Pi Coin has failed to maintain its recovery over the past few days, making investors increasingly skeptical of its upcoming outlook.

Despite Bitcoin’s stable above $110,000, the separation of Pi Coin from the broader market makes it more likely to continue.

Pi Coin has more work to do than that

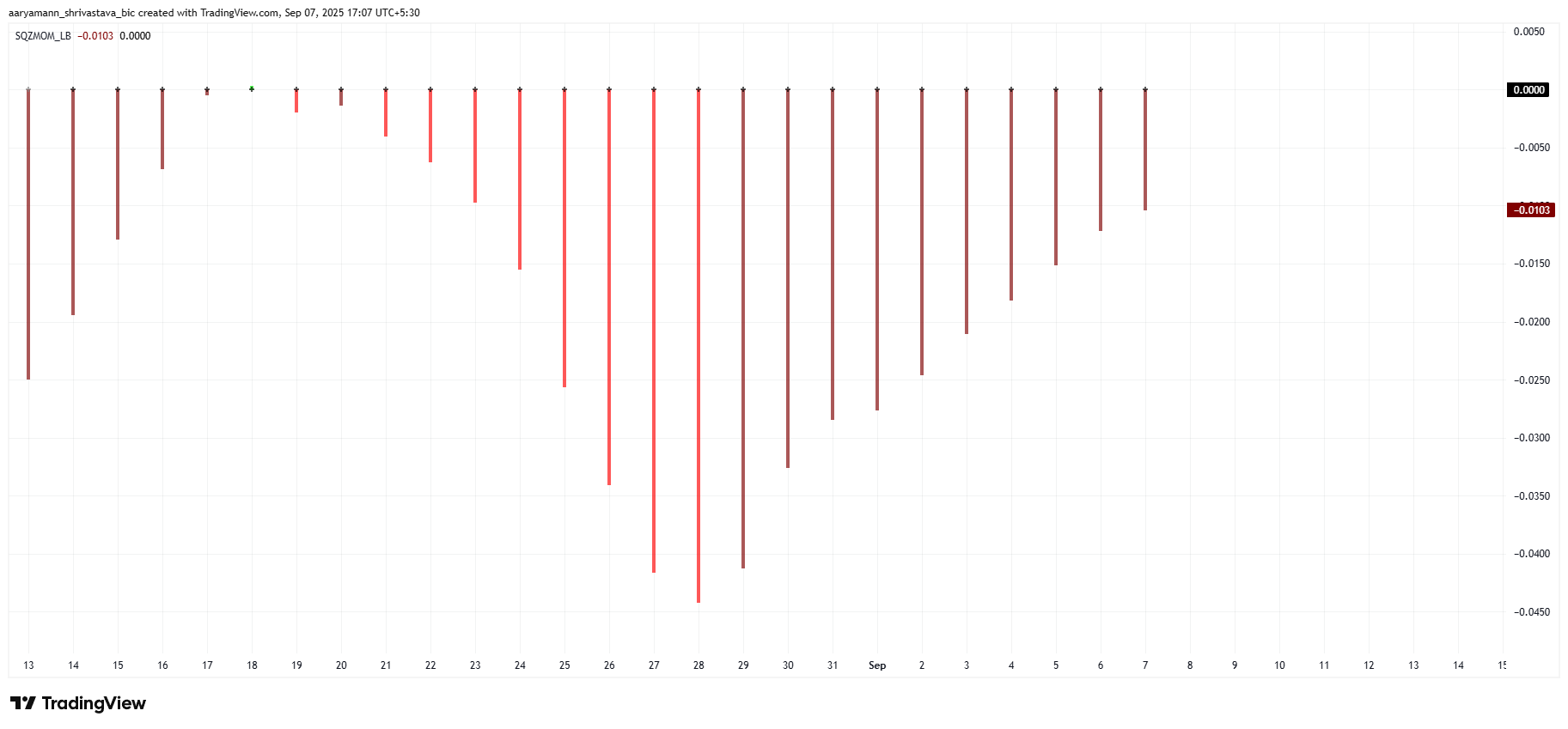

The correlation between Pi Coin and Bitcoin is currently at 0.12, indicating that Altcoin is no longer tracking the movements of the world’s largest cryptocurrency. This divergence is a concern, especially as Bitcoin shows signs of stability.

Sponsored Sponsors

Pi Coin’s decoupling from Bitcoin is counterproductive when BTC is above the key support level of $110,000. Instead of benefiting from the strength of Bitcoin, Pi Coin’s weaknesses further reveal the risk of eroding investor trust and further diminishing.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Technical indicators also suggest that PI coin volatility could increase quickly. The squeeze momentum indicator is to flash a black dot. This indicates that a squeeze is formed. Once this is released, price action may experience sharp movements in response to the wider market direction.

Given the bearish environment, volatility spikes can accelerate the decline in Pi Coin rather than causing recovery. Without stronger influx and supportive investor sentiment, squeezes from the future could be a key driver to bring tokens closer to new lows.

PI price needs help

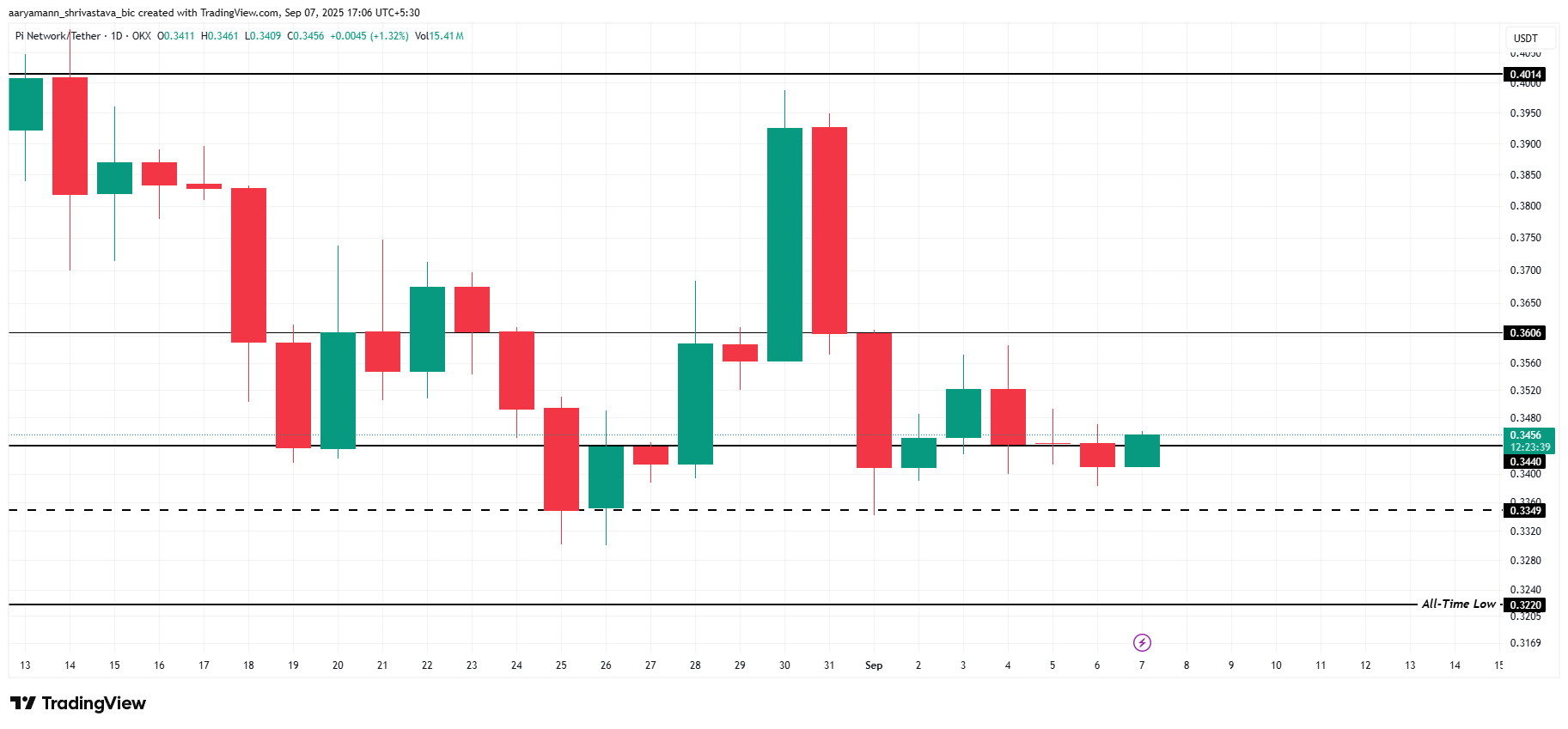

The Pi Coin price is currently trading at $0.345 and immediately retains significant support of $0.344. For now, Altcoin’s short-term resilience depends on maintaining this level, but it suggests that market signals will not last very long.

If support fails, the Pi Coin price could slip past $0.334, dropping to an all-time low of $0.322. A break below that point could open the door to further downside pressure and potentially new records low.

The only scenario that could negate this bearish outlook is a bounce of $0.344, allowing Pi Coin to climb to $0.360. However, due to weak emotions and limited correlation with Bitcoin, there is little chance of recovery at this stage.