XLM has experienced considerable volatility and faced drawdowns as investors’ feelings weaken. Despite attempts to recover, Altcoin is struggling to regain its previous highs.

Market conditions continue to deteriorate, with investors primarily reluctant to re-enter the market, contributing to the ongoing decline in prices.

Star investors are uncertain

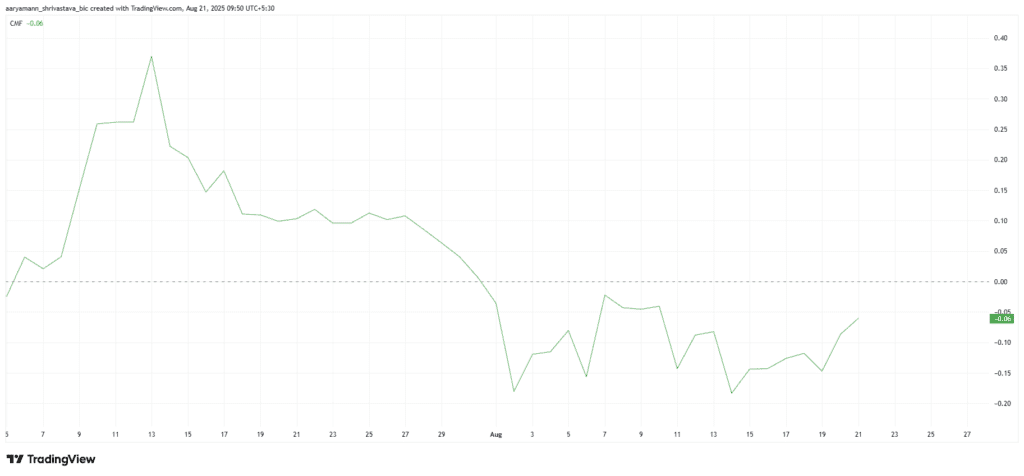

The Chaikin Money Flow (CMF) has been trapped under the zero line since the beginning of the moon, indicating a strong leak from the XLM. This indicates that investors’ uncertainty is preventing new inflows into the assets.

CMF remains negative, reflecting a lack of confidence in XLM’s short-term outlook. Investors seem to be withdrawing their own funds, leading to lasting bearish feelings in the market.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

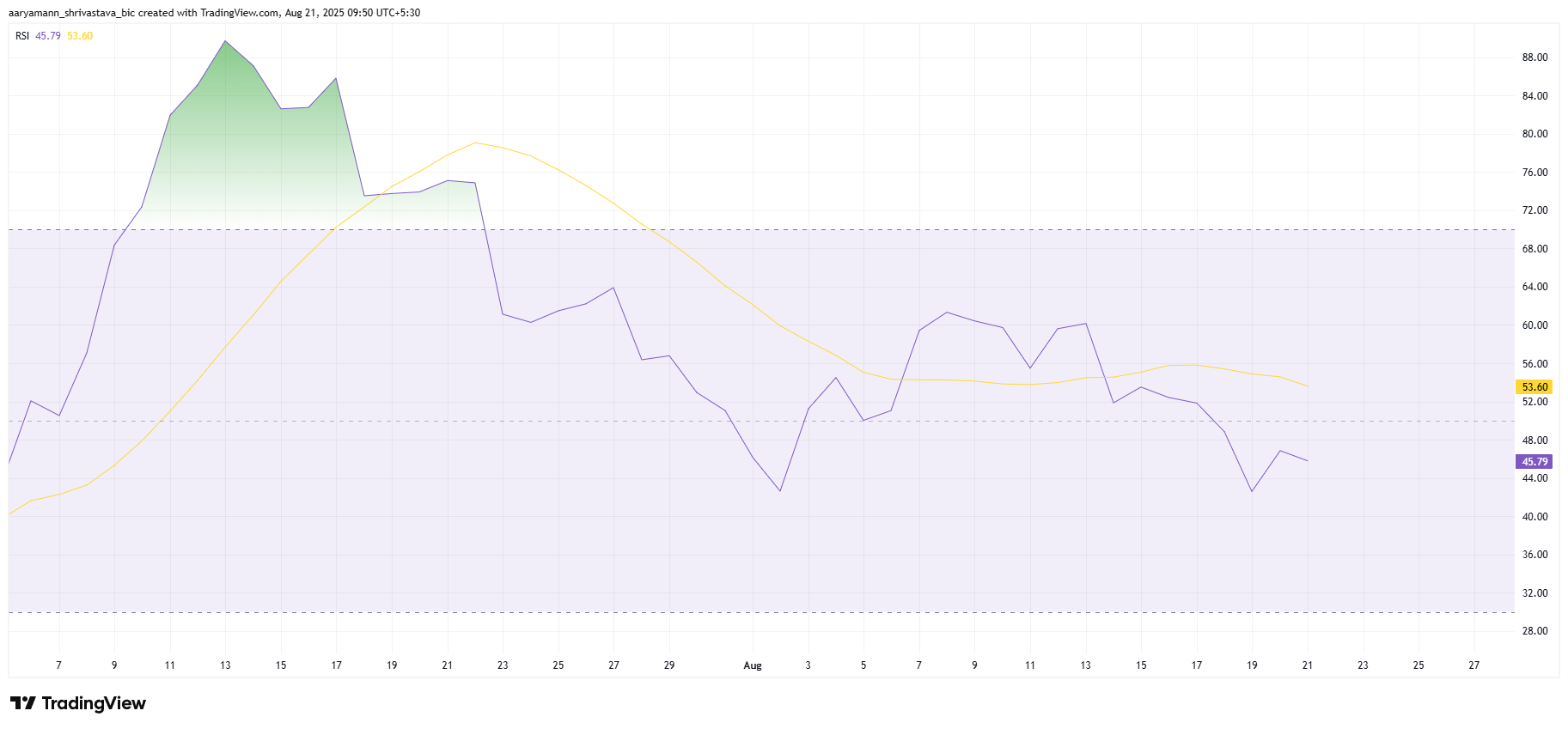

The XLM’s relative strength index (RSI) also slips under the neutral line, enhancing the bearish outlook. RSI is an important indicator that tracks momentum and market conditions, and its current position indicates an increase in XLM’s debilitating weakness.

With RSI heading downwards, XLM’s broader market environment remains at a disadvantage. This further supports the notion that for the time being, Altcoin has been subject to considerable sales pressure and that a potential recovery appears to be far away.

XLM prices are not aware of the downward trend

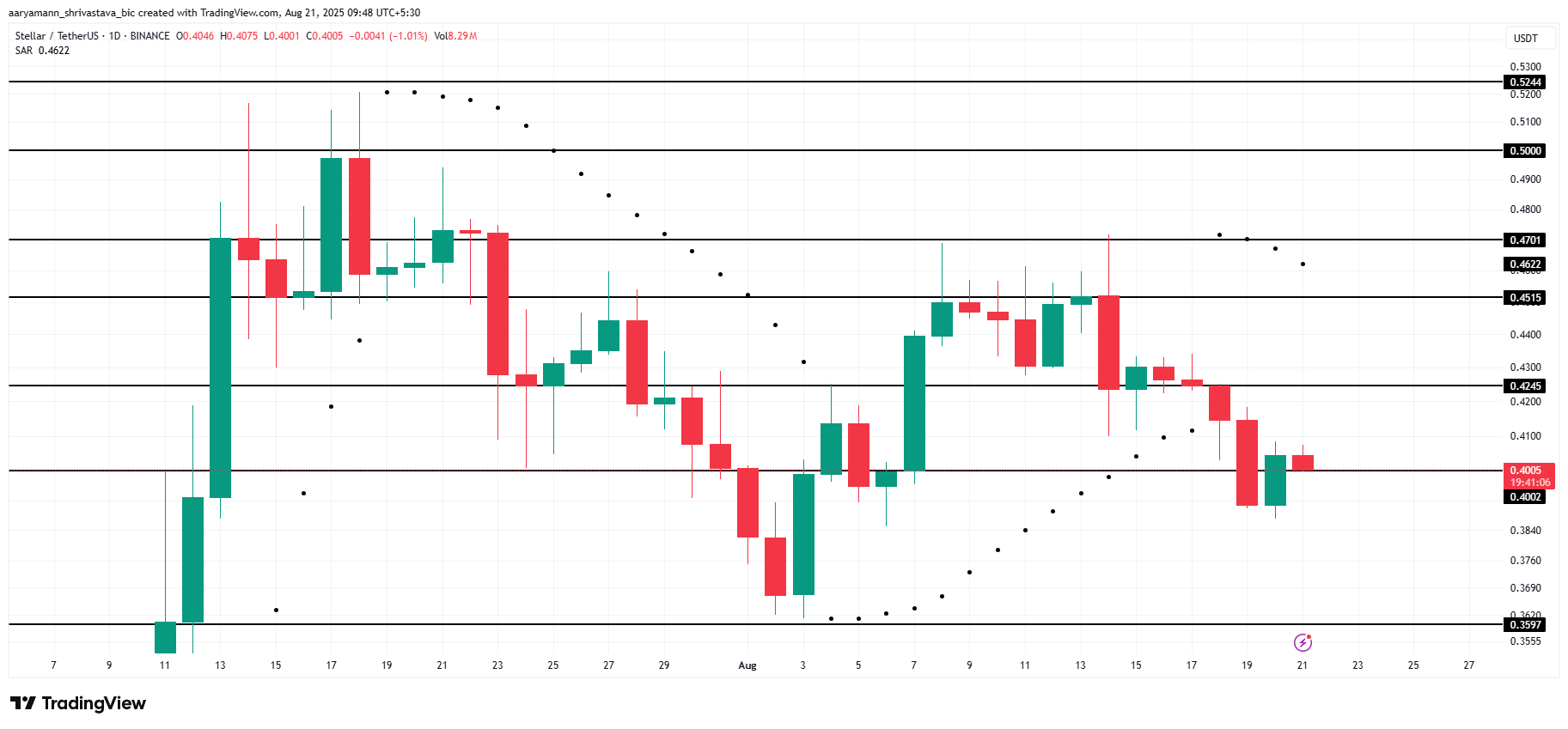

The XLM currently costs $0.40 and is trying to hold this level as support. However, given the current market situation and the above indicators, it appears that XLM is unlikely to recover losses in the short term. The parabolic SAR above the candlestick will see ongoing downtrends and make it difficult for Altcoin to reverse its trajectory.

The next important support level for XLM is $0.35, which I visited more than a month ago. If the downtrend continues, prices can drop to this level, causing further sales from investors. This could strengthen bear market sentiment and extend the duration of weak price action.

However, if XLM can bounce back a support level of $0.40, it could potentially recover from being $0.42 or even $0.45 if investors shift their emotions and re-enter them into the market. A successful rebound will invalidate the bearish paper.

Post Stellar (XLM) prices are facing further downtrends as they show that outflow was first introduced in Beincrypto.