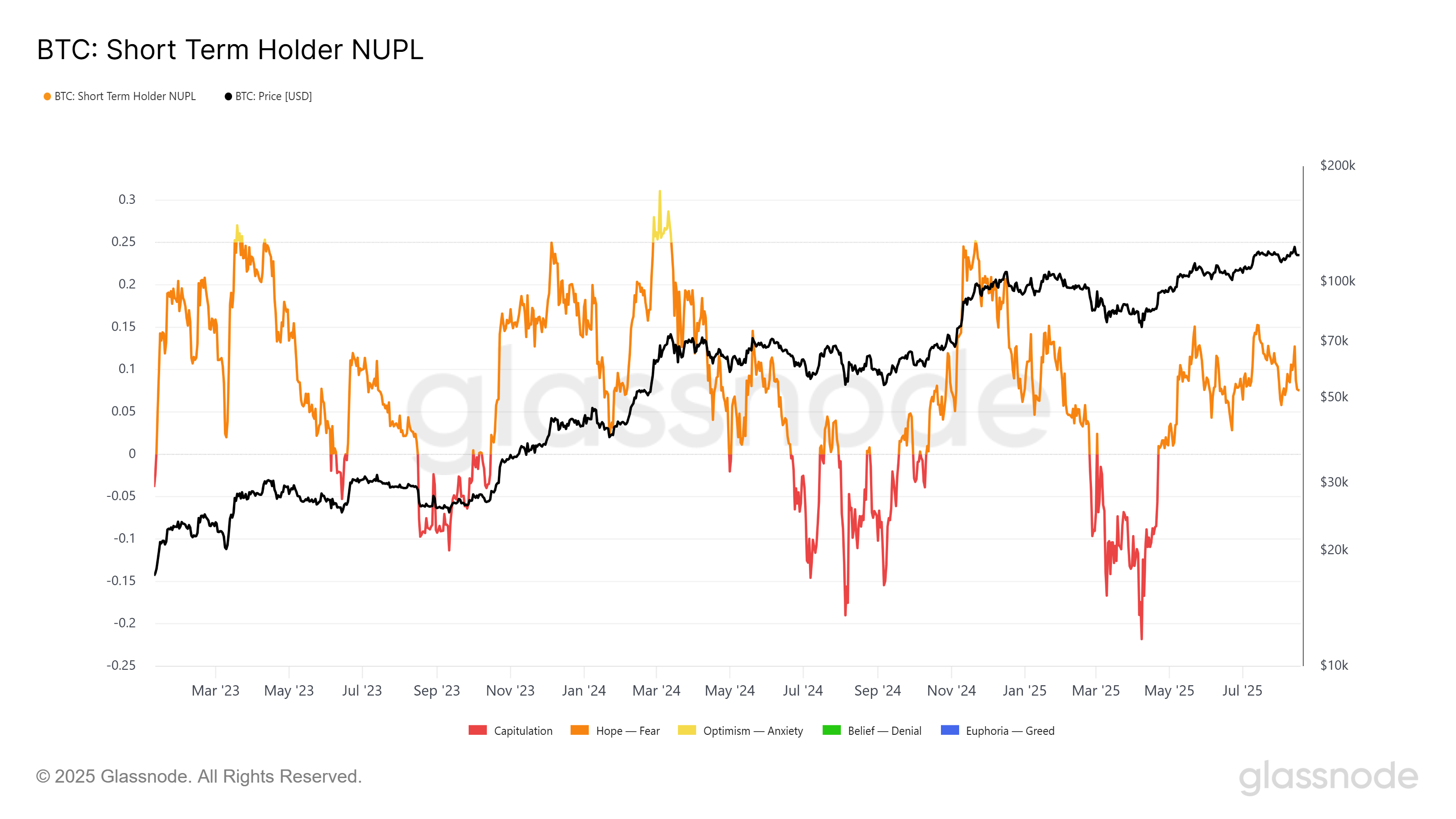

STH Net Unrealized Profit/Loss (NUPL) provides additional insight into the broader momentum. Historically, a threshold of 0.25 marked a saturation point for STH profits, often followed by periods of consolidation or mild revision. This trend helps to highlight that the market is overheating and vulnerable to reversals.

Currently, NUPL is located just 0.07, far below the saturation mark. This indicates that there is still room for profit growth before a reversal becomes more likely. As prices rise, this will validate the cost-based model and strengthen the expectations that Bitcoin can move further before it encounters massive sales pressure.

BTC prices are retained

At the time of writing, Bitcoin traded for $115,448 and holds solid support of $115,000. The model suggests that sales by STH will remain limited until BTC approaches $127,000.

Bitcoin will need broader market support to achieve this goal. Geopolitical tensions still drag on emotions, but trust from new investors could help momentum. Recovering $117,261 in support and pushing it to $120,000 will mark the stage for the best new history of the near future.

If conditions worsen, Bitcoin risks losing $115,000 in support, which could drop below $112,526. Such a move negates bullish papers, highlights BTC’s vulnerability to external pressures, and strengthens attention among traders while the market reassesssing its trajectory.

Isn’t the post-bitcoin pullback peak? Short-term benefits far from the “hot” zone first appeared in Beincrypto.