Bitcoin prices have risen 2.5% in the last 24 hours, trading nearly $115,700, but still followed by Ethereum and others already pushed to new highs.

Despite being nearly 7% below the peak, some key on-chain and technical signals suggest that breakout setups are being formed, similar to the rally seen earlier this month.

Whale sales pressure is weakening

For weeks, Bitcoin prices have been lagging behind as whales spin capital into other assets, driving more movements by retail buyers.

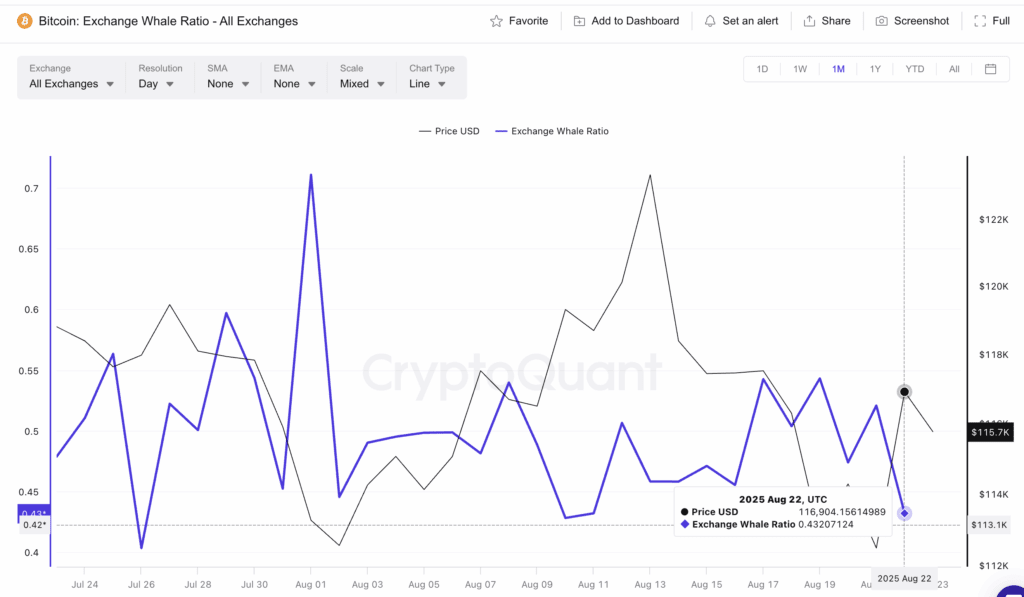

So it became important to track whether the whales were ultimately slowing down sales. The ratio of exchange whales that measures the share of the top 10 inflows compared to all inflows into exchanges provides that signal.

This ratio fell from 0.54 on August 19 to 0.43 on August 22, reaching its lowest in nearly two weeks. A similar drop occurred on August 10th, when the ratio fell to 0.42. The move went from $119,305 to $124,000, ahead of a sharp gathering in Bitcoin. This is about 3.9% profit.

If the history is repeated, the current setup will open the door for similar upside extensions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Hodl Waves refers to accumulation

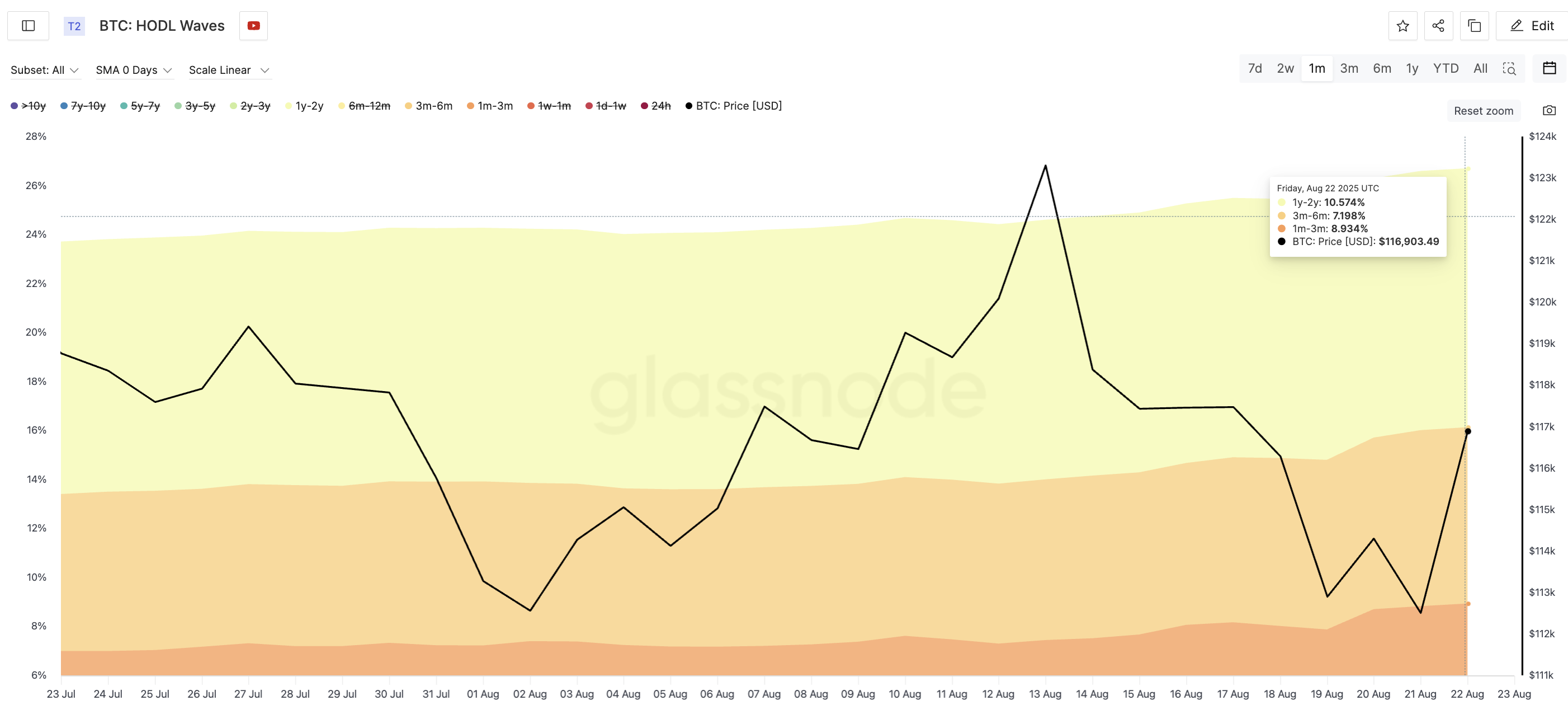

With the ease of BTC sales pressure, the next question is whether medium-term and long-term holders are accumulating. The HODL Waves metric tracks the percentage of Bitcoin supply held across the age band.

Last month, the major cohort expanded their positions.

1Y-2Y wallets rose from 10.31% to 10.57% 3M-6M wallets climbed from 6.40% to 7.19%, while 1M-3M wallets rose from 6.99% to 8.93%

This extensive accumulation during volatility suggests certainty. Combined with the low whale exchange flow, the structure refers to a market that is preparing for a Bitcoin price breakout.

Bitcoin price levels define breakout paths

Technical photos link these signals together. Bitcoin is currently outweighing strong support at $115,400. The serious resistance is $117,600, and $119,700 serves as the major breakout trigger for Bitcoin prices, heading towards an all-time high.

Meanwhile, slips will be below $114,100, especially if they fall below $111,900, which will change the momentum that is weaker in the short term.

If the Exchangehale ratio repeats the August 10th pattern, Bitcoin prices could rise by nearly 4% from their current levels. This will push prices directly up to breakout territory beyond $119,000.

From there, we examine the idea that the stage is set for the greatest retest of history and that this rally is behind without being denied.

The Whale Post indicators show the new price direction for Bitcoin, which first appeared on Beincrypto.