Sonic Labs has just approved plans to expand into the US market, including establishing Sonic USA LLC and opening an office in New York. Furthermore, we will develop TradFi related products such as ETFs and pipes.

The move promises to unlock capital access for $s institutions, while poses the challenge of balancing short-term dilutions and long-term deflation possibilities.

A strategic boost for S-tokens?

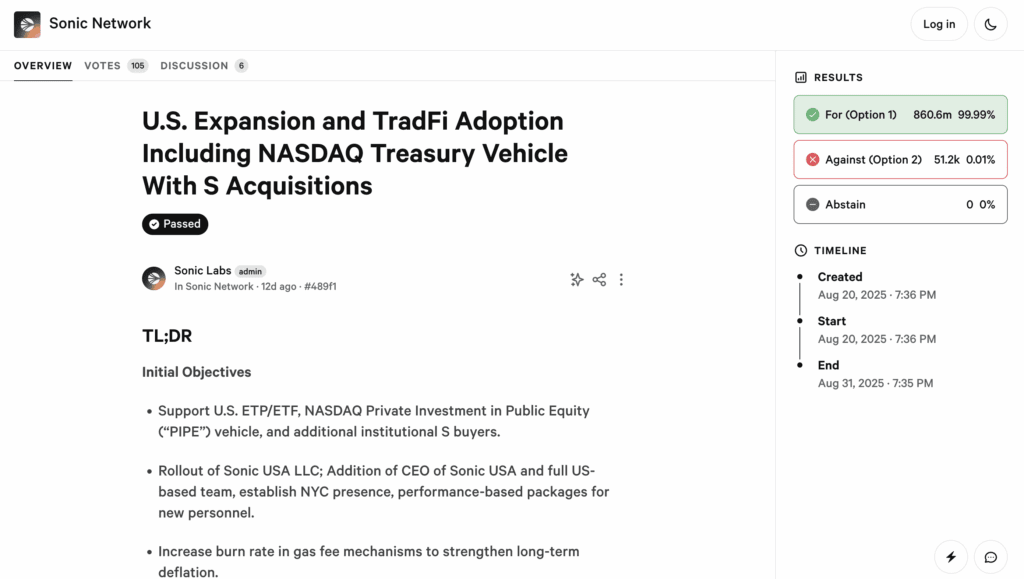

The Sonic Labs community voted in favor of “expanding the US market and Tradfi’s adoption plan.” The proposal allows the project to establish a US corporation named Sonic USA LLC, hire a CEO and a local team, and open an office in New York. Additionally, we apply a performance-based reward scheme.

The proposal also outlines a long-term deflation mechanism through gas fees to offset supply growth as the network activates expansion plans.

An important technical highlight of the resolution package is the adjustment of network parameters to issue tokens to two potential options. The first is a $50 million allocation for a managed ETF/ETP structure, a $100 million dollar token (formerly FTM) designated to cover Sonic America. Or reject all of the above adjustments.

On the institutional demand side, ETF/ETP allocations could create access channels that are compliant with traditional investors. Additionally, it standardizes custody, increases transparency in holdings, and streamlines the creation/repayment process.

Meanwhile, the NASDAQ pipe acts as a strategic “capital reserve” and allows Sonic to interact with the open market more carefully. This is consistent with the long-term objective of positioning it closer to the standard of institutionally held assets.

On the supply side, the deflation mechanism of gas fees is important. As transaction activity grows with ecosystem expansion, combustion fees may absorb some of the supply pressure from the issuance. Additionally, locked fees contribute to reducing this pressure. Yet its effectiveness depends on specific rate designs, network activities, and the discipline of the Ministry of Finance throughout the market cycle.

US approval remains a risk

However, investors need to remain cautious. New issuances for ETF, Pipe, and Sonic USA funding represent immediate dilution. The net impact depends on the speed of product deployment, compliance progress, and the ability to convert these channels into the actual cash flow of the ecosystem.

Conversely, the main risk lies in the delayed regulatory regulations of US ETF/ETP approvals. Furthermore, strict pipe disclosure requirements and market contracts can increase the operating costs of operating US entities. Therefore, the key metric after this vote is not an immediate price action, but a milestone in execution.

Post Sonic Labs debuted the US market using ETF, pipes and DEFL models.