Cryptocurrency Saros (Saros) plunged to its lowest level since April 2025, experiencing a dramatic 70% price drop on August 24th.

The sudden decline that temporarily erased profits over several months has sparked widespread concern among investors. Some market watchers even have similarities with the troubled mantra (OM).

Why did Sarostoken prices crash?

For context, Saros is a Decentralized Finance (DEFI) platform built on the Solana (SOL) blockchain. It combines a wide range of services into a single ecosystem, including trading, staking, yield farming, and launchpad participation.

Its native utility tokens, Saros, Power Governance, Staking, Liquidity Incentives and more. The tokens will be deployed to both Solana and Viction.

With a market capitalization of $922 million, Altcoin has been on a major upward trend for several months, reaching its all-time high (ATH) on August 4th.

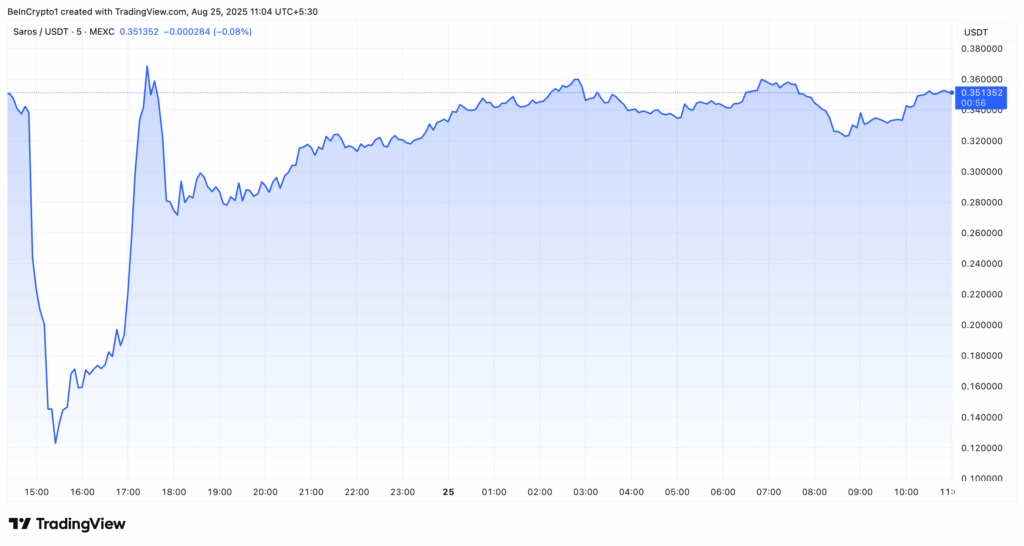

However, yesterday’s 70% crash hampered this upward trajectory, and soon raised the price to a four-month low. Market data showed that Saros’ prices fell to the last seen level in April, the level of $0.109.

Nevertheless, the dip was short. Saros bounced back and reversed the loss. At the time of writing, it was trading at $0.35, a 5.3% decrease over the past day.

Than Le, founder of Saros, is working on recent price volatility. He explained that Saros’ sharp moves stem from leveraged traders reducing their position in centralized exchanges, which is due to a sudden decline in open interest.

“Based on ongoing research and available data, we believe this is a market-driven adjustment and could include a large, leveraged location that reduces exposure in centralized exchanges (CEX). Before the movement, it was about 90m Saros, according to exchange data, and since then it has dipped to about 20m Saros,” he said.

He emphasized that neither the team nor long-term investors sold their holdings.

“The market cycles go back and forth, but our focus remains the same. We build Saros into the liquidity backbone of Solana. Your trust and support drive us.

Nevertheless, the big crash caused many traders to lose money, causing market sentiment to occur. Coingecko’s data showed that over 50% of the community were bearish towards Saros.

Volatility rekindled comparisons with OM, which experienced a 90% crash in April and has yet to fully recover.

“It’s been falling for at least a year or two years ago… anything I’ve said about OM before has come true, and now it’s also realized what we said about Saros.”

Therefore, this incident highlights the broader risks within the Altcoin market. Saros has shown some recovery, but the price decline has led to many questions about the market stability. Now the community watches carefully to see how Saros navigates this set date.

Post Saros (Saros) faces a 70% crash. What caused the sudden price drop? It first appeared in Beincrypto.