Since the beginning of June, Solana has traded sideways and has consolidated within a narrow range. Altcoin faces strong resistance at $158.80, finds support at $141.97, making some unsuccessful attempts in either direction.

However, this period of price stagnation offers long-term holders (LTHS) with the greatest benefits to purchase opportunities.

Solana long-term holders have messed up weak price action

Glassnode data shows that Sol’s vibrancy has been heading down since June 4th, rising to a 90-day high. This shows that this metric tracking the movement of previous dormant tokens fell to a 30-day low of 0.764 yesterday, marking a marked decline in selling between Sol’s LTHS.

Vitality measures the movement of long tokens by calculating the ratio of coin days to the total accumulated coin days. Climbing suggests that more dormant tokens are being moved or sold, often informing them that they will benefit from long-term holders.

Convergently, when vitality drops, it indicates that LTHS is choosing to move and hold assets off the exchange.

For SOL, this trend suggests that long-term holders are confident in their short-term meeting prospects and shows little concern about the coin’s current inactive performance.

Continuing accumulation from these investors can build a foundation for bullish breakouts as market sentiments change in a more favorable direction.

Solana holders remain “hopeful”

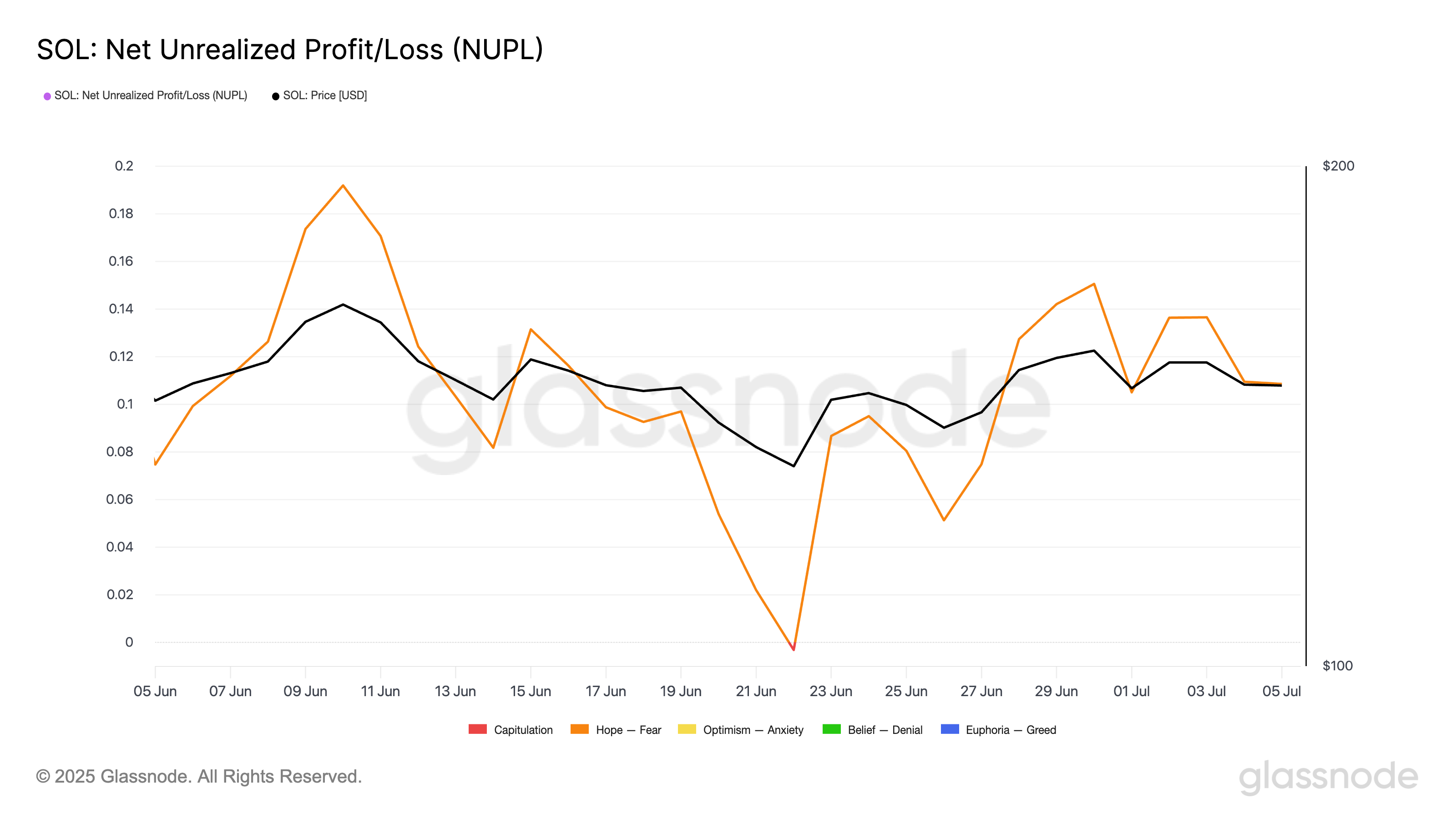

Additionally, measurements from Sol’s net unrealized profits/losses (NUPL) confirm the possibility of a bullish breakout. According to GlassNode, the metric has remained within the “hope” zone for the past 30 days. At the time of pressing, it is 0.108.

NUPL tracks the difference between unrealized total profit and investor losses based on the price at which the coin was last moved. Indicates whether the holder is on average a profit or loss or is likely to sell.

The “hope” zone suggests that many investors are back in profits, but they have not yet begun to actively acquire profits. Instead, they hold on expecting even more upward momentum.

This trend shows careful optimism among solcoin holders, often showing an early stage of a potential bullish trend.

Sol Bulls Eye Long-Term Holder Closing Grip $170

At press time, Sol trades for $148.06. If the coin’s LTHS doubled its accumulation and historical patterns, this could outweigh the Sol price by $158.80.

A successful violation of this long-term resistance zone could lay the foundation for the rally towards $170.

However, if the selloffs are enhanced, Sol has a $141.97 break under the support floor. In this case, that price could drop to $123.49.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.