SUI became a hot topic center after seeing a massive $300 million accumulation by a company listed and published in Robinhood Legend.

Record transaction fees and huge token volumes indicate the potential for a strong breakout. However, whether the key challenges can surpass the critical $4.3 resistance remains.

Sponsored Sponsors

Positive foundation chain

In short, the SUI blockchain (SUI) story combines bullish news with heavy resistance levels.

Recently, SUI Group Holdings announced that it has purchased an additional 20 million SUIs and raised its total stock to over 101.7 million (approximately $332 million at the time of disclosure). Additionally, Robinhood is verifying that SUI (and HBAR) is available in Robinhood Legend, increasing access to US retail investors.

On the basis, trading fees stand out as a critical strength of native tokens. The average trading in August only costs around $0.00799. Ethereum Network’s ETH transfers are around $1.1, which means this fee is almost 140 times cheaper. The team explained it on their blogThis fee structure was designed to remain stable throughout the epoch, preventing spikes during network congestion.

Sponsored Sponsors

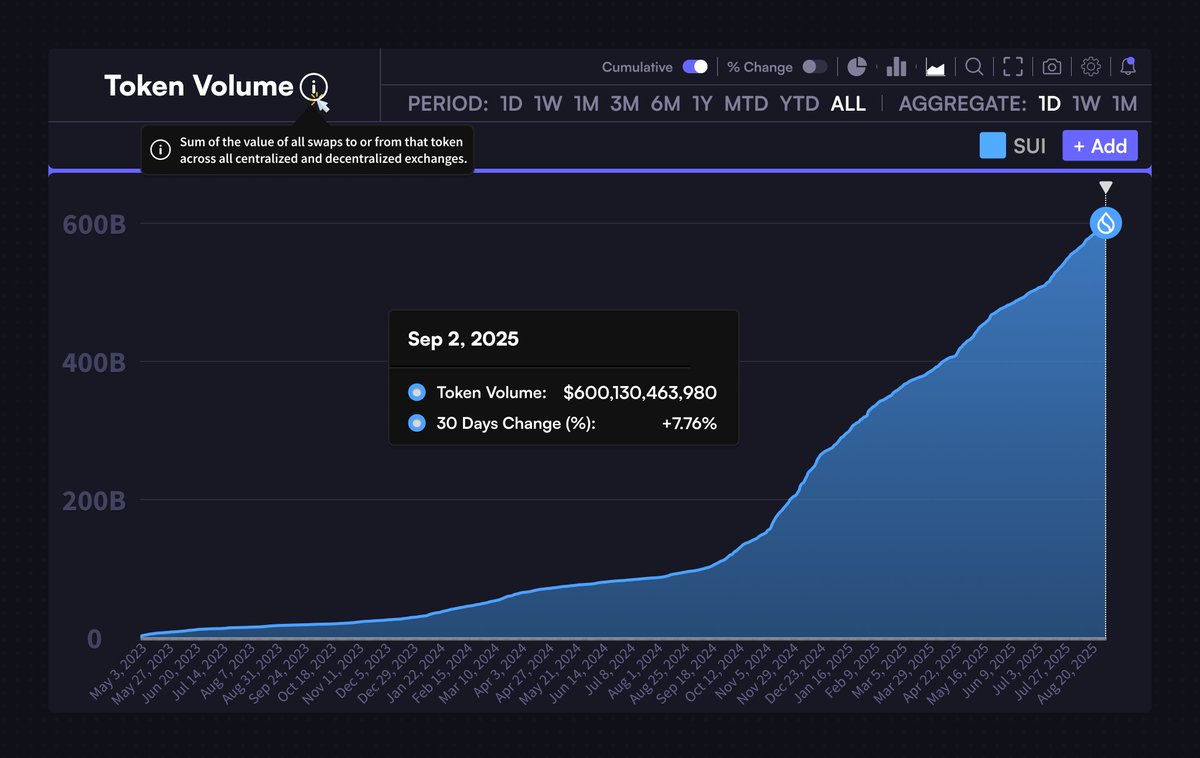

Low and stable pricing improves the end-user experience and enables high-throughput use cases such as gaming, defi, and micropayments. The total token volume for SUI reached $600 billion, showing an A+7.76% increase over the last 30 days.

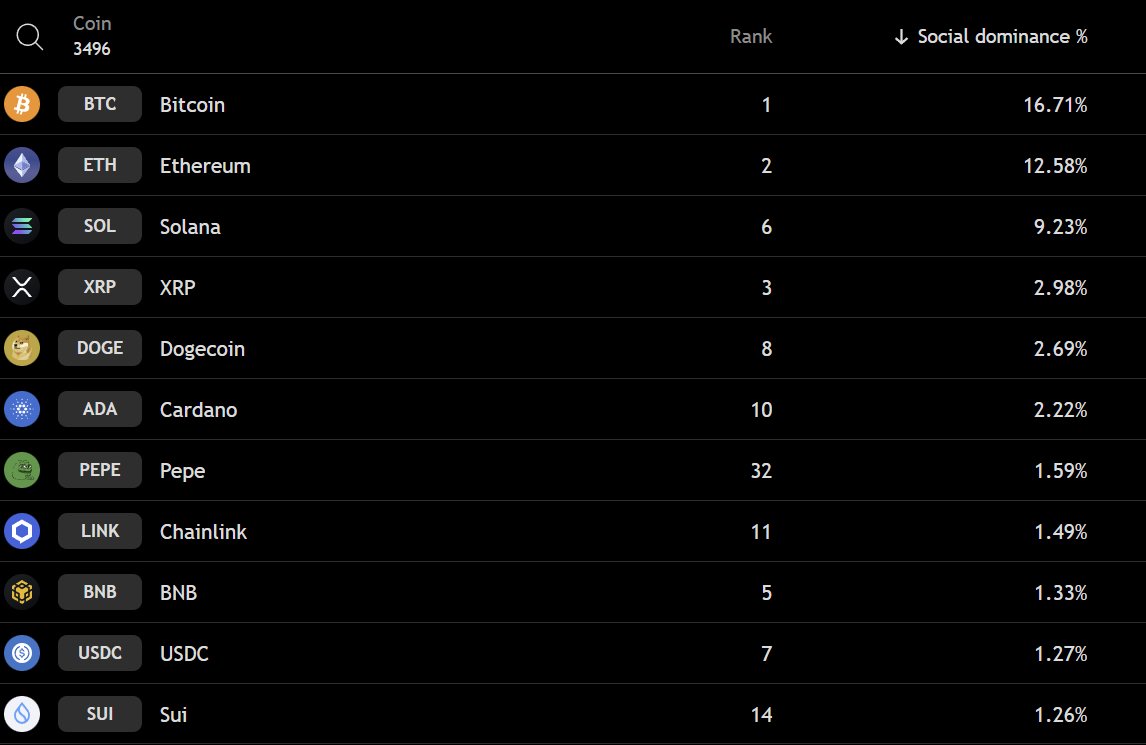

Market sentiment and brand visibility also show positive signals. The data show that SUI’s “social domination” (discussion frequency metric) continues to rise, and is currently approaching the top ten.

Breakout or breakdown at $4.3?

ACCoded in the beincrypto market, SUI currently trades for around $3.3-3.4, 37% below the all-time high of $5.35 in January 2025.

Sponsored Sponsors

From a technical point of view, the photos are compressed and often noise. Some analysts highlight the ascending triangle with nearly $4.3 resistance on their weekly charts. A critical breakout could set a high-level target, with some optimistic predictions focusing on the $10 mark.

“The longer you go below the $4.3 resistance, the better, but it’s time to finally break out,” the analyst commented.

Conversely, on the 4-hour chart, others claim that Altcoin remains trapped in a descending triangle, indicating weakness around 50SMA. This allows you to drag the price to test the $3.42 or even $3 zone. This is considered the first central demand area.

In other words, the market is waiting for the next “movement of direction.” Over $4.3 per week will result in a confirmed breakout and losing $3.42 will increase the chances of lowering your accumulation range.