Solana (Sol) Price has dropped by 4.3% over the past 24 hours. This may seem like a daily pause after recent profits, but on-chain activities will talk more carefully.

Both short-term and long-term holders are arranged in a way that signal historically capped rallys, with price lists often printing structures that precede deeper revisions. More when you read it!

Short-term holders are sitting in profitable territory

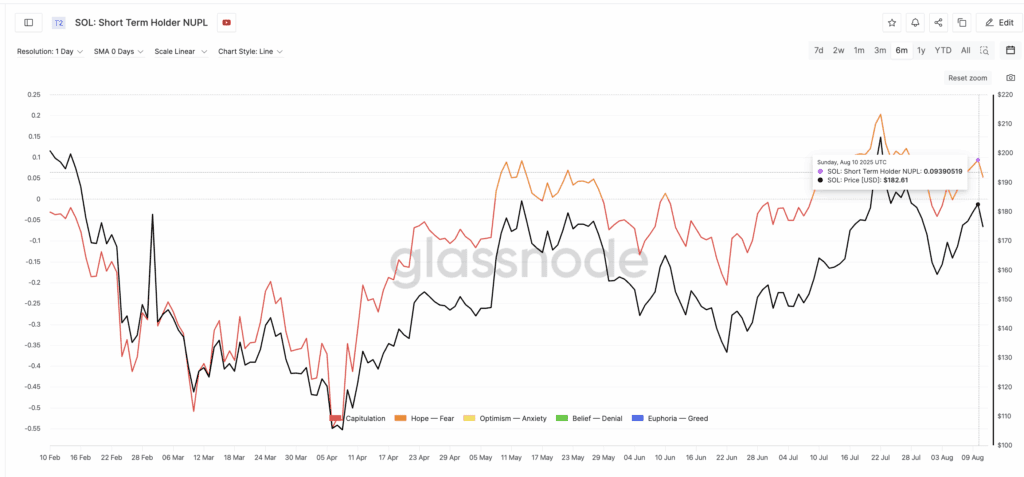

Solana short-term holders are sitting in relatively high unrealized profits, currently having STH-Nupl (net unrealized profits/losses) at 0.093. This number is close to the level observed on May 10th-13, when the SOL price was revised from $183 to $131. This promoted NUPL suggests that short-term holders are in the hope/terror zone, where the lock of profits becomes more attractive.

This metric does not directly confirm that owners are selling, but highlights an environment in which profits become more obvious, especially when price momentum stalls. Reading is still below extreme highs, suggesting that the market has not yet been overheated, but remains high enough to pay attention.

Sth-nupl measures the average unrealized profit or loss of coins held by short-term holders. A high measurement means the owner is profitable and is more likely to sell.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Long term holders trim position

If short-term holders create immediate sales risks, long-term holders set a tone of bearish trend intensity. Recently they’ve been trimming positions. A subtle but important signal. Solana Price has responded to every change in net position metrics over the past month. Prices get soaked when metrics soak and vice versa.

Hodler Net Position Change Metric, which tracks monthly net accumulation or distribution of long-term investors, has been soaking up for weeks. This means that long term holders sell more than they are buying, indicating that they are less willing to hold this resistance zone.

This behavior is often restricted to upside down, as it removes a strong hand buffer that supports the sol price during pullback. Combined with the rising short-term holder NUPL, we create a scenario that can be added to sales pressure rather than absorbed by both cohorts.

Two-day chart shows bearish Solana price compression

Solana’s price action bolsters what on-chain data suggests. In the two-day time frame, the Solana forms a descending triangle. The lower highs are pushed against the flat support base.

This pattern is often seen at the distribution stage. There, rally declines more quickly and the risk of breakdowns increases. In a longer time frame (2 days), this increases the risk of failure.

Descending triangles are bearish technical patterns that form when buyers adhere to fixed support levels while consistently keeping highs. If support fails, the pressure often resolves downwards.

Immediate resistance to curb the bearish remains at $186, with key support levels being $169 and $158. If it falls below $158, you can see a breakdown from the triangle and open up a deeper downside. The $147 level blows the entire structure into the medium period.

Cases that weaken when Sol breaks and exceeds $186 will weaken, ideally reversed to a decline in short-term holder Nupl and net accumulation by long-term holders. It shows that sales pressure is being eased and could pave the way for retesting $205.

Post Solana Price Lurries were capped as both holder groups show the risk of profiting: forward breakdown? It first appeared in Beincrypto.