Bitcoin once again hit a new all-time high, temporarily moving $121,000 before stabilizing nearly $120,500. Prices are up 2.54% today, continuing the strong trend that began earlier this month. But is this rally sustainable or is it approaching a slowdown?

Key indicators suggest that trends may not be taking place yet.

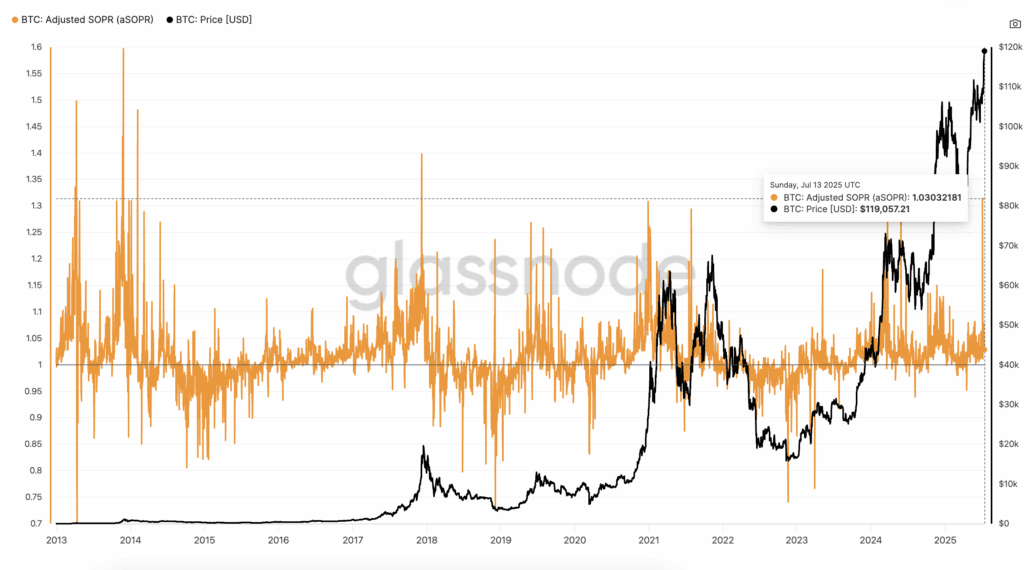

The holders have not yet made a profit

The adjusted used production profit ratio (ASOPR) is currently at 1.03, well below the level in early July 2025, with aggressive profits making the ratio much higher. This time, it appears that traders are holding instead of selling, despite Bitcoin creating new highs.

This means that most coins that move in the chain are not sold for large profits. This suggests that the gathering is not overheated.

SOPR indicates whether BTC is moving on-chain and selling for profit (>1) or loss (<1). The adjusted SOPR fine-tunes the metrics and filters short-term internal transactions to indicate whether BTC is moving on-chain and whether it is being sold in profit or loss.

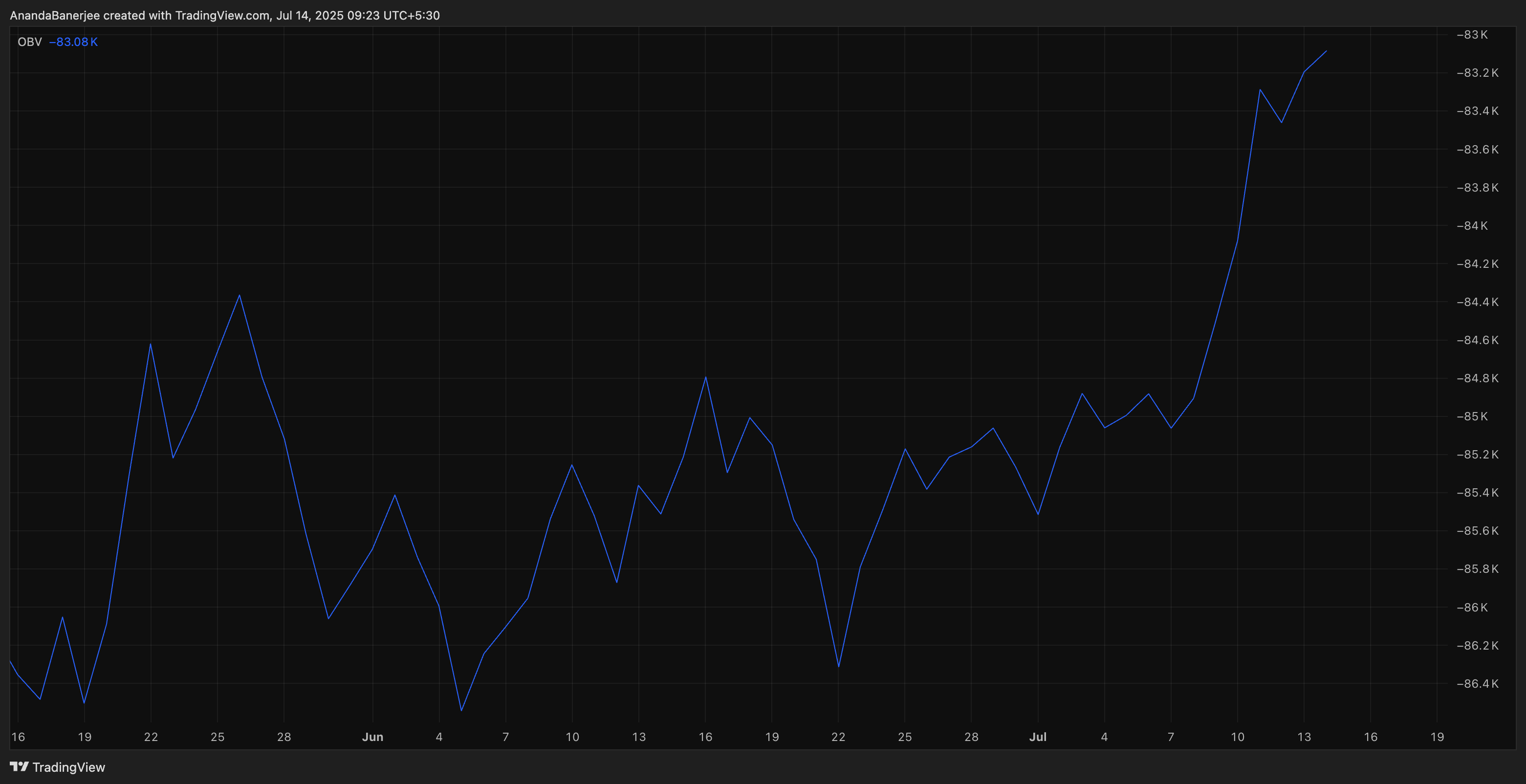

Volume supports rally

On-Balance Volume (OBV) is rising in parallel with Bitcoin prices. This is an important indication that buying the amount is responding to the rally. There is no visible divergence or breakdown of momentum.

Simply put, BTC is rising and volume is not against it.

obv measures cumulative purchase/sell pressure based on daily volume direction. When it follows a positive price trend, it is a sign of bullishness.

BTC price structure and next level

BTC is currently just below the $121,519 key resistance level from the trend-based Fibonacci extension. If Bitcoin closes beyond this level, the next expansion target is $127,798, followed by $135,425. These are long distance predictions based on previous trend behaviors.

Trend-based Fibonacci extension is a tool that uses three key price points: low, high and retracement to project future resistance levels in the trending market.

If BTC is integrated, there is short-term support. $117,109, which is the previous breakout area. When BTC falls below $112,699, the bullish trend weakens. This is the highest major support level of first history, especially when exchange inflows begin to rise sharply. It suggests that owners are beginning to take profits aggressively, which could lead to pullbacks and trend reversals.

New Day, New Bitcoin History’s Highest: What’s Next for BTC Prices? It first appeared in Beincrypto.