Disclosure: This is a paid article. Readers should do further research before taking action. Learn more >

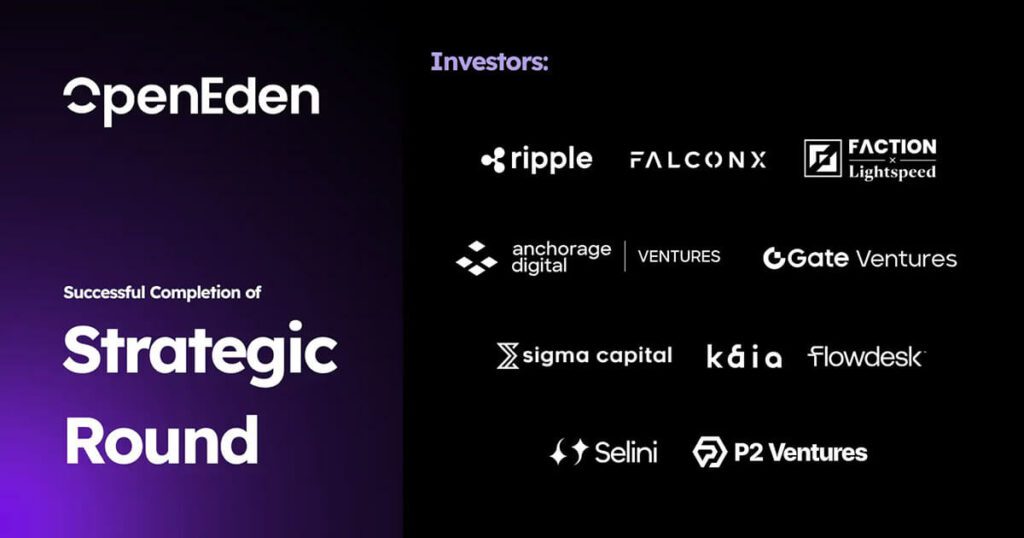

OpenEden has closed a new strategic investment round backed by some of the most influential companies in blockchain and institutional finance, including Ripple, Lightspeed Faction, Gate Ventures, FalconX, Anchorage Digital Ventures, Flowdesk, P2 Ventures, Selini Capital, Kaia Foundation, and Sigma Capital.

This raise marks a significant milestone for the RWA tokenization platform as financial institutions’ demand for compliant, high-yielding on-chain assets accelerates globally.

Strategically driving towards compliant and composable tokenized finance

This investment follows OpenEden’s previous funding in Yzi Labs in 2024 and will be used to scale its end-to-end tokenization-as-a-service platform, an infrastructure designed to enable institutions, fintechs, and developers to issue and manage regulated real-world asset products.

The company says the participation of a diverse group of investors across blockchain networks, venture firms, trading desks, and institutional infrastructure providers shows growing confidence in the tokenization theory, especially in regulated formats.

“OpenEden’s growth reflects the broader transformation we are seeing in the RWA space,” said Jeremy Ng, Founder and CEO of OpenEden. “As tokenization adoption grows, institutions and protocols are seeking reliable and compliant infrastructure to bring traditional assets on-chain. This funding round strengthens our ability to deliver regulated, market-ready products that meet both traditional and decentralized finance standards.”

RWA and tokenized government bonds surge as OpenEden gains institutional momentum

The announcement comes at a pivotal moment for the RWA landscape. Both tokenized US Treasuries and the broader RWA market have more than doubled since the beginning of the year, with adoptions and capital inflows reaching record highs.

OpenEden’s flagship TBILL fund was one of the earliest tokenized US Treasury products, making it the preferred vehicle for institutions seeking secure and fully transparent Treasury exposure on-chain. At its peak, assets under management increased more than 10 times in less than two years.

Earlier this year, the fund achieved a rare institutional milestone in the digital asset sector: an ‘AA+f/S1+’ rating from S&P Global, in addition to its existing ‘A’ credit rating from Moody’s.

OpenEden’s credibility is further strengthened by the appointment of the Bank of New York, one of the world’s most established financial institutions, as both the custodian and investment manager of the underlying assets of the TBILL Fund.

USDO attracts attention as a regulated stablecoin with high yields

The institutional momentum behind TBILL translated directly into the growth of USDO, OpenEden’s regulated yield stablecoin fully backed by tokenized U.S. Treasuries. USDO is currently deployed across major decentralized exchanges, liquidity exchanges, lending markets, and cryptocurrency and fiat gateways.

Its wrapped form, cUSDO, also garnered significant attention as it became the first yielding digital asset to be approved as off-exchange collateral on Binance, allowing institutional users to earn yield from assets held in custody while maintaining access to full margin trading.

New tokenized funds, structured products, and the global expansion of stablecoins are coming

With new strategic capital and an expanded network of global investors, OpenEden is now ready to accelerate the next stage of its roadmap. The company is preparing to launch a tokenized short-term global high yield bond fund in collaboration with a leading global asset manager, alongside a multi-strategy yield token that combines traditional income sources with DeFi-native yield generation. OpenEden is also developing a tokenized structured product that delivers the familiar TradFi payoff profile on-chain in a compliant and programmable format.

Beyond investment products, the company plans to deepen USDO’s integration across both consumer and institutional payment networks around the world, while expanding its multicurrency stablecoin framework to support new regional markets. In parallel, OpenEden is building a cross-border stablecoin payment network that connects blockchain rails with existing financial infrastructure.

Collectively, these efforts reflect the growing demand for tokenization platforms that provide institutional-grade safeguards without compromising the transparency and composability that define on-chain finance.

Industry leaders support OpenEden’s regulation-first model

Several participating investors emphasized that OpenEden’s disciplined regulatory approach and institutional partnerships set it apart in the crowded RWA market.

Markus Infanger, Senior Vice President of RippleX, said:

“As regulated financial assets move on-chain, institutional investors are seeking products that offer the same compliance, trust, and control they expect in traditional markets. Open Eden demonstrates a disciplined approach to how it operates, and we are pleased to support its growth as assets like tokenized Treasury bills emerge as a viable way for institutions to begin entering on-chain markets.”

Nathan McCauley, co-founder and CEO of Anchorage Digital, added:

“RWA is attracting strong institutional interest, and OpenEden is building the kind of platform the market needs now, expanding access to tokenized financial products with a focus on trust and security. We are excited to support projects like OpenEden that drive the on-chain ecosystem and create avenues for more institutions to participate.”

Tokenized RWA moves towards mainstream finance

As RWA adoption enters a new phase, OpenEden’s regulation-first, institutional-grade platform positions the company to play a central role in shaping the next generation of tokenized financial markets.

By combining traditional financial oversight with blockchain programmability, OpenEden is building the infrastructure needed to bring trillions of real-world assets on-chain securely and at scale.