Stellar (XLM) gave him the background after a strong run earlier this year. Tokens have fallen 16.1% over the past month, slipping 8.2% this week, losing another 1.7% over the past 12 hours. While annual profits are still close to 300%, some bearish signals suggest that there may be room for sellers to press more.

For long-term holders, the next few sessions will allow Stellar to defend support or face sudden fixes.

Derivative weaknesses reduce support

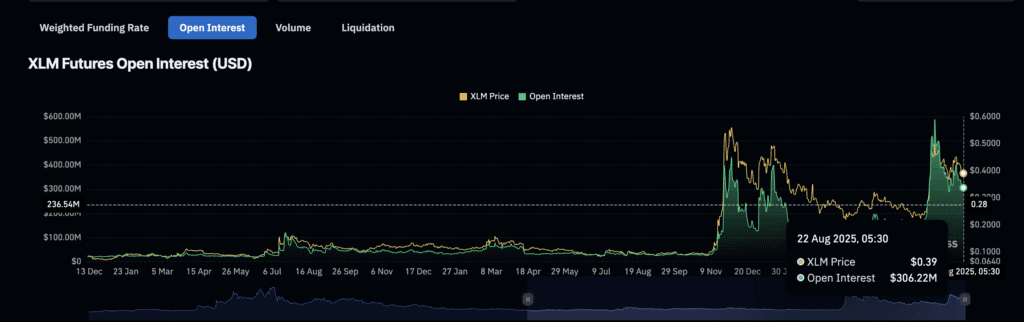

One of the first warnings comes from the derivatives market. Open interest in measuring the value of active futures contracts often indicates the amount of leverage behind the movement. When open interest is high, traders can rapidly promote prices in either direction, often causing squeezes.

On July 18th, Stellar’s public interest reached $588.53 million as XLM prices rose. That leverage accumulation helped the shorter aperture gain momentum and promote movement. Since then, open interest has dropped to $306.22 million. This is almost a 50% decrease.

Less contracts reduce the likelihood of another squeeze-driven rally, exposing the market to spot sales.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bearish Crossover Build Pressure

Spot momentum also tilts negatively even in smaller time frames, which often indicates changes in early trends.

On the 12-hour star price chart, the 20 EMA or exponential moving average (red line) fell below 50 EMA (orange line).

On the 4-hour star price chart, the 50 EMA crosses below the 200 EMA (Deep Blue Line). A similar cross fell earlier this month. If confirmed, add another layer of sales pressure to strengthen the bearish bias.

Exponential Moving Averages (EMAs) respond faster than simple averages because they are moving averages that give extra weight to recent prices. A shorter EMA/MA falls below the longer EMA, which will result in a bearish crossover, indicating that the seller has momentum.

Triangle patterns refer to the risk of price collapse of stars

On the great daily price charts, XLM trades in a falling triangle.

The price is close to $0.39 and is $0.38 and $0.36 just above the key support. If these levels fail, the lack of strong technical support refers to a slide to $0.23, a drop of nearly 40% from the current levels.

Stellar faces pressure from three sides: a decline in derivatives, bearish crossovers on short and medium charts, and a downward triangle that threatens failure. Together, these setups highlight the risk of a 40% drop unless buyers can quickly regain the highlands.

For buyers, the level of disabling is clear. Upside down the triangle near $0.43 and cancel the sales room for bearish setup and recovery. Until then, sellers are still in control.

Three bearish setups were first shown on beincrypto, which means the great price of the post drops by 40%.