Bitcoin prices have been traded nearly $113,600 at the time of press, but have fallen 1.3% over the past 24 hours. While many traders are worried that prices will continue to slip, a group of investors have shown signs that a short-term bounce may be on the way.

These buyers are quietly increasing their holdings and accepting losses. A pattern where prices have been rebounded previously. Their actions may once again indicate that the worst of this dip could already lie behind us.

Short term holders are still buying dip

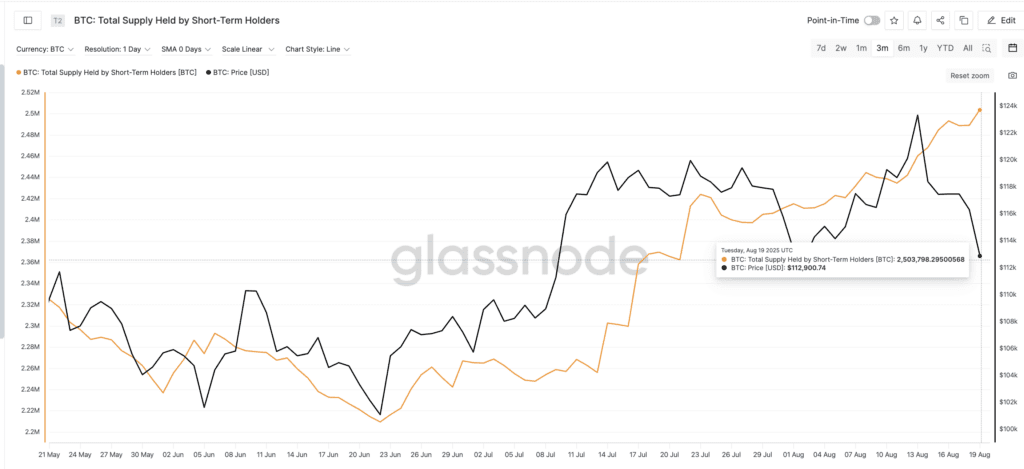

Wallet, a short-term holder that acquired Bitcoin within the last 155 days in the past few days, has increased its supply even as prices drop. Currently, the group holds 2,503,798 BTC from 2,460,514 BTC just seven days ago.

This means that over 43,000 BTC accumulates during a sudden price adjustment of between $123,000 and $112,000. Interestingly, short-term holder supply is currently at a height of three months.

This trend reflects a similar pattern seen in early June. At the time, when Bitcoin prices fell from $105,900 to $104,700, short-term holders raised their supply from 2,275,000 BTC to about 2,287,000 BTC. After that accumulation, Bitcoin price rose to $110,000.

This repetitive behavior is often seen as a show of confidence in short-term bounce as new holders increase exposure during price drops.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

I lost it and sold it, but still bought it

At the same time, short-term holders are showing their willingness to incur losses to buy new BTC dips unless they expect rebounds.

Short-term holders fell to the lowest point on August 18th in more than a month. This means that the coins spent by this group were sold for less than they were acquired. Simply put, they are at a loss.

At press, the SOPR remains below 1.

SOPR, or used output profit margin is METRIC compares the price at which Bitcoin was on sale with the price purchased. A short-term holder’s SOPR below 1.0 means that this group is on average achieving losses.

This is often considered a bottom signal. In early August, a similar SOPR drop (from 1.00 to 0.99) occurred just before Bitcoin reversed from $114,000 to a new high of nearly $123,000. At the time, it was shown that short-term holders had surrendered by losing and selling. Shake-out required before the rally begins.

While some holders accept the losses, the overall supply between short-term wallets is still rising. This combination suggests emotional changes, although in some cases, while more buyers are intervening. It’s not a panic sale.

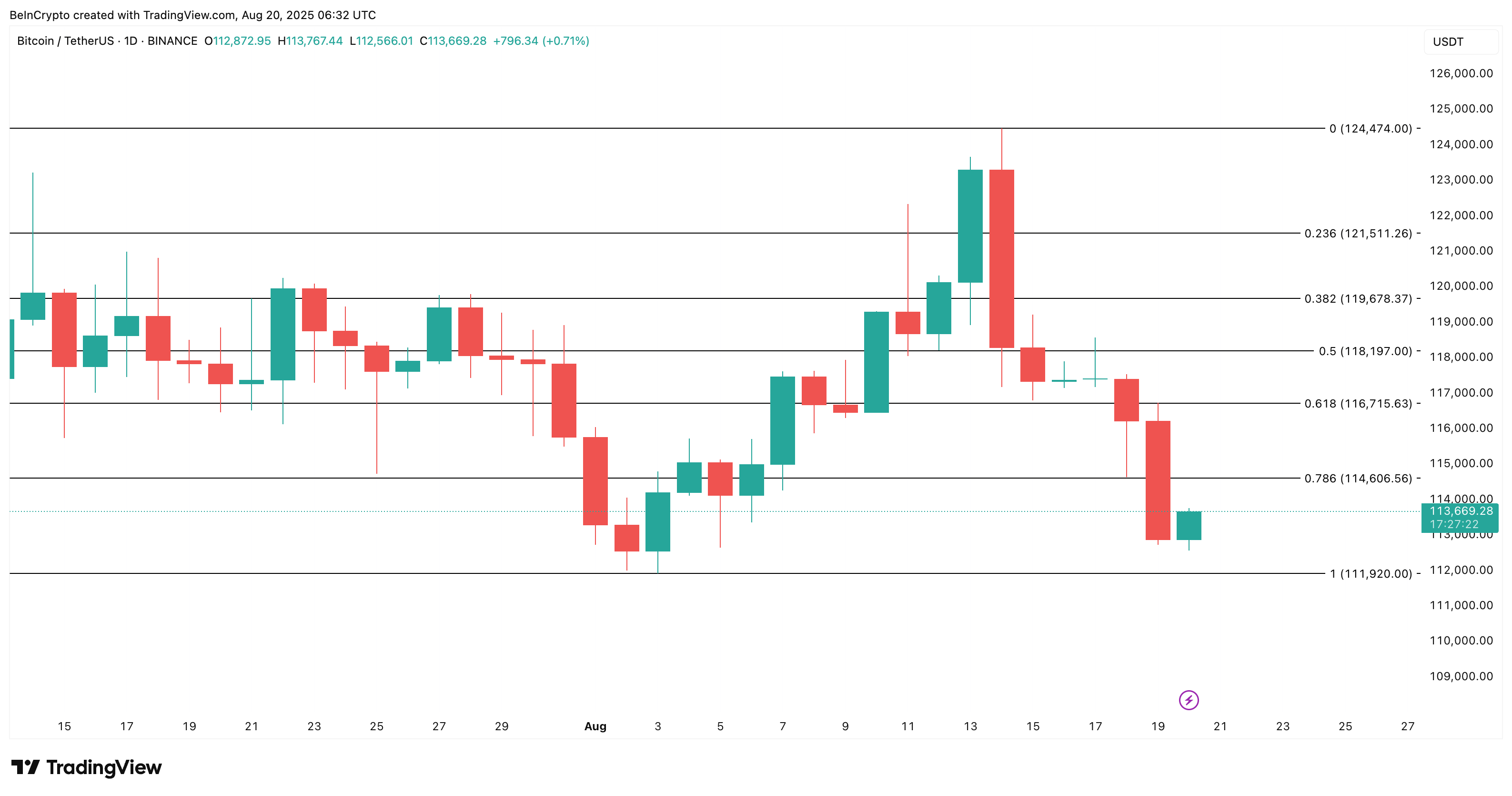

Bitcoin price recovery is at one level

Bitcoin prices are still under pressure, but there are indications that the reversal could be taking shape. Prices fell just $113,600 today, down 1.3% on the 24-hour chart. The ultimate support is around $111,900. If that level is achieved, recovery may begin immediately.

The advantage is that immediate resistance is around $114,600. The next important hurdles are $116,715 and $118,197. The latter is the best important pivot of the previous swing. A clean breakout of over $118,200 will confirm that momentum is in the bull’s favor.

This exact short-term holder setup has often marked a local bottom when short-term supply and negative SOPR increases occurred. Previous cases have led to more than $10,000 gatherings within a few days.

If the current pattern is repeated, the price of Bitcoin may be ready to increase another push. However, if it drops and loses the $111,900 level, deeper corrections could continue, invalidating the bullish hypothesis.

The short-term holder post signalling Bitcoin rebound with offensive purchases first appeared on Beincrypto.