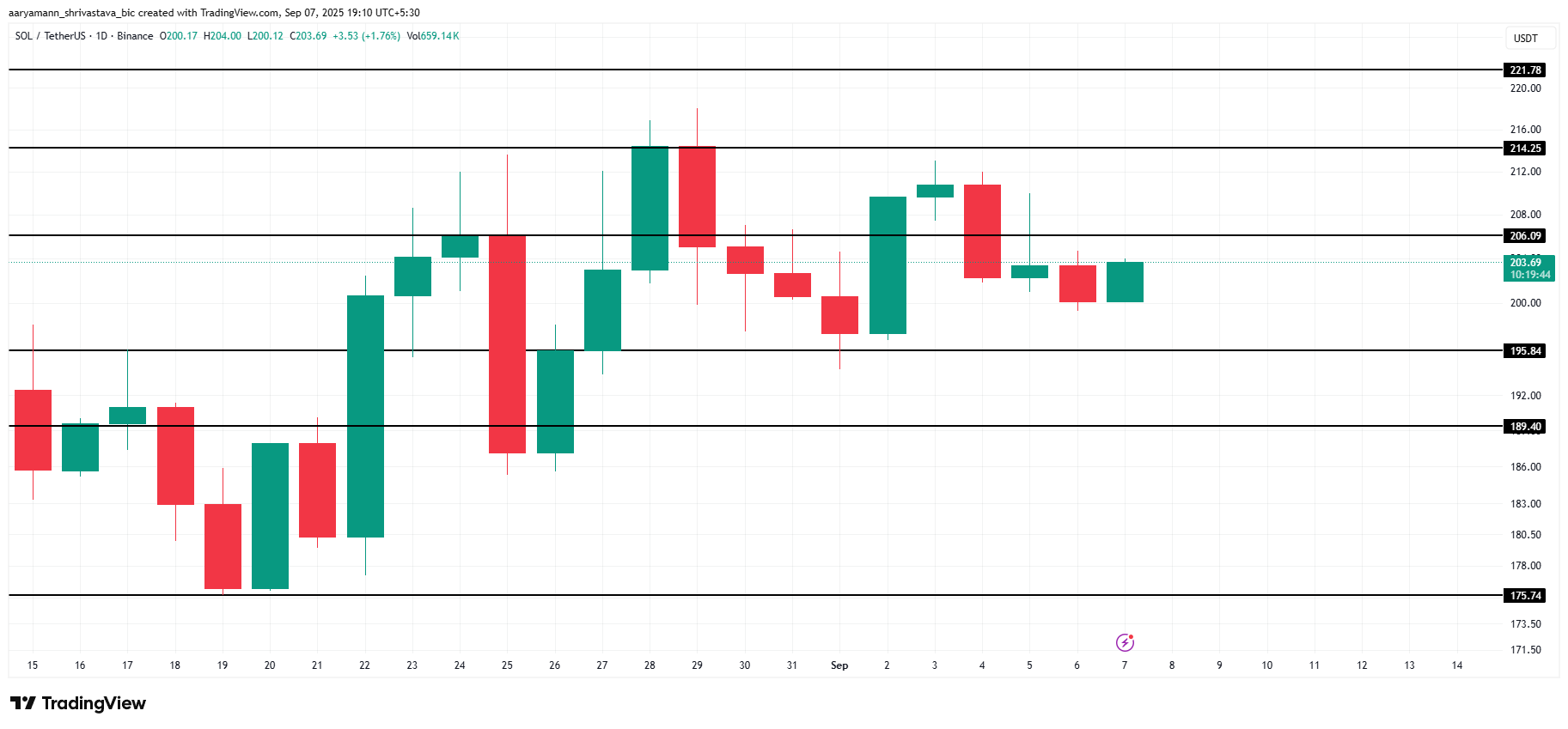

The price of the Solana has been stable for the past few days, moving sideways with the $200 mark.

This integration period could change towards bullish momentum as investors intervened in heavy accumulation and signaled new optimism about Altcoin’s short-term outlook.

Solana Investors Pick Up Supply

Data shows that the exchange balance has dropped by 3.79 million SOL since the beginning of the month. This shows a clear change in investor behavior as the coin leaves the focus platform. This is a typical indication of accumulation and long-term holding.

Sponsored Sponsors

In just a week, investors scooped up $770 million worth of sol, highlighting a strong bullish stance. The hope is that continuous accumulation could boost support of over $200, allowing Solana prices to break through higher levels of resistance.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

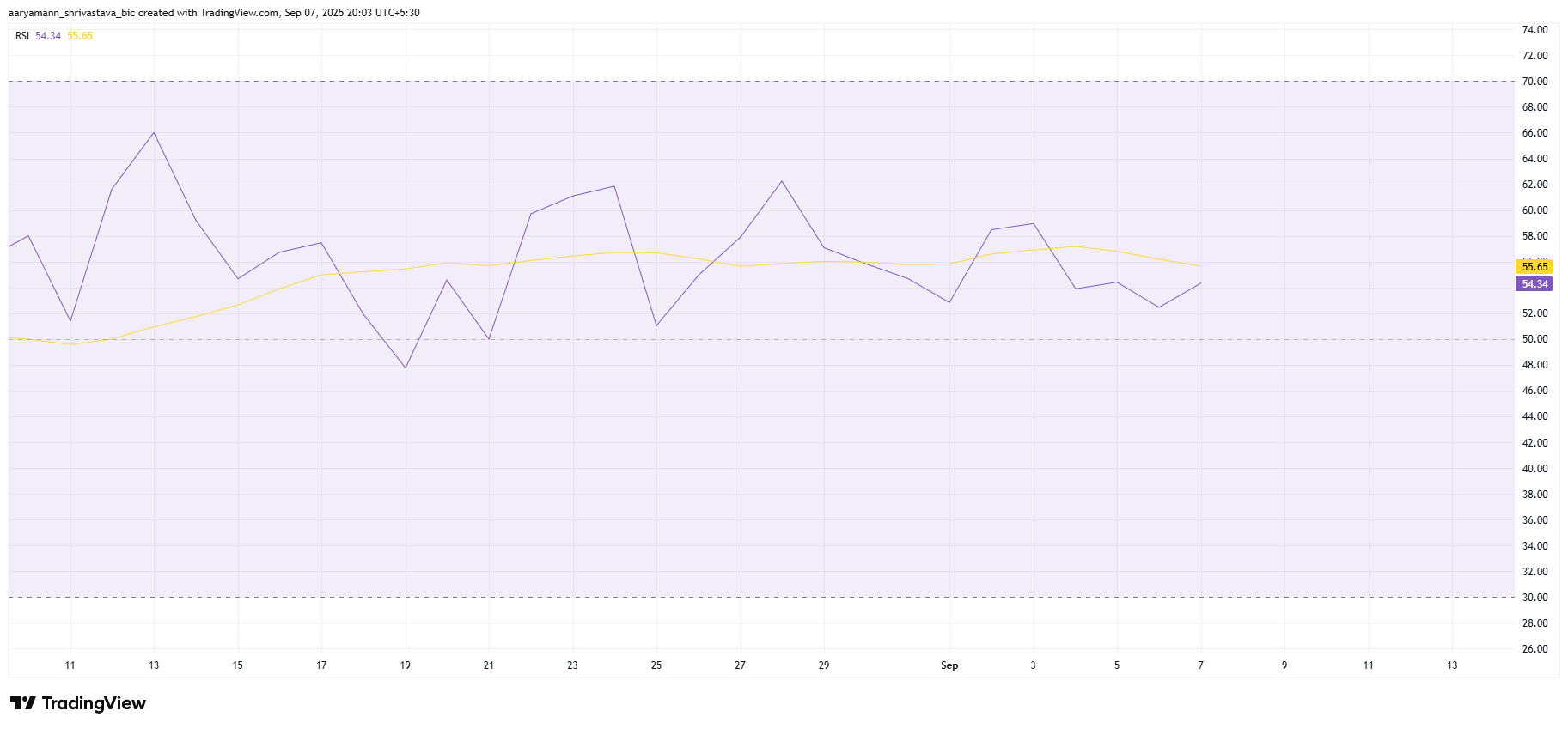

From a technical standpoint, Solana’s relative strength index (RSI) is held more comfortably than the neutral 50.0 mark. The indicator remains in the positive region, suggesting that bullish momentum will continue, suggesting that Altcoin still has room for upward movement.

This positioning also demonstrates resilience to wider market pressures. With RSI not yet in the unbought zone, Solana appears to be well-placed to continue climbing.

At the time of writing, Solana priced at $203 and immediate resistance was $206. Holding over $200 remains important as it provides a foundation for further profits in the short term.

Strong investor support could push Sol beyond $206 and to $214 in the coming days. A successful breakout that level opens the door to $221, adding momentum to the bullish outlook.

However, if the holder decides to lock the profit, Solana could face a pullback. Losing support for $195 will reduce the price to under $189. This effectively disables bullish cases and prolongs the lateral action.