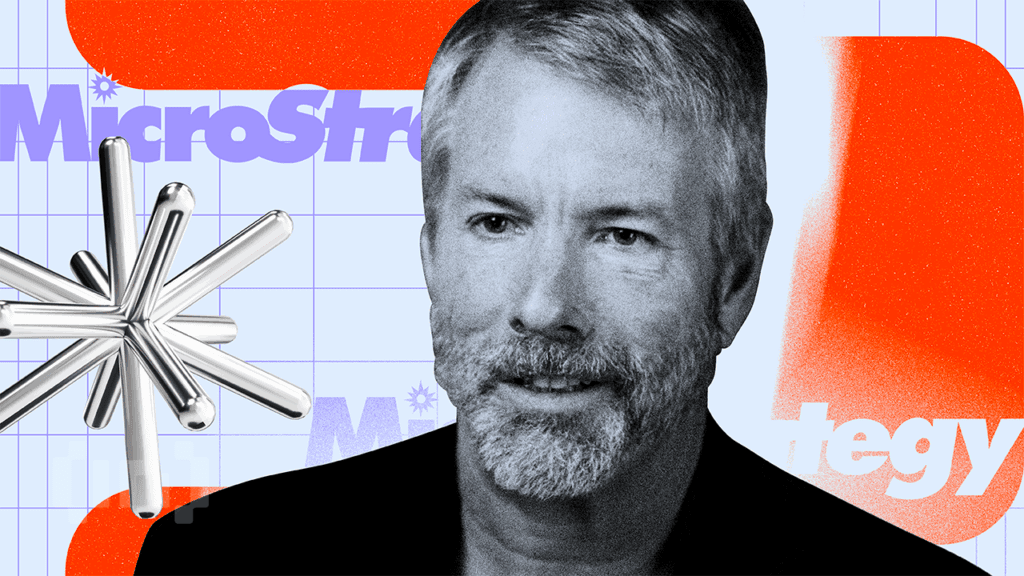

Amid the rise of a financing company focused on Altcoin, Michael Saylor, co-founder of Strategy (formerly MicroStrategy), reaffirmed that he is committed to Bitcoin.

Far from concern, Saylor sees the growing adoption of Altcoins as part of a broader “explosion of innovation” in the digital asset space.

All Bitcoin: Michael Saylor’s Focus is Focused in Altcoin Frenzy

In an interview with Bloomberg, Bitcoin Maximearist Saylor emphasized that despite growing interest in altcoins, most of the capital is still in Bitcoin.

“So I’m like a laser that’s focused on Bitcoin,” he said.

The strategy co-founders revealed that the number of companies adding Bitcoin to their finances more than doubled in just six months, jumping to around 60-160. Additionally, Saylor has labeled Bitcoin as “digital capital.”

He predicted it would surpass the S&P 500 in the long run.

“I think it’s a clear global financial product right now, so if you want to outperform S&P and inject vitality and performance into your balance sheet, it’s the lowest risk, the best return, the easiest strategy,” added Saylor.

His latest remarks came after the strategy announced its third-largest Bitcoin purchase. Between July 28th and August 3rd, the company purchased 21,021 BTC for $2.46 billion. The company, the largest public owner of BTC, has 628,791 BTC worth $743.3 billion.

Strategic Bitcoin bets have also proven to be advantageous. In the second quarter, the company reported net profit of $10.2 billion. This is a transition from losses posted in the first quarter.

The end of the Bitcoin-only Treasury? How ETH steals the spotlight

Saylor’s belief in Bitcoin has not been shaken, but Ethereum is becoming the next preferred option for many institutional players. Moreover, their beliefs are not without reason.

Industry leaders point to diverse applications from tokenization to enterprise solutions as factors driving their adaptability, evolving ecosystems, and long-term trust. In fact, Geoff Kendrick of Standard Chartered claimed that Ethereum-centric finance companies “make more meaningful” than their Bitcoin counterparts. That’s why he explained it

“In terms of yield, defi leverage and regulatory arbitration, they make more sense than what it is BTC equivalent.

Additionally, Shawn Young, chief analyst at MEXC Research, recently told Beincrypto that the industry has moved beyond the time of the Bitcoin-only Corporate Treasury.

“Companies are increasingly diversifying across ETH, SOL, BNB and TON, treating them as strategic assets tailored to the evolving structure of digital finance, indicating a significant departure from traditional institutional financial playbooks.

He explained that companies that have publicly held digital assets have set new benchmarks. According to Young, companies that integrate cryptocurrency into today’s finances could help shape new corporate standards in the coming years.

Post MicroStrategy’s Saylor says it will help Altcoin Corporate Treasuries first appear in Beincrypto.